Ct Op 424 2012

What is the Ct Op 424

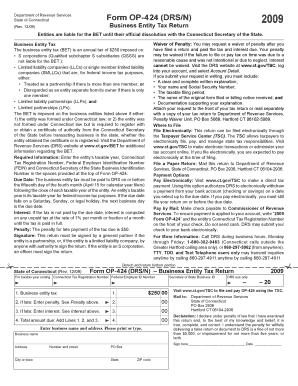

The Ct Op 424 is a specific form used in the state of Connecticut for various legal and administrative purposes. This document is essential for individuals and businesses to comply with state regulations. It typically requires information related to the parties involved, the nature of the transaction or request, and any relevant supporting documentation. Understanding the purpose of this form is crucial for ensuring accurate completion and submission.

How to use the Ct Op 424

Using the Ct Op 424 involves several key steps to ensure proper completion and submission. First, gather all necessary information, including personal or business details and any relevant data pertaining to the request. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it through the appropriate channels, whether online or via mail.

Steps to complete the Ct Op 424

Completing the Ct Op 424 requires a systematic approach to avoid mistakes. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Collect all necessary documentation and information needed for the form.

- Fill out the form, ensuring clarity and accuracy in each section.

- Double-check all entries for correctness and completeness.

- Submit the form through the designated method, whether online or by mail.

Key elements of the Ct Op 424

The Ct Op 424 includes several key elements that must be addressed for the form to be valid. These elements typically consist of:

- Identification of the parties involved in the transaction.

- A detailed description of the purpose of the form.

- Signatures of the individuals or representatives submitting the form.

- Date of submission and any applicable reference numbers.

Legal use of the Ct Op 424

The legal use of the Ct Op 424 is significant, as it serves as an official document in various administrative processes within Connecticut. It may be required in legal proceedings, business transactions, or for compliance with state regulations. Proper use ensures that individuals and entities meet their legal obligations, thus avoiding potential penalties or complications.

Who Issues the Form

The Ct Op 424 is issued by the appropriate state authority in Connecticut, which may vary depending on the specific use case of the form. Typically, it is managed by state departments or agencies responsible for overseeing the relevant legal or administrative processes. Understanding the issuing authority helps users know where to direct their inquiries or submissions.

Quick guide on how to complete ct op 424 100064418

Complete Ct Op 424 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a great eco-friendly substitute for conventional printed and signed documents, as you can obtain the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Ct Op 424 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Ct Op 424 with ease

- Obtain Ct Op 424 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that task.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Edit and eSign Ct Op 424 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct op 424 100064418

Create this form in 5 minutes!

How to create an eSignature for the ct op 424 100064418

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct op 424 and how does it relate to airSlate SignNow?

ct op 424 refers to a specific operational procedure that can be streamlined using airSlate SignNow. This solution allows businesses to efficiently manage document signing and workflows, ensuring compliance and enhancing productivity.

-

How much does airSlate SignNow cost for using ct op 424?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for implementing ct op 424. You can select from different tiers that cater to various business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for ct op 424?

airSlate SignNow provides a range of features that support ct op 424, including customizable templates, automated workflows, and secure eSigning capabilities. These features help businesses streamline their document processes and enhance operational efficiency.

-

How can airSlate SignNow benefit my business with ct op 424?

By utilizing airSlate SignNow for ct op 424, your business can reduce turnaround times for document signing and improve overall workflow efficiency. This leads to faster decision-making and a more agile operational process.

-

Can I integrate airSlate SignNow with other tools while using ct op 424?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, making it easy to incorporate ct op 424 into your existing systems. This flexibility allows for a more cohesive workflow and better data management.

-

Is airSlate SignNow secure for handling ct op 424 documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents related to ct op 424 are protected with advanced encryption and compliance measures. This guarantees that your sensitive information remains safe throughout the signing process.

-

What types of businesses can benefit from ct op 424 with airSlate SignNow?

Businesses of all sizes and industries can benefit from implementing ct op 424 with airSlate SignNow. Whether you're in healthcare, finance, or any other sector, this solution can help streamline your document processes and enhance operational efficiency.

Get more for Ct Op 424

- Lenderpurchaser disclosure statement loan origination form

- Log of appraisal experience form 3004 example

- Referencecan a seller back out of a purchase agreementzillowtypes of listing agreements understanding real estate can a seller form

- Foia request form pdf

- Landlord w 9 form pdf

- Communication matrix pdf form

- Junior kabaddi registration form 2021 1529120

- Application for flight crew licence validation form

Find out other Ct Op 424

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile