Letter 4364c 2014

What is the Letter 4364c

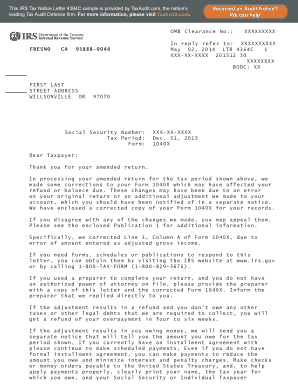

The IRS Letter 4364c, also known as LTR 4364c, is a communication from the Internal Revenue Service that notifies taxpayers of a specific issue regarding their tax returns. This letter typically addresses discrepancies or missing information related to a taxpayer's account. It is essential for recipients to understand the contents of this letter, as it may require action to resolve any outstanding issues with the IRS.

How to obtain the Letter 4364c

To obtain the IRS Letter 4364c, taxpayers usually receive it directly from the IRS through mail. If you believe you should have received this letter but have not, you can contact the IRS directly. When reaching out, be prepared to provide your Social Security number, tax identification number, and any other relevant information to help the IRS locate your records. Additionally, you may check your online IRS account for any notifications or messages regarding your tax status.

Key elements of the Letter 4364c

The Letter 4364c includes several critical elements that taxpayers should review carefully. Key components typically found in the letter are:

- Taxpayer Information: This section contains the recipient's name, address, and taxpayer identification number.

- Issue Description: A clear explanation of the reason for the letter, detailing any discrepancies or required actions.

- Response Instructions: Guidance on how to respond to the letter, including deadlines and necessary documentation.

- Contact Information: Details on how to reach the IRS for further assistance, including phone numbers and office hours.

Steps to complete the Letter 4364c

Completing the requirements outlined in the Letter 4364c involves several important steps. First, carefully read the letter to understand the specific issue and any actions required. Next, gather any necessary documents that support your case or clarify the discrepancies mentioned. Once you have compiled the necessary paperwork, follow the instructions provided in the letter to respond appropriately. This may involve submitting additional information or correcting errors in your tax return.

IRS Guidelines

The IRS provides specific guidelines regarding how to handle communications like the Letter 4364c. Taxpayers are encouraged to respond promptly to avoid further complications. The IRS outlines the importance of maintaining accurate records and ensuring that all information submitted is correct. Following the guidelines can help prevent penalties and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to respond to the Letter 4364c or to address the issues raised can result in penalties. The IRS may impose fines, interest on unpaid taxes, or even initiate collection actions if the discrepancies are not resolved. It is crucial for taxpayers to take the letter seriously and act within the specified time frame to avoid any adverse consequences.

Quick guide on how to complete letter 4364c

Accomplish Letter 4364c effortlessly on any gadget

Digital document management has gained popularity among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Letter 4364c on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and eSign Letter 4364c effortlessly

- Obtain Letter 4364c and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you'd like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs with just a few clicks from a device of your choosing. Edit and eSign Letter 4364c while ensuring outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct letter 4364c

Create this form in 5 minutes!

How to create an eSignature for the letter 4364c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS letter 4364c?

The IRS letter 4364c is a notification sent by the IRS to inform taxpayers about their tax return status. It typically indicates that the IRS has received your return and is processing it. Understanding this letter is crucial for ensuring that your tax matters are in order.

-

How can airSlate SignNow help with IRS letter 4364c?

airSlate SignNow provides a seamless way to eSign and send documents related to your IRS letter 4364c. By using our platform, you can quickly prepare and submit any necessary forms or responses to the IRS, ensuring timely communication and compliance.

-

Is there a cost associated with using airSlate SignNow for IRS letter 4364c?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution allows you to manage documents related to IRS letter 4364c efficiently, with plans that cater to both individuals and businesses.

-

What features does airSlate SignNow offer for handling IRS letter 4364c?

airSlate SignNow includes features such as eSignature, document templates, and secure cloud storage, all of which are beneficial for managing IRS letter 4364c. These tools streamline the process of preparing and sending necessary documents to the IRS.

-

Can I integrate airSlate SignNow with other applications for IRS letter 4364c?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage your documents related to IRS letter 4364c. Whether you use CRM systems or cloud storage solutions, our platform can enhance your workflow.

-

What are the benefits of using airSlate SignNow for IRS letter 4364c?

Using airSlate SignNow for IRS letter 4364c provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled quickly and securely, allowing you to focus on other important tasks.

-

How secure is airSlate SignNow when dealing with IRS letter 4364c?

Security is a top priority at airSlate SignNow. When handling IRS letter 4364c, our platform employs advanced encryption and compliance measures to protect your sensitive information, ensuring that your documents remain confidential and secure.

Get more for Letter 4364c

- Quotcontractorquot and form

- Specific propertyfree legal forms

- Kentucky department of workers claims notice of claim form

- Workerscomp form kentucky personnel cabinet kentuckygov

- Dissolution of marriage representing yourself in a family law case form

- Aoc 4962 doc code pexc rev 7 16 page 1 of 2 commonwealth form

- 145 krs 395 form

- Code pgm or form

Find out other Letter 4364c

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast