Hartford Funds IRA Distribution Request Form

What is the Hartford Funds IRA Distribution Request Form

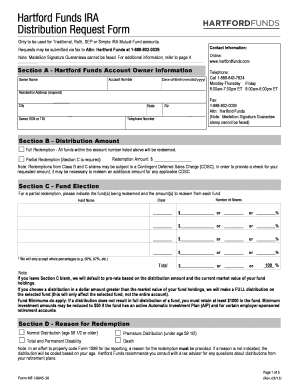

The Hartford Funds IRA Distribution Request Form is a crucial document for individuals looking to withdraw funds from their Individual Retirement Accounts (IRAs) managed by Hartford Funds. This form initiates the process of distributing assets from the account, whether for retirement income, unexpected expenses, or other financial needs. Understanding this form is essential for ensuring compliance with IRS regulations and for managing your retirement funds effectively.

How to use the Hartford Funds IRA Distribution Request Form

Using the Hartford Funds IRA Distribution Request Form involves several straightforward steps. First, ensure you have the correct version of the form, which can usually be obtained from the Hartford Funds website or customer service. Next, complete the required fields, including your personal information, account details, and the amount you wish to withdraw. After filling out the form, review it for accuracy and completeness before submitting it to Hartford Funds via the specified method, whether online, by mail, or in person.

Steps to complete the Hartford Funds IRA Distribution Request Form

Completing the Hartford Funds IRA Distribution Request Form involves a series of clear steps:

- Obtain the form from the Hartford Funds website or customer service.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide your Hartford Funds account number to ensure the request is processed correctly.

- Indicate the distribution amount and the reason for the withdrawal.

- Sign and date the form to validate your request.

- Submit the completed form as instructed, ensuring you keep a copy for your records.

Legal use of the Hartford Funds IRA Distribution Request Form

The Hartford Funds IRA Distribution Request Form is legally binding once completed and submitted according to the guidelines set forth by Hartford Funds and applicable IRS regulations. It is important to ensure that all information is accurate and that the form is signed, as this validates your request. Compliance with the legal requirements surrounding IRA distributions helps avoid potential penalties and ensures that your withdrawal is processed smoothly.

Required Documents

When submitting the Hartford Funds IRA Distribution Request Form, certain documents may be required to process your request. Typically, you will need to provide:

- A copy of a government-issued ID to verify your identity.

- Any additional documentation that supports the reason for your distribution, such as proof of financial hardship if applicable.

- Previous account statements may also be requested to confirm account details.

Form Submission Methods

The Hartford Funds IRA Distribution Request Form can be submitted through various methods to accommodate user preferences. You can choose to submit the form:

- Online through the Hartford Funds website, if electronic submission is available.

- By mail, sending the completed form to the address specified on the form.

- In person at a Hartford Funds office or authorized location, if applicable.

Quick guide on how to complete hartford funds ira distribution request form

Effortlessly Complete Hartford Funds IRA Distribution Request Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Hartford Funds IRA Distribution Request Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Steps to Edit and eSign Hartford Funds IRA Distribution Request Form with Ease

- Find Hartford Funds IRA Distribution Request Form and click Get Form to begin.

- Make use of our tools to fill out your document.

- Emphasize key sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Edit and eSign Hartford Funds IRA Distribution Request Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Hartford Funds online services offered by airSlate SignNow?

Hartford Funds online services through airSlate SignNow include the ability to electronically sign documents, manage approvals, and streamline workflows efficiently. By using our platform, you can ensure that your document processes are quick and secure, making it easier for you to focus on your business needs.

-

How much does it cost to use Hartford Funds online with airSlate SignNow?

The pricing for Hartford Funds online through airSlate SignNow varies based on your specific needs and the features you choose. Our plans are designed to be cost-effective, ensuring that you get excellent value while enjoying a range of document management capabilities. Contact us for a customized quote.

-

What features are included with Hartford Funds online on airSlate SignNow?

Hartford Funds online with airSlate SignNow includes features like document templates, customizable workflows, real-time tracking, and secure cloud storage. These features are aimed at enhancing efficiency in document handling and ensuring compliance with legal standards.

-

Can I integrate Hartford Funds online with other applications?

Yes, Hartford Funds online services offered by airSlate SignNow allow for seamless integration with various applications, including CRM systems, project management tools, and more. This enables you to synchronize your workflows and access your documents where you need them most.

-

What benefits does using Hartford Funds online provide for businesses?

Using Hartford Funds online with airSlate SignNow helps businesses reduce turnaround times on document signing and approvals signNowly. It enhances security by providing a digitally secured process and improves overall productivity by automating manual tasks.

-

Is it easy to use Hartford Funds online for someone without tech experience?

Absolutely! Hartford Funds online through airSlate SignNow is designed with user-friendliness in mind. Our platform offers an intuitive interface that makes it easy for users of all skill levels to navigate and manage their documents without any technical jargon.

-

How can I get support for Hartford Funds online with airSlate SignNow?

If you need support for Hartford Funds online, airSlate SignNow offers multiple support channels, including a robust help center, email support, and live chat assistance. Our customer service team is dedicated to ensuring your experience is smooth and hassle-free.

Get more for Hartford Funds IRA Distribution Request Form

Find out other Hartford Funds IRA Distribution Request Form

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online