1072 Form 2016

What is the 1072 Form

The 1072 form is a tax-related document used primarily for reporting certain types of income and expenses by businesses and individuals. It is essential for ensuring compliance with tax regulations in the United States. This form is often utilized by various business entities, including partnerships and corporations, to accurately report their financial activities to the Internal Revenue Service (IRS).

How to use the 1072 Form

Using the 1072 form involves several key steps. First, gather all necessary financial records, including income statements and expense receipts. Next, fill out the form with accurate details regarding your income and deductions. It is crucial to ensure that all information is complete and correct to avoid potential penalties. After completing the form, it can be submitted electronically or via mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the 1072 Form

Completing the 1072 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Begin filling out the form with your business information.

- Report your total income and allowable deductions accurately.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the 1072 Form

The legal use of the 1072 form is critical for maintaining compliance with federal tax laws. Businesses must file this form to report their financial activities accurately, ensuring transparency and accountability. Failure to use the form correctly can result in legal repercussions, including fines and audits. It is advisable to consult with a tax professional to navigate the complexities of this form and its legal implications.

Filing Deadlines / Important Dates

Filing deadlines for the 1072 form can vary based on the type of entity submitting it. Generally, businesses should be aware of the following important dates:

- The typical deadline for filing is the fifteenth day of the third month following the end of the tax year.

- Extensions may be available, but they must be requested in advance.

- Late submissions may incur penalties, so timely filing is essential.

Key elements of the 1072 Form

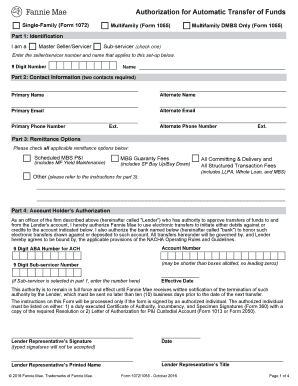

Key elements of the 1072 form include sections for reporting income, deductions, and credits. Each section must be filled out accurately to reflect the financial status of the business. Important components include:

- Business name and address

- Tax identification number

- Detailed income reporting

- Itemized deductions and credits

Quick guide on how to complete 1072 form

Complete 1072 Form effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as it allows you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any delays. Manage 1072 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1072 Form without any hassle

- Obtain 1072 Form and click Get Form to begin.

- Make use of the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or redact sensitive details with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 1072 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1072 form

Create this form in 5 minutes!

How to create an eSignature for the 1072 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1072 form and why is it important?

The 1072 form is a crucial document used for reporting certain financial transactions. It helps businesses maintain compliance with regulatory requirements and ensures accurate record-keeping. Understanding the 1072 form is essential for any organization looking to streamline their financial processes.

-

How can airSlate SignNow help with the 1072 form?

airSlate SignNow simplifies the process of completing and signing the 1072 form by providing an intuitive eSignature platform. Users can easily fill out the form, add signatures, and send it securely to relevant parties. This not only saves time but also enhances the accuracy of the document.

-

Is there a cost associated with using airSlate SignNow for the 1072 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that facilitate the completion and management of documents like the 1072 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 1072 form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage for the 1072 form. These tools help streamline the document management process, making it easier to track and manage submissions. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other software for the 1072 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the 1072 form alongside your existing tools. This integration capability enhances productivity and ensures that your workflow remains uninterrupted.

-

What are the benefits of using airSlate SignNow for the 1072 form?

Using airSlate SignNow for the 1072 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround times, which is essential for timely compliance. Additionally, eSigning reduces the need for physical signatures, making the process more convenient.

-

Is airSlate SignNow user-friendly for completing the 1072 form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the 1072 form. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. This accessibility is a key advantage for businesses of all sizes.

Get more for 1072 Form

- Leaseloan that heshe is employed by you form

- Tenant will accomplish the work described in paragraph 1 by using the form

- Application for each potential sub lessee intending to sign sub lease form

- Of each item in the leased premises form

- In order that we may return as much of your security deposit as possible this move out form

- Maintenance as necessary to preserve the property in good condition form

- Delayed or partial rent payment will result the breach of this agreement and landlord will have the option form

- This request is made under the terms of my lease agreement form

Find out other 1072 Form

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe