Form OP?424 2018-2026

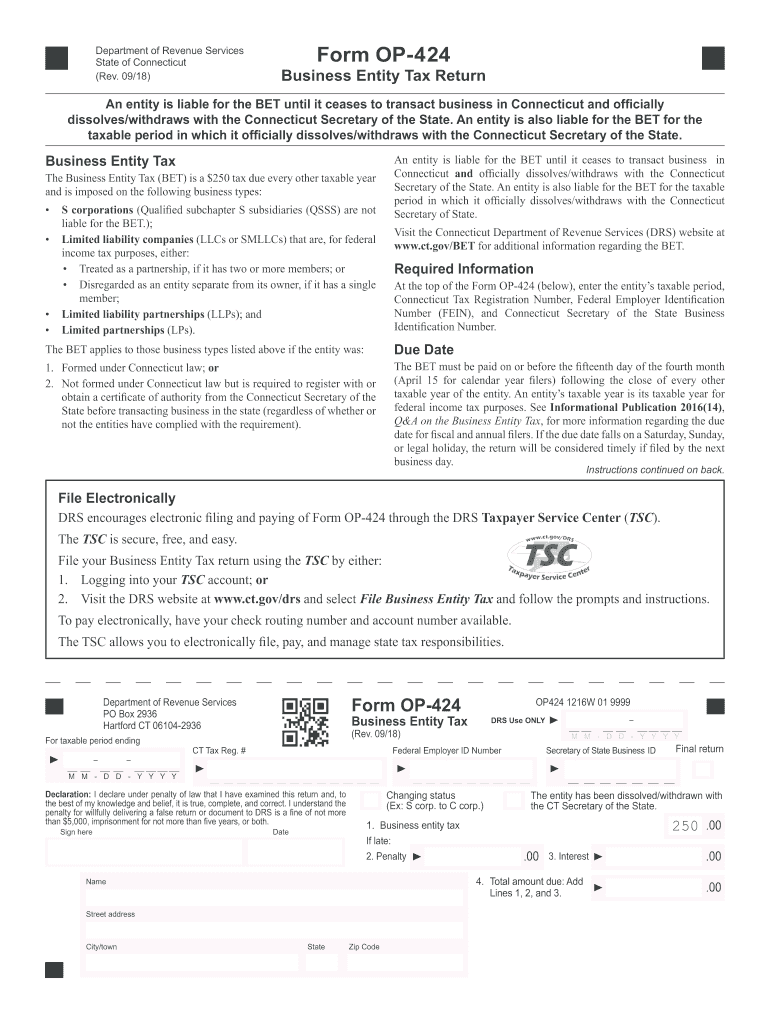

What is the Form OP-424?

The Form OP-424 is a specific document used for various official purposes, primarily in the context of regulatory compliance and reporting. It serves as a means for individuals and businesses to provide necessary information to relevant authorities. Understanding the purpose of this form is crucial for ensuring compliance with applicable laws and regulations.

How to use the Form OP-424

Using the Form OP-424 involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation that supports the information you will enter on the form. Next, fill out the form carefully, ensuring that each section is completed according to the guidelines provided. It is important to review the form for accuracy before submission to avoid any potential delays or issues.

Steps to complete the Form OP-424

Completing the Form OP-424 involves a systematic approach:

- Identify the specific purpose of the form and gather relevant documents.

- Fill in personal or business information as required.

- Provide detailed responses to all questions or sections of the form.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the Form OP-424

The Form OP-424 must be used in accordance with legal requirements set forth by relevant authorities. This includes ensuring that all information provided is truthful and accurate. Misuse of the form, such as providing false information, can lead to legal consequences, including penalties or fines. It is essential to understand the legal implications of submitting this form to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form OP-424 can vary based on the specific purpose of the form. It is important to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications with the processing of the form. Always check for the most current deadlines relevant to your situation to stay compliant.

Required Documents

When preparing to submit the Form OP-424, certain documents may be required to support the information provided. Commonly required documents include identification, proof of address, and any additional documentation that verifies the claims made on the form. Ensuring that all required documents are included can facilitate a smoother processing experience.

Quick guide on how to complete form op424

Complete Form OP?424 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly, without unnecessary delays. Handle Form OP?424 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign Form OP?424 effortlessly

- Find Form OP?424 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form OP?424 to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form op424

Create this form in 5 minutes!

How to create an eSignature for the form op424

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is op424 and how does it relate to airSlate SignNow?

Op424 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, ensuring that documents are sent and signed efficiently. By utilizing op424, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with the op424 feature?

The pricing for airSlate SignNow, including the op424 feature, varies based on the subscription plan chosen. Typically, plans are designed to be cost-effective, catering to businesses of all sizes. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

What are the main features of airSlate SignNow's op424?

The op424 feature in airSlate SignNow includes advanced eSigning capabilities, document templates, and real-time tracking. These features are designed to simplify the signing process and enhance user experience. Additionally, op424 supports various file formats, making it versatile for different business needs.

-

What benefits does using op424 provide for businesses?

Using op424 with airSlate SignNow offers numerous benefits, including increased efficiency and reduced paper usage. Businesses can save time by automating their document workflows and ensuring secure eSignatures. This not only enhances productivity but also contributes to a more sustainable business model.

-

Can I integrate airSlate SignNow with other tools using op424?

Yes, airSlate SignNow's op424 feature supports integration with various third-party applications. This allows businesses to connect their existing tools and streamline their workflows seamlessly. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is op424 secure for handling sensitive documents?

Absolutely, op424 in airSlate SignNow is designed with security in mind. It employs advanced encryption protocols to protect sensitive documents during transmission and storage. Businesses can trust that their data is secure while using the op424 feature for eSigning.

-

How can I get started with airSlate SignNow and op424?

Getting started with airSlate SignNow and the op424 feature is simple. You can sign up for a free trial on their website to explore the functionalities. Once registered, you can easily navigate the platform and begin sending and signing documents right away.

Get more for Form OP?424

- Control number hi p064 pkg form

- Free hawaii sublease agreement templates pdf ampamp docx form

- Hawaii option to purchase forms and faqus legal forms

- Control number hi p072 pkg form

- Control number hi p075 pkg form

- Bill of sale hawaii automobile bos template formslegal

- Control number hi p078 pkg form

- Control number hi p081 pkg form

Find out other Form OP?424

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors