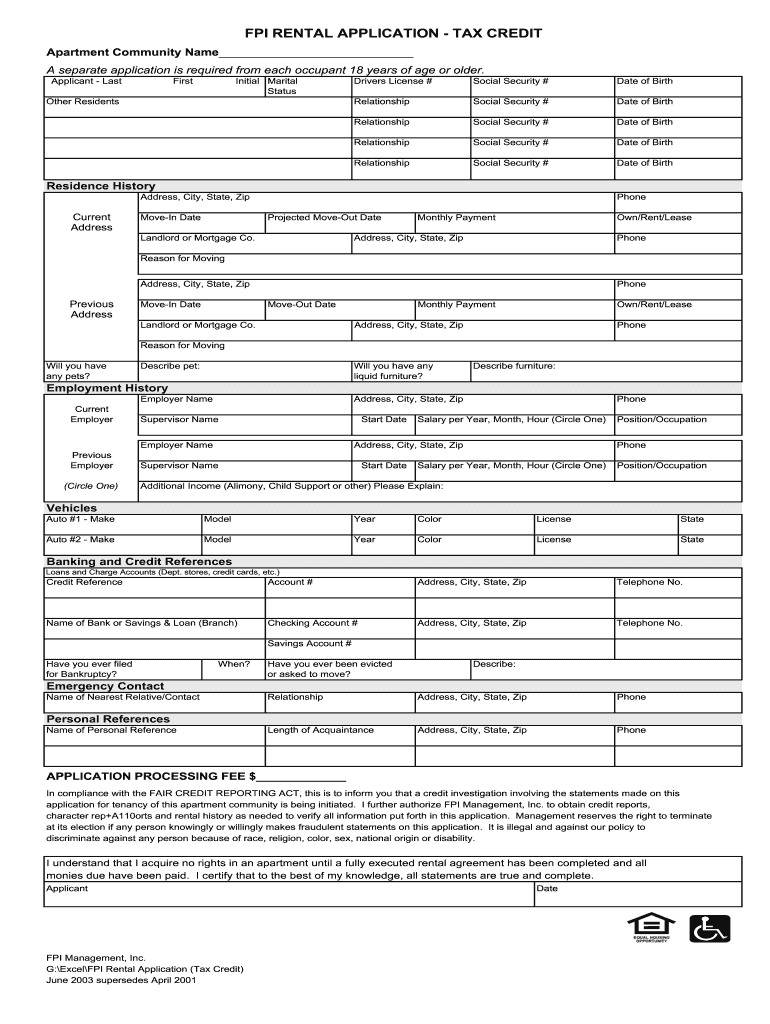

FPI Rental Application Tax Credit Apartments for Rent 2003

What is the FPI Rental Application Tax Credit Apartments For Rent

The FPI Rental Application Tax Credit is a program designed to assist eligible renters in reducing their housing costs. This tax credit is specifically aimed at individuals and families who meet certain income requirements and are seeking affordable housing options. The program encourages landlords to offer reduced rent in exchange for tax benefits, making it easier for low-income tenants to secure stable housing. Understanding this tax credit is essential for both renters and property owners to navigate the rental market effectively.

How to obtain the FPI Rental Application Tax Credit Apartments For Rent

To obtain the FPI Rental Application Tax Credit, applicants must first determine their eligibility based on income and family size. Once eligibility is confirmed, renters can apply through their local housing authority or designated agency. The application typically requires documentation such as proof of income, identification, and rental agreements. It is important to gather all necessary documents before starting the application process to ensure a smooth experience.

Steps to complete the FPI Rental Application Tax Credit Apartments For Rent

Completing the FPI Rental Application Tax Credit involves several key steps:

- Gather required documents, including income verification and identification.

- Visit the local housing authority or designated agency’s website to access the application form.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application along with the required documentation, either online or in person.

- Await confirmation of application receipt and any further instructions from the agency.

Eligibility Criteria

Eligibility for the FPI Rental Application Tax Credit is primarily based on income levels and family size. Generally, applicants must fall within specific income limits set by the local housing authority, which vary by location. Additionally, applicants may need to demonstrate a need for affordable housing. It is advisable to check with local agencies for precise eligibility requirements to ensure compliance and increase the chances of approval.

Required Documents

When applying for the FPI Rental Application Tax Credit, several documents are typically required:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including a driver's license or state ID.

- Rental agreements or lease documents.

- Any additional documentation requested by the housing authority.

Legal use of the FPI Rental Application Tax Credit Apartments For Rent

The FPI Rental Application Tax Credit must be utilized in accordance with local and federal regulations. This includes adhering to income limits and ensuring that the rental agreement reflects the terms of the tax credit. Landlords and tenants should maintain accurate records of all transactions and communications related to the tax credit to avoid any potential legal issues. Compliance with these regulations is essential for both parties to benefit from the program.

Quick guide on how to complete fpi rental application tax credit apartments for rent

The simplest method to obtain and sign FPI Rental Application Tax Credit Apartments For Rent

On a corporate level, ineffective workflows regarding paper authorization can consume a signNow amount of productive time. Signing documents such as FPI Rental Application Tax Credit Apartments For Rent is an inherent aspect of operations in any organization, which is why the efficacy of each agreement’s lifecycle signNowly impacts the company’s overall outcomes. With airSlate SignNow, signing your FPI Rental Application Tax Credit Apartments For Rent can be as straightforward and quick as possible. This platform provides you with the most up-to-date version of virtually any document. Even better, you can sign it instantly without needing to install external software on your computer or printing out physical copies.

How to acquire and sign your FPI Rental Application Tax Credit Apartments For Rent

- Explore our collection by category or use the search bar to locate the document you require.

- Check the document preview by clicking Learn more to ensure it is the correct one.

- Press Get form to begin editing immediately.

- Fill out your document and include any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your FPI Rental Application Tax Credit Apartments For Rent.

- Select the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Hit Done to finalize editing and move on to document-sharing options if needed.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can search, complete, modify and even distribute your FPI Rental Application Tax Credit Apartments For Rent in one tab without any trouble. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct fpi rental application tax credit apartments for rent

FAQs

-

How do you feel about landlords that require you to fill out an app prior to seeing the rental property? My daughter is a CO, has a perfect rental history, and a very high credit score. We ran into this while she looks for a rental.

“How do you feel about landlords that require you to fill out an app prior to seeing the rental property? My daughter is a CO, has a perfect rental history, and a very high credit score. We ran into this while she looks for a rental.”I have a certain sympathy for landlords. It isn’t an easy way to make a living. You have huge capital tied up in immobile investments. One destructive tenant can wipe out the profits from 20 good ones.If you want a landlord who will show the property without asking questions until and unless you show an interest, you can probably find that. We had that when we rented our first apartment after retiring and selling our house (Liberty Lake Apts in Boise ID - great place BTW, we recommend them). The nice office lady showed us around the complex, and let us inside an empty unit just like the one we eventually rented. (That empty unit was already promised to someone else; the one we eventually rented was still occupied). Then we went back to the office and filled out applications.But anyways, it all comes down to supply and demand in a free market. If you want a landlord who asks no questions, you can find one. Probably a “slumlord” who doesn’t maintain the property and has lots of anti-social, destructive tenants who would make dangerous neighbors. If there is a glut of housing in your market, you can find landlords who bend over backwards to court you. If there is a housing shortage, you have to play by the landlords’ rules.

-

Do we have to separately fill out the application forms of medial institutions like AMU apart from the NEET application form for 2017?

No there's no separate exam to get into AMU , the admission will be based on your NEET score.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do you invest in real estate for rental income? What are the pros and cons to buying and renting out an apartment as opposed to a house?

I love investing in rental real estate for the income instead of appreciation. It’s a much more surefire way to build wealth.My practice is dedicated to assisting real estate investors and their are two huge causes for investment failure that I see time and time again.Not knowing the market and the neighborhood you are investing in;Failing to understand financial formulas and operating costs.Figure those two things out and you will do well. I’m not a handy person, so I build property management and maintenance expenses into my financial models. I spend months researching an area before I feel comfortable investing in it.Houses are nice because they have better exit options. Everyone wants to buy a house. Additionally, the tenants usually mow the lawn and service the property with minor maintenance issues.Multi-family, in my opinion, is a much better route to take (and the one I’ve taken). The exit options are reduced as not everyone wants to buy multi-family, but the you benefit from economies of scale.For instance, I have three-units, but one roof to repair and one yard to mow.When one tenant moves out, I still have two more that are paying on a monthly basis. Vacancy becomes much less painful.Hope this helps!

Create this form in 5 minutes!

How to create an eSignature for the fpi rental application tax credit apartments for rent

How to create an eSignature for your Fpi Rental Application Tax Credit Apartments For Rent online

How to generate an eSignature for the Fpi Rental Application Tax Credit Apartments For Rent in Google Chrome

How to make an eSignature for putting it on the Fpi Rental Application Tax Credit Apartments For Rent in Gmail

How to create an electronic signature for the Fpi Rental Application Tax Credit Apartments For Rent straight from your smartphone

How to create an eSignature for the Fpi Rental Application Tax Credit Apartments For Rent on iOS devices

How to make an electronic signature for the Fpi Rental Application Tax Credit Apartments For Rent on Android

People also ask

-

What is the FPI Rental Application Tax Credit for Apartments For Rent?

The FPI Rental Application Tax Credit for Apartments For Rent is a tax incentive designed to help low-income tenants afford quality housing. This program allows eligible renters to receive financial support, making it easier to secure their desired apartment while benefiting landlords through tax deductions.

-

How can I apply for the FPI Rental Application Tax Credit for Apartments For Rent?

To apply for the FPI Rental Application Tax Credit for Apartments For Rent, you need to fill out a specific application form and provide necessary documentation, including proof of income and residency. It's essential to check with your local housing authority for detailed application guidelines and eligibility requirements.

-

What are the benefits of using airSlate SignNow for FPI Rental Application Tax Credit documents?

Using airSlate SignNow streamlines the process of signing and sending documents related to the FPI Rental Application Tax Credit for Apartments For Rent. Our intuitive platform ensures quick eSigning, reducing paperwork delays, and enhancing the overall efficiency of your rental application process.

-

Is there a cost associated with using airSlate SignNow for FPI Rental Application Tax Credit documents?

airSlate SignNow offers a cost-effective solution for managing documents related to the FPI Rental Application Tax Credit for Apartments For Rent. With flexible pricing plans, you can choose the option that best suits your needs, ensuring you get the most value for your investment.

-

Can I integrate airSlate SignNow with other tools for FPI Rental Application Tax Credit management?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, making it easier to manage your FPI Rental Application Tax Credit for Apartments For Rent. Whether you use CRM systems, document management software, or other platforms, our solution can enhance your workflow and streamline your rental processes.

-

What features does airSlate SignNow offer for managing rental applications?

airSlate SignNow provides essential features such as customizable templates, automated workflows, and secure cloud storage for documents related to the FPI Rental Application Tax Credit for Apartments For Rent. These tools help simplify the application process and keep everything organized.

-

How secure is airSlate SignNow when handling FPI Rental Application Tax Credit documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your sensitive documents related to the FPI Rental Application Tax Credit for Apartments For Rent, ensuring that your information remains confidential and secure.

Get more for FPI Rental Application Tax Credit Apartments For Rent

- Civ 401 cost bill 3 00 civil forms

- Dr 710 notice of motion 911 pdf fill in domestic relations forms

- Writ of execution in alaska form

- Alabama transcript purchase order form

- Alabama form explanation rights

- Child support in arkansas form

- Blank title page in az 2011 form

- Cso 1079a adoptive family subsidy application cso 1079a adoptive family subsidy application form

Find out other FPI Rental Application Tax Credit Apartments For Rent

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online