St 28d Form 2008-2026

What is the St 28d Form

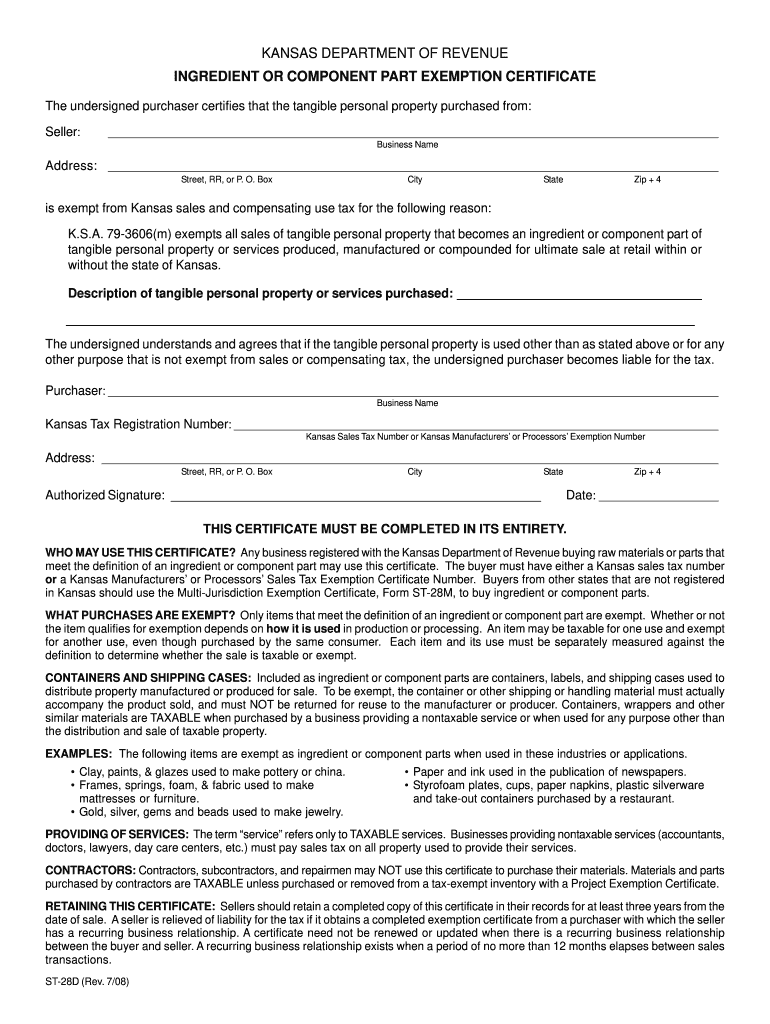

The St 28d form, also known as the Kansas tax exempt form, is a crucial document used by individuals and businesses in Kansas to claim tax exemption on certain purchases. This form is essential for entities that qualify for tax-exempt status under Kansas law, allowing them to avoid paying sales tax on eligible items. The St 28d form is specifically designed to ensure compliance with the Kansas Department of Revenue regulations and to facilitate the proper documentation of tax-exempt purchases.

How to use the St 28d Form

Using the St 28d form involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, fill out the form accurately, providing all required information, including the name of the purchaser, the type of exemption being claimed, and the specific items being purchased. After completing the form, present it to the seller at the time of purchase. It is advisable to keep a copy of the completed form for your records, as it may be required for future reference or audits.

Steps to complete the St 28d Form

Completing the St 28d form requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the St 28d form from the Kansas Department of Revenue website or your local revenue office.

- Fill in your name, address, and the name of your organization if applicable.

- Indicate the specific type of exemption you are claiming.

- List the items for which you are claiming tax exemption.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the St 28d Form

The legal use of the St 28d form is governed by Kansas state law. This form must be used by eligible organizations or individuals to claim tax exemption on qualifying purchases. Misuse of the form, such as using it for ineligible items or providing false information, can lead to penalties, including fines or revocation of tax-exempt status. It is essential to understand the legal implications and ensure compliance with all relevant regulations when using the St 28d form.

Required Documents

When completing the St 28d form, certain documents may be necessary to support your claim for tax exemption. These may include:

- Proof of your tax-exempt status, such as a letter from the IRS or state tax authority.

- Identification documents, such as a driver's license or business ID.

- Invoices or receipts for the purchases being claimed as tax-exempt.

Form Submission Methods

The St 28d form can be submitted in various ways, depending on the seller's preferences. Common submission methods include:

- Presenting the completed form in person at the point of sale.

- Submitting the form via email or fax if the seller accepts electronic documentation.

- Mailing the form to the seller if required for record-keeping purposes.

Quick guide on how to complete st 28d kansas department of revenue ksrevenue

Your assistance manual on how to prepare your St 28d Form

If you’re curious about how to create and submit your St 28d Form, here are some brief guidelines on how to simplify tax filing.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document tool that enables you to edit, create, and finalize your income tax forms seamlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your St 28d Form in minutes:

- Create your account and start working on PDFs in just a few minutes.

- Utilize our catalog to obtain any IRS tax form; explore different versions and schedules.

- Click Get form to access your St 28d Form in our editor.

- Fill in the necessary fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save your adjustments, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper may increase return errors and delay refunds. Before e-filing your taxes, make sure to visit the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What is the full procedure of admission to St. Stephen’s College after filling out the form?

After filling the form:Wait for the cutoff list of St. Stephen’s CollegeIf you have cleared the cutoff, you would receive an Interview invite letter from the college corresponding to your course.You will have to appear physically for interview in St. Stephen’s College premises, North Campus, University of Delhi.There you will have to give an aptitude test and an interview as directed.The results of final candidates selected after the interview will be uploaded on the official website of St. Stephen’s within 4–5 days of Interview.If your name is there in the list, then you need to present physically there again for your documents and for the annual fee submission process.After that, you are supposed to start college from 20th July.If you are not selected ( Step-6), don’t feel defeated or demotivated. Cheer up and go for some other great college of DU in that course with high spirits.

Create this form in 5 minutes!

How to create an eSignature for the st 28d kansas department of revenue ksrevenue

How to create an eSignature for your St 28d Kansas Department Of Revenue Ksrevenue in the online mode

How to generate an eSignature for your St 28d Kansas Department Of Revenue Ksrevenue in Chrome

How to create an electronic signature for putting it on the St 28d Kansas Department Of Revenue Ksrevenue in Gmail

How to generate an eSignature for the St 28d Kansas Department Of Revenue Ksrevenue straight from your mobile device

How to generate an electronic signature for the St 28d Kansas Department Of Revenue Ksrevenue on iOS devices

How to create an electronic signature for the St 28d Kansas Department Of Revenue Ksrevenue on Android devices

People also ask

-

What is the St 28d Form and how is it used?

The St 28d Form is a crucial document used for various business transactions, often requiring electronic signatures. With airSlate SignNow, you can easily eSign the St 28d Form, ensuring compliance and efficiency in your document workflow. Our platform simplifies the signing process, making it quick and straightforward.

-

How does airSlate SignNow simplify the St 28d Form eSigning process?

airSlate SignNow streamlines the eSigning process for the St 28d Form by providing an intuitive interface that guides users through each step. You can upload your document, add signatures, and send it for signing within minutes. This reduces the time spent on paperwork and increases productivity for your business.

-

Is there a free trial available for the St 28d Form eSigning service?

Yes, airSlate SignNow offers a free trial that allows you to explore the features related to the St 28d Form and other documents. During the trial, you can test the eSigning capabilities and see how our platform can enhance your document management process. Sign up today to experience the benefits risk-free!

-

What are the pricing options for using airSlate SignNow with the St 28d Form?

airSlate SignNow offers flexible pricing plans tailored to your business needs when managing the St 28d Form and other documents. Our plans are cost-effective and include various features such as unlimited templates and integrations. Visit our pricing page to find the plan that best suits your requirements.

-

Can I integrate airSlate SignNow with other software for managing the St 28d Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage the St 28d Form alongside your favorite tools. Whether it's CRM systems, cloud storage, or project management software, our integrations help streamline your workflow and improve collaboration.

-

What security measures does airSlate SignNow implement for the St 28d Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the St 28d Form. Our platform uses advanced encryption protocols, secure cloud storage, and compliance with industry standards to ensure your documents are safe and protected from unauthorized access.

-

How can airSlate SignNow help businesses save time with the St 28d Form?

By automating the eSigning process for the St 28d Form, airSlate SignNow signNowly reduces the time spent on document management. With features like bulk sending, reminders, and templates, businesses can speed up their workflows and focus on more important tasks, ultimately improving efficiency.

Get more for St 28d Form

- Calperslongtermcare form

- Request for section 504 accommodations 2016 2017 new york city schools nyc form

- Formulare amp merkbl tter amt f r wirtschaft und arbeit awa

- Sage acquisitions sales contract for owner occupants and investors for all areas form

- Entyvio vedolizumab iv dosage 300 mg infusion associates form

- Awana registration form bmalesusb

- Form ieat 011 application for land utilization for ieat go

- Adult in camp state compliance form ntrail

Find out other St 28d Form

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe