TPG 198, Request for Payoff Real Estate or Uniform CT Gov Ct 2010

What is the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

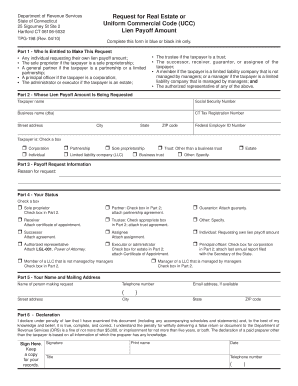

The TPG 198 form, known as the Request For Payoff Real Estate or Uniform CT gov Ct, is a document used primarily in real estate transactions. This form is essential for individuals seeking to obtain a payoff statement from a lender or mortgage holder. The payoff statement provides a detailed account of the outstanding balance on a mortgage, including any interest, fees, and penalties that may apply. It is an important tool for buyers, sellers, and real estate professionals involved in property transactions, ensuring clarity and transparency regarding financial obligations.

How to use the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

To effectively use the TPG 198 form, individuals must first complete the required fields accurately. This includes providing information such as the property address, the borrower’s name, and the lender’s details. Once the form is filled out, it should be submitted to the lender or mortgage servicer. Typically, this can be done via mail, email, or through an online portal, depending on the lender's preferences. After submission, it is advisable to follow up to ensure that the request has been processed and to obtain the payoff statement in a timely manner.

Steps to complete the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

Completing the TPG 198 form involves several key steps:

- Gather necessary information about the property and mortgage.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the lender using the preferred submission method.

- Keep a copy of the submitted form for your records.

- Follow up with the lender to confirm receipt and inquire about the timeline for receiving the payoff statement.

Legal use of the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

The TPG 198 form is legally recognized as a formal request for a payoff statement in real estate transactions. It is crucial for maintaining compliance with state and federal regulations regarding mortgage disclosures and financial transactions. By using this form, borrowers can ensure they are informed about their financial obligations and can make educated decisions regarding their property. Proper use of the TPG 198 can also help prevent disputes between parties involved in the transaction.

Key elements of the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

Key elements of the TPG 198 form include:

- Property Information: Details about the property associated with the mortgage.

- Borrower Information: The name and contact details of the borrower.

- Lender Information: The name and contact details of the mortgage holder.

- Request Details: Specifics regarding the type of information requested, including the payoff amount.

- Signature: The borrower’s signature to authorize the request.

Examples of using the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

Examples of when to use the TPG 198 form include:

- When selling a property and needing to provide a payoff statement to a buyer.

- When refinancing a mortgage and requiring a current payoff amount from the existing lender.

- When settling a debt and needing a formal statement of the total amount owed.

Quick guide on how to complete tpg 198 request for payoff real estate or uniform ct gov ct

Prepare TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Manage TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct with ease

- Obtain TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct and click Get Form to begin.

- Take advantage of the features we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign function, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choice. Modify and eSign TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tpg 198 request for payoff real estate or uniform ct gov ct

Create this form in 5 minutes!

How to create an eSignature for the tpg 198 request for payoff real estate or uniform ct gov ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct?

TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct is a standardized form used in Connecticut for requesting payoff information related to real estate transactions. This form ensures that all necessary details are captured accurately, facilitating smooth transactions.

-

How can airSlate SignNow help with TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct?

airSlate SignNow provides an efficient platform for electronically signing and sending the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct. Our solution simplifies the process, allowing users to complete and manage their documents seamlessly.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support the completion of documents like TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the management of documents like TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct, making the process more efficient.

-

Is airSlate SignNow compliant with legal standards for TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct?

Yes, airSlate SignNow complies with all legal standards for electronic signatures and document management. This compliance ensures that your TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct is legally binding and recognized.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow. This means you can easily incorporate the TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct into your existing systems.

-

What are the benefits of using airSlate SignNow for real estate documents?

Using airSlate SignNow for real estate documents like TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct streamlines the signing process, reduces paperwork, and saves time. Our platform is user-friendly and designed to improve efficiency in document handling.

Get more for TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

- Form civ 694 ampquotpetition to change childs nameampquot alaska

- Alaska promissory installment note legal form

- Free unsecured promissory note template wordpdfeforms

- And located in county such real property being more fully form

- In the superior court for the state of alaska at juneau form

- Alaska small estate affidavit form p 110affidavit for

- Affidavit for release of property to temporary custodian form

- As temporary property form

Find out other TPG 198, Request For Payoff Real Estate Or Uniform CT gov Ct

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors