Regence Form 2014-2026

What is the Regence Form

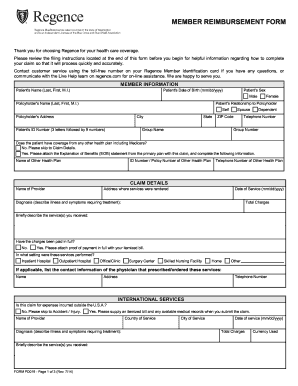

The Regence form is a specific document used for reimbursement requests related to healthcare services. It is essential for members seeking to claim expenses incurred from medical treatments or services not directly billed to their insurance provider. This form captures necessary details such as patient information, service dates, and the nature of the expenses, ensuring that all relevant data is submitted for processing.

How to use the Regence Form

Using the Regence form involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained online or through your healthcare provider. Next, fill out the required fields accurately, including your personal information and details about the services received. Attach any supporting documents, such as receipts or invoices, to substantiate your claim. Finally, submit the completed form through the designated method, whether online, by mail, or in person.

Steps to complete the Regence Form

Completing the Regence form requires careful attention to detail. Follow these steps for a successful submission:

- Download the latest version of the Regence form from the official website.

- Fill in your personal information, including your member ID and contact details.

- Provide details of the services received, including dates and descriptions.

- Attach relevant documentation, such as receipts or bills.

- Review the form to ensure all information is accurate and complete.

- Submit the form according to the instructions provided, either electronically or by mail.

Key elements of the Regence Form

The Regence form includes several key elements that are crucial for processing reimbursement requests. These elements typically consist of:

- Member Information: Personal details including name, address, and member ID.

- Service Details: Information about the services rendered, including dates and provider names.

- Expense Information: Total amount being claimed and any applicable co-pays or deductibles.

- Supporting Documentation: Required receipts or invoices that validate the claim.

Form Submission Methods

The Regence form can be submitted through various methods to accommodate member preferences. Common submission methods include:

- Online Submission: Many members prefer to submit their forms electronically through the Regence member portal.

- Mail: Members can also print the completed form and send it via postal mail to the designated address.

- In-Person: Some members may choose to deliver the form directly to a local Regence office for immediate processing.

Eligibility Criteria

To use the Regence form for reimbursement, members must meet specific eligibility criteria. Generally, these criteria include:

- Being an active member of a Regence health plan.

- Having incurred eligible medical expenses that are covered under the plan.

- Submitting the form within the specified timeframe set by Regence for reimbursement claims.

Quick guide on how to complete member information king county

The optimal method to locate and endorse Regence Form

On a business-wide scale, ineffective procedures surrounding paper approval can consume a signNow amount of work hours. Endorsing documents like Regence Form is a fundamental aspect of operations in any sector, which is why the productivity of every agreement’s lifecycle is crucial to the organization's overall effectiveness. With airSlate SignNow, endorsing your Regence Form is as simple and swift as it can be. This platform provides you with the most current version of nearly any form. Even better, you can sign it immediately without needing to install additional software on your computer or printing any hard copies.

Steps to obtain and sign your Regence Form

- Browse our collection by category or use the search bar to find the document you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to start editing right away.

- Fill out your form and input any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Regence Form.

- Select the signature method that works best for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can find, complete, modify, and even send your Regence Form in one tab without any trouble. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct member information king county

FAQs

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

How can I create an online certificate for membership? I want to send a link for members to just fill out and download.

ClassMarker will enable you to do exactly what you are wanting to achieve.With ClassMarker, you can create fully customized certificates.Options include:Portrait & Landscape CertificatesA4 & Letter sizesMultiple Font styles and sizesDrag and Drop Text and ImagesAdd extra Text fields and ImagesSelect different date display formatsAbility to create wallet sized certificatesYou can also now have Unique IDs, Serial Numbers, Course numbers and more included on your ClassMarker Certificates.If you choose for users to add their names, you can select for these to be automatically added to their certificates.Creating customized certificatesTo do as you have mentioned, you could create questionnaires/forms that you are wanting users to fill out (this can be done with a variety of different question types). You can ask for information such as name and/or email and additional ‘extra information’ questions that you can choose to make mandatory. If you like, you can choose to include these on the certificates as well.You will also be able to choose what your users see when they have finished completing their questionnaire. You can choose to not show any questions and answers but instead some customized feedback to thank your users for taking the time to fill out your questionnaire and any additional details you require, along with redirecting them elsewhere.Users will then click on the ‘certificate download’ button on their results page on-screen and/or have the results emailed to them which will also include the certificate download link so that they can download their certificate at a time that is convenient for them!You had mentioned you want to send a link to members - you can do this in ClassMarker by assigning your questionnaire to a link, in which you can then embed this directly into a page on your website or email them the link.You can check out ClassMarker’s video demo here:Online Testing Video Demonstrations

-

How is a single-member LLC owned by a nonresident alien taxed? Should I fill out a W-8 or am I deemed not to have U.S. activities?

Based on the facts as you have presented them:You are selling a product, as I see it, and not a service - although there's something of a gray area here, this is more like an intangible asset than it is providing a personal service for compensation. That product is being offered to US-based customers who are using it in the US - your focus is building up your market in the US, and you are doing that under the auspices of an LLC which is US-based. Looking at all of the facts and circumstances surrounding the conduct of your business, as you have presented them and as the IRS will look at them if asked, I conclude that you are conducting a business in the US and your income from US sources is effectively connected with the conduct of that business in the US, which means that you are subject to US taxes on that income.With that conclusion, Form W-8ECI is the proper form to provide to your US sources if you wish to prevent withholding on the income from your business.I want to add one point, since this seems to be coming up frequently - while an LLC is a disregarded entity for tax purposes, it is still a legal entity in the US - and the fact that you, as a nonresident alien, choose to operate a business under the auspices of a US-based LLC is a piece of evidence that can, under the appropriate set of facts and circumstances, be used by the IRS to support an argument that you are conducting business in the US and that your income from that business that comes from US sources should be taxable in the U.S. You should not assume that as a nonresident alien you have carte blanche to create a US LLC, operate a business under its auspices, and then at tax time argue that the income should not be taxable in the US because the LLC is a disregarded entity. The IRS will look at all of the facts and circumstances surrounding your business, including your choice of a US-based entity as the face of your business, and while that decision alone won't be dispositive, it will certainly be considered.

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

Create this form in 5 minutes!

How to create an eSignature for the member information king county

How to create an electronic signature for your Member Information King County online

How to make an electronic signature for your Member Information King County in Google Chrome

How to generate an eSignature for putting it on the Member Information King County in Gmail

How to create an electronic signature for the Member Information King County straight from your mobile device

How to make an eSignature for the Member Information King County on iOS

How to create an electronic signature for the Member Information King County on Android devices

People also ask

-

What is a Regence Form and how can airSlate SignNow help?

A Regence Form is a document used for various administrative and healthcare purposes. With airSlate SignNow, you can easily create, send, and eSign Regence Forms digitally, streamlining your workflow and eliminating the need for paper documents.

-

Is there a cost associated with using airSlate SignNow for Regence Forms?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Whether you are a small business or a large enterprise, our plans provide cost-effective solutions for managing Regence Forms and other documents efficiently.

-

What features does airSlate SignNow offer for managing Regence Forms?

airSlate SignNow provides a range of features for Regence Forms, including customizable templates, automated reminders, and secure eSignature capabilities. These features enhance your ability to manage documents quickly and efficiently.

-

Can I integrate airSlate SignNow with other software for Regence Forms?

Absolutely! airSlate SignNow seamlessly integrates with numerous third-party applications, allowing you to connect your existing systems with our platform. This integration enables you to streamline the process of handling Regence Forms alongside your other business tools.

-

How secure is my data when using airSlate SignNow for Regence Forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and comply with industry standards to ensure that your Regence Forms and sensitive information are protected at all times.

-

What are the benefits of using airSlate SignNow for Regence Forms?

Using airSlate SignNow for Regence Forms offers numerous benefits, including increased efficiency, reduced processing time, and enhanced accuracy. Our solution helps you manage documents faster, allowing your business to focus on what matters most.

-

How can I get started with airSlate SignNow for my Regence Forms?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features and learn how to efficiently manage your Regence Forms. Once you're ready, choose a pricing plan that suits your needs and start streamlining your document processes.

Get more for Regence Form

- Irish pps number application form reg 1docfish ru

- Maine form

- This certificate is awarded to gkr karate international form

- Autocheque form

- Employee personal details form template

- Patient financial agreement template form

- Vehicle owner finance contract template form

- Vehicle payment contract template form

Find out other Regence Form

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now