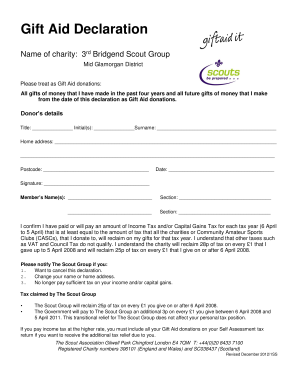

Gift Aid Declaration Name of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat as Gift Aid Donations All Gift Form

Understanding the Gift Aid Declaration

The Gift Aid Declaration is a crucial document for charities in the UK, allowing them to reclaim tax on donations made by UK taxpayers. When a donor completes this declaration, they enable the charity to receive an additional twenty-five pence for every pound donated, enhancing the impact of their contribution. This declaration is particularly beneficial for organizations like the 3rd Bridgend Scout Group, as it maximizes the funds available for community programs and activities.

Steps to Complete the Gift Aid Declaration

Completing the Gift Aid Declaration involves several straightforward steps. First, the donor must provide their personal details, including name, address, and postcode. Next, they need to confirm that they are a UK taxpayer and that they want all donations made in the past four years and future donations to be treated as Gift Aid. Finally, the donor should sign and date the form to validate their declaration. It is important to keep a copy of the declaration for personal records.

Legal Use of the Gift Aid Declaration

The legal framework surrounding the Gift Aid Declaration ensures that charities can reclaim tax efficiently. Donors must be aware that they should only complete the declaration if they pay enough UK tax to cover the amount that the charity will reclaim on their donations. This ensures compliance with HM Revenue and Customs regulations and prevents any potential penalties for both the donor and the charity.

Eligibility Criteria for Gift Aid

To qualify for Gift Aid, donors must meet specific eligibility criteria. They must be individuals who pay income tax or capital gains tax in the UK. The total amount of tax paid must be at least equal to the amount that the charity will reclaim on donations made in that tax year. Additionally, the donations must be made voluntarily and not in exchange for goods or services. Understanding these criteria helps ensure that both donors and charities can benefit from this tax relief.

Examples of Using the Gift Aid Declaration

Gift Aid can be applied in various scenarios. For instance, if a donor contributes a hundred dollars to the 3rd Bridgend Scout Group, the charity can reclaim an additional twenty-five dollars from the government, assuming the donor is a UK taxpayer. This process can significantly enhance the financial resources available for community projects, educational programs, and other charitable activities. Donors can also use the declaration for multiple charities, maximizing their impact across different organizations.

Obtaining the Gift Aid Declaration Form

The Gift Aid Declaration form can be easily obtained from the charity's website or directly from the organization. Charities often provide downloadable versions of the form, making it accessible for potential donors. Additionally, charities may have physical copies available at events or meetings. Ensuring that the form is readily available encourages more individuals to participate in the Gift Aid program, thereby increasing the funding for charitable causes.

Quick guide on how to complete gift aid declaration name of charity 3rd bridgend scout group mid glamorgan district please treat as gift aid donations all

Accomplish Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to alter and eSign Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift with ease

- Locate Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent parts of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your updates.

- Decide how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift aid declaration name of charity 3rd bridgend scout group mid glamorgan district please treat as gift aid donations all

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UK gift aid declaration?

A UK gift aid declaration is a statement that allows charities to reclaim tax on donations made by UK taxpayers. By completing this declaration, donors enable charities to increase the value of their contributions at no extra cost to themselves. This process is essential for maximizing donations and supporting charitable causes.

-

How does airSlate SignNow facilitate the UK gift aid declaration process?

airSlate SignNow streamlines the UK gift aid declaration process by providing an easy-to-use platform for creating and managing declarations. Users can quickly generate, send, and eSign documents, ensuring that the process is efficient and compliant with UK regulations. This helps charities save time and resources while maximizing their fundraising efforts.

-

Is there a cost associated with using airSlate SignNow for UK gift aid declarations?

Yes, airSlate SignNow offers various pricing plans to accommodate different organizational needs. The cost is competitive and reflects the value of features provided, such as document management and eSigning capabilities. Investing in airSlate SignNow can lead to increased donations through efficient handling of UK gift aid declarations.

-

What features does airSlate SignNow offer for managing UK gift aid declarations?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning to simplify the management of UK gift aid declarations. These tools help organizations ensure that all necessary information is captured accurately and efficiently. Additionally, the platform provides tracking and reporting capabilities to monitor the status of declarations.

-

Can airSlate SignNow integrate with other software for UK gift aid declarations?

Yes, airSlate SignNow offers integrations with various CRM and accounting software, making it easier to manage UK gift aid declarations alongside other organizational processes. This seamless integration helps streamline workflows and ensures that all data is synchronized across platforms. Organizations can benefit from a more cohesive approach to managing donations and declarations.

-

What are the benefits of using airSlate SignNow for UK gift aid declarations?

Using airSlate SignNow for UK gift aid declarations provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced donor engagement. The platform's user-friendly interface allows for quick document creation and signing, which can lead to faster processing of donations. Ultimately, this can result in higher fundraising success for charities.

-

How secure is the airSlate SignNow platform for handling UK gift aid declarations?

airSlate SignNow prioritizes security and compliance, ensuring that all UK gift aid declarations are handled with the utmost care. The platform employs advanced encryption and security protocols to protect sensitive information. Users can trust that their data is safe while managing declarations and other important documents.

Get more for Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift

- Ps2025a form

- Indian harbour beach permit search form

- Us bank power of attorney form

- Aviva beneficiary form

- Form 1 articles of incorporation

- Bill of lading hawaii form

- Affidavit to accompany joint application for order dissolving marriage justice govt form

- Hartford funds ira distribution request form

Find out other Gift Aid Declaration Name Of Charity 3rd Bridgend Scout Group Mid Glamorgan District Please Treat As Gift Aid Donations All Gift

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now