IRS Internal Revenue Service Taxaudit Com 2022-2026

Understanding IRS Letter 4364C

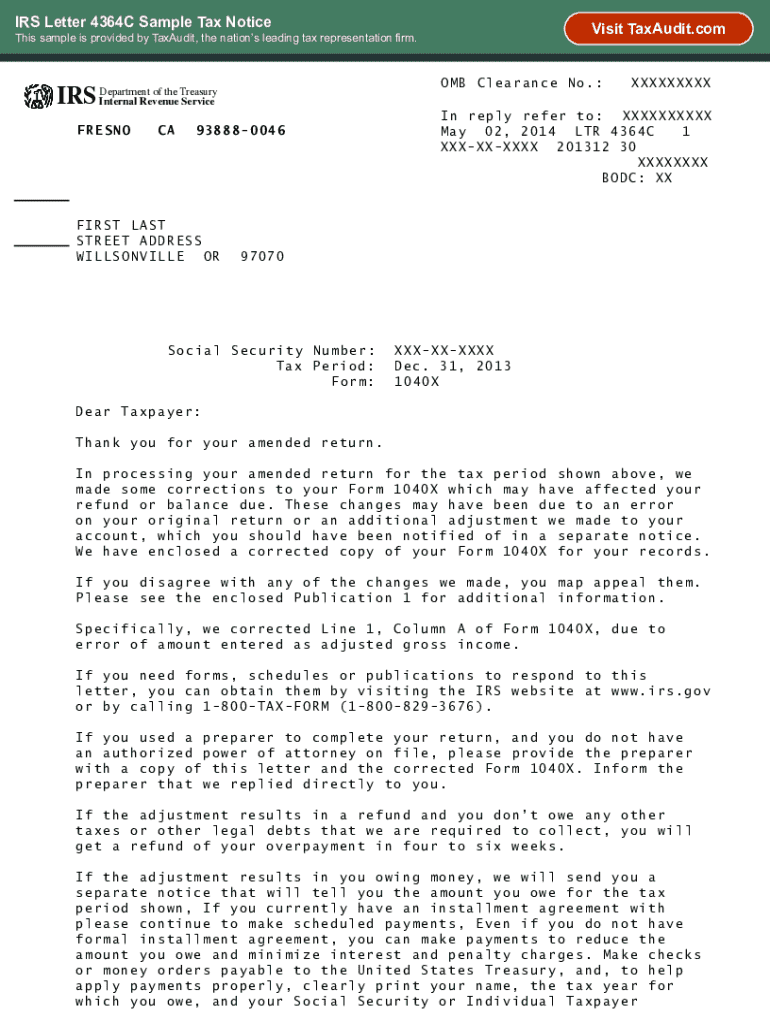

The IRS Letter 4364C is a communication from the Internal Revenue Service that typically informs taxpayers about the status of their tax return or any issues that may have arisen during processing. This letter serves as an important document in the tax audit process, providing clarity on what the IRS requires from the taxpayer. It is crucial for individuals to understand the contents of this letter to respond appropriately and ensure compliance with IRS regulations.

Key Elements of IRS Letter 4364C

IRS Letter 4364C contains several key elements that taxpayers should be aware of:

- Taxpayer Information: This section includes the taxpayer's name, address, and Social Security number, ensuring that the communication is correctly directed.

- Reason for the Letter: The letter outlines the specific reason for the communication, such as discrepancies in reported income or missing documentation.

- Actions Required: It details the steps the taxpayer must take to resolve the issue, including deadlines for submission of additional information or documentation.

- Contact Information: The letter provides contact details for the IRS office handling the case, allowing taxpayers to seek clarification or assistance as needed.

Steps to Respond to IRS Letter 4364C

Responding to IRS Letter 4364C involves several important steps to ensure compliance:

- Review the Letter: Carefully read the letter to understand the specific issues raised by the IRS.

- Gather Required Documentation: Collect any necessary documents that support your case or address the concerns outlined in the letter.

- Prepare Your Response: Draft a clear and concise response that addresses the IRS's requests, ensuring all information is accurate.

- Submit Your Response: Send your response along with any supporting documents to the address provided in the letter, ensuring it is sent by the specified deadline.

Legal Use of IRS Letter 4364C

IRS Letter 4364C is a legally binding document that outlines the IRS's position regarding a taxpayer's return. It is essential for taxpayers to treat this letter seriously, as failure to respond appropriately can lead to further penalties or legal action. Understanding the legal implications of this letter can help taxpayers navigate their obligations and rights effectively.

Common Scenarios Involving IRS Letter 4364C

Taxpayers may encounter IRS Letter 4364C in various scenarios, including:

- Income Discrepancies: If the IRS identifies differences between reported income and information received from third parties, such as employers or banks.

- Missing Documentation: When the IRS requires additional information to process a return or resolve an audit.

- Audit Notifications: As part of the audit process, this letter may inform taxpayers of specific issues that need to be addressed.

Filing Deadlines Related to IRS Letter 4364C

It is important for taxpayers to be aware of the filing deadlines associated with IRS Letter 4364C. The letter will specify a deadline for responding to the IRS, which is typically within thirty days. Missing this deadline can result in penalties or further actions from the IRS, so timely responses are critical.

Quick guide on how to complete irs internal revenue service taxaudit com

Effortlessly Prepare IRS Internal Revenue Service Taxaudit com on Any Device

Digital document management has gained popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage IRS Internal Revenue Service Taxaudit com on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

How to Modify and eSign IRS Internal Revenue Service Taxaudit com with Ease

- Find IRS Internal Revenue Service Taxaudit com and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive data using tools designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Dismiss concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and eSign IRS Internal Revenue Service Taxaudit com to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs internal revenue service taxaudit com

Create this form in 5 minutes!

How to create an eSignature for the irs internal revenue service taxaudit com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS letter 4364c?

The IRS letter 4364c is a notification sent by the IRS to inform taxpayers about the status of their tax return. It typically indicates that the IRS has received your return and is processing it. Understanding this letter is crucial for ensuring that your tax matters are handled correctly.

-

How can airSlate SignNow help with IRS letter 4364c?

airSlate SignNow provides a seamless way to eSign and send documents related to your IRS letter 4364c. With our platform, you can quickly prepare and submit any necessary forms or responses to the IRS, ensuring that you stay compliant and informed throughout the process.

-

Is there a cost associated with using airSlate SignNow for IRS letter 4364c?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage documents related to your IRS letter 4364c without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing IRS letter 4364c?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your IRS letter 4364c and any related documents efficiently. Our user-friendly interface ensures that you can navigate the process with ease.

-

Can I integrate airSlate SignNow with other applications for IRS letter 4364c?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when dealing with IRS letter 4364c. Whether you use CRM systems or accounting software, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for IRS letter 4364c?

Using airSlate SignNow for your IRS letter 4364c provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents digitally, saving time and ensuring that your sensitive information is protected.

-

How secure is airSlate SignNow when handling IRS letter 4364c?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including those related to your IRS letter 4364c. You can trust that your information is safe while using our platform.

Get more for IRS Internal Revenue Service Taxaudit com

- Hereinafter referred to as quotbuyer form

- State legal forms or allstate legal forms us legal forms

- Modify primary residential responsibility with an agreement form

- Sample letter of lost item in hotel form

- Postal terms united states postal service uspscom form

- Us 0207ltrdocx instruction this is a model letter adapt to fit your form

- Sampleletter sample complaint letteryour addressyour city state form

- Administrative dissolution of form

Find out other IRS Internal Revenue Service Taxaudit com

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple