Misc Tax Forms CT Gov 2020-2026

Understanding the TPG 198 Form

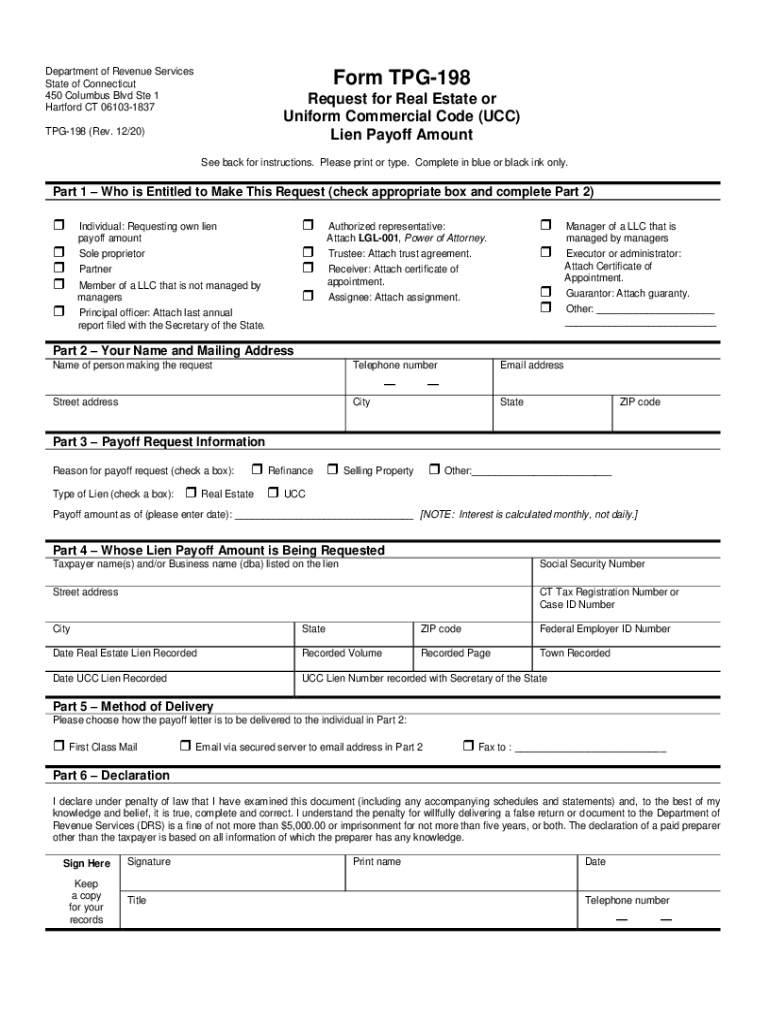

The TPG 198 form is a specific tax document used for miscellaneous tax reporting in the United States. It is essential for individuals and businesses to understand the purpose of this form, as it aids in the accurate reporting of various types of income or transactions that may not fall under standard tax categories. The form is typically utilized to report income from sources such as freelance work, rental payments, or other non-traditional income streams.

Steps to Complete the TPG 198 Form

Completing the TPG 198 form involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary information, including your personal identification details and specifics about the income being reported. Next, carefully fill out each section of the form, ensuring that all entries are clear and correct. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy for your records.

Legal Use of the TPG 198 Form

The TPG 198 form is legally recognized for reporting miscellaneous income, which means it must be used in accordance with IRS guidelines. Failure to use the form correctly can result in penalties or audits. It is crucial to understand the legal implications of the information reported on this form, as inaccuracies can lead to significant tax liabilities. Consulting a tax professional may be beneficial to ensure compliance.

Filing Deadlines for the TPG 198 Form

Timely filing of the TPG 198 form is essential to avoid penalties. The IRS typically sets specific deadlines for submitting this form, which may vary depending on the type of income reported. It is important to stay informed about these deadlines to ensure that your submission is timely. Missing the deadline can result in late fees and interest on any taxes owed.

Required Documents for the TPG 198 Form

When preparing to submit the TPG 198 form, certain documents are necessary to support the information provided. These may include W-2 forms, 1099 forms, or other documentation that verifies the income being reported. Having these documents on hand will facilitate a smoother filing process and help ensure that all reported information is accurate and complete.

Form Submission Methods for the TPG 198

The TPG 198 form can be submitted through various methods, including online filing, mail, or in-person submission at designated locations. Each method has its own set of guidelines and requirements. Online filing is often the most efficient, allowing for quicker processing times, while mail submissions may take longer to be processed. It is important to choose the method that best suits your needs and to follow the specific instructions for each submission type.

Penalties for Non-Compliance with the TPG 198 Form

Non-compliance with the TPG 198 form can lead to serious consequences, including financial penalties and potential legal action. The IRS imposes fines for late submissions, inaccuracies, or failure to file altogether. Understanding these penalties is crucial for individuals and businesses to avoid costly mistakes and ensure compliance with tax regulations.

Quick guide on how to complete misc tax forms ct gov

Complete Misc Tax Forms CT gov effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Misc Tax Forms CT gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Misc Tax Forms CT gov without hassle

- Obtain Misc Tax Forms CT gov and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Misc Tax Forms CT gov to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct misc tax forms ct gov

Create this form in 5 minutes!

How to create an eSignature for the misc tax forms ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tpg 198 and how does it relate to airSlate SignNow?

TPG 198 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, ensuring that documents are signed quickly and efficiently. By utilizing tpg 198, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with the tpg 198 feature?

The pricing for airSlate SignNow varies based on the plan selected, but the tpg 198 feature is included in all subscription tiers. This ensures that all users can benefit from its advanced functionalities without incurring additional costs. For detailed pricing information, visit our pricing page.

-

What are the main benefits of using tpg 198 in airSlate SignNow?

Using tpg 198 in airSlate SignNow provides numerous benefits, including enhanced security, faster document processing, and improved collaboration among team members. This feature allows businesses to manage their documents more effectively, ensuring compliance and reducing errors. Overall, tpg 198 contributes to a more efficient workflow.

-

Can I integrate tpg 198 with other software applications?

Yes, tpg 198 is designed to seamlessly integrate with various software applications, enhancing its functionality. Whether you use CRM systems, project management tools, or other business applications, airSlate SignNow can connect with them to streamline your processes. This integration capability makes tpg 198 a versatile choice for businesses.

-

Is tpg 198 suitable for small businesses?

Absolutely! TPG 198 is particularly beneficial for small businesses looking to optimize their document management processes. With its user-friendly interface and cost-effective pricing, airSlate SignNow empowers small businesses to handle eSigning and document workflows efficiently, allowing them to focus on growth.

-

What types of documents can I manage with tpg 198?

With tpg 198, you can manage a wide variety of documents, including contracts, agreements, and forms. The flexibility of airSlate SignNow allows users to customize their document workflows according to their specific needs. This versatility makes tpg 198 an essential tool for any business dealing with multiple document types.

-

How does tpg 198 enhance security for my documents?

TPG 198 enhances document security through advanced encryption and authentication measures. airSlate SignNow ensures that all documents are securely stored and transmitted, protecting sensitive information from unauthorized access. This level of security is crucial for businesses that handle confidential documents.

Get more for Misc Tax Forms CT gov

- This is my written revocation of the above referenced special power of attorney and i am form

- Control number hi p003 pkg form

- Revocation of health care durable power of attorney answers form

- Control number hi p005 pkg form

- Control number hi p007 pkg form

- Control number hi p008 pkg form

- Uncontested divorce forms hawaii state judiciary

- Control number hi p012 pkg form

Find out other Misc Tax Forms CT gov

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later