Form O 255 CT Gov

What is the Form O-255 CT gov

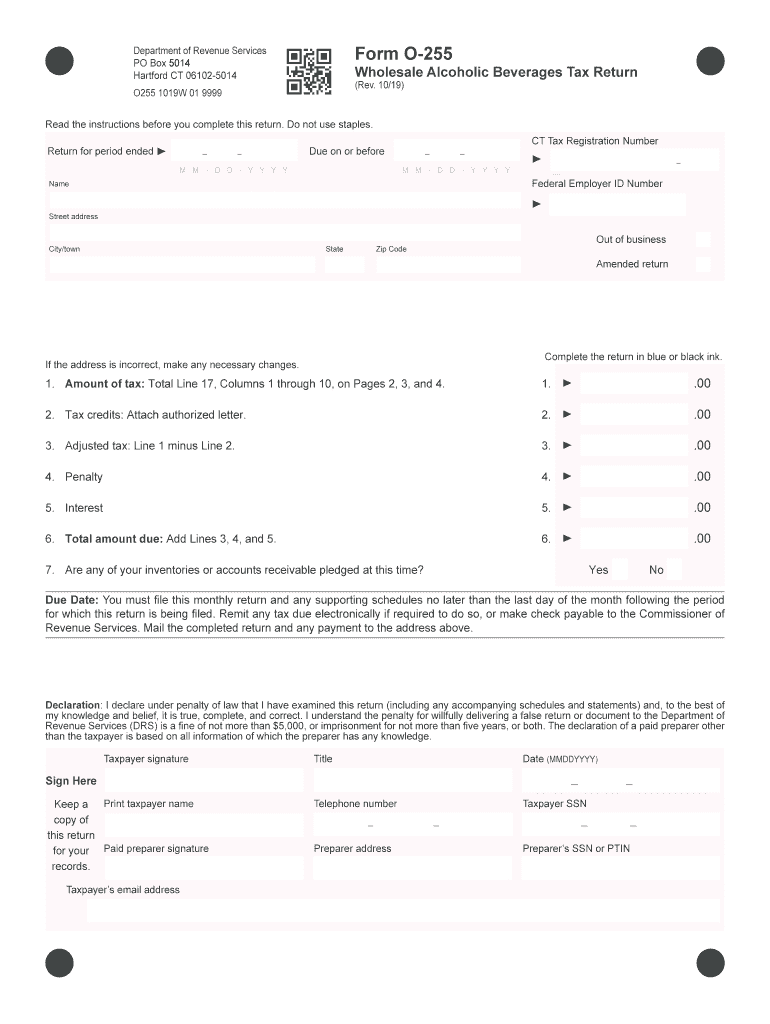

The Form O-255 CT is a tax-related document used in Connecticut. It is specifically designed for businesses and individuals to report certain tax information to the state government. This form is essential for compliance with state tax regulations and helps ensure that all necessary information is accurately reported. Understanding the purpose of this form is crucial for anyone involved in business operations or financial reporting in Connecticut.

How to use the Form O-255 CT gov

Using the Form O-255 CT involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and data that pertain to your tax situation. Next, fill out the form with the required information, ensuring that all entries are correct and complete. After completing the form, review it for any errors before submission. It is important to follow state guidelines for filing to avoid penalties.

Steps to complete the Form O-255 CT gov

Completing the Form O-255 CT requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill in your personal or business information as required on the form.

- Provide accurate figures for income, deductions, and any other relevant tax information.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring that all required signatures are included.

Key elements of the Form O-255 CT gov

The Form O-255 CT includes several key elements that are essential for proper completion. These elements typically consist of:

- Taxpayer Information: Name, address, and identification numbers.

- Income Details: Total income earned during the reporting period.

- Deductions: Any deductions that apply to your tax situation.

- Signature Section: Required signatures for validation of the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form O-255 CT. Typically, the form must be submitted by a specific date each year to avoid penalties. Mark your calendar for the due date, and allow ample time for preparation and submission. Staying informed about these deadlines helps ensure compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form O-255 CT can be submitted through various methods, depending on your preference and the requirements set by the state. Options typically include:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: You can print the completed form and send it via postal service to the appropriate state office.

- In-Person: Some individuals may choose to submit the form directly at designated state offices.

Quick guide on how to complete form o 255 ct gov

Access Form O 255 CT gov effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle Form O 255 CT gov across any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and electronically sign Form O 255 CT gov effortlessly

- Locate Form O 255 CT gov and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize crucial sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your amendments.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form O 255 CT gov to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form o 255 ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form O 255 CT gov and how can airSlate SignNow help?

Form O 255 CT gov is a document used for specific state tax purposes in Connecticut. airSlate SignNow simplifies the process of filling out and eSigning this form, ensuring compliance and accuracy. With our platform, you can easily manage and send Form O 255 CT gov securely.

-

How much does it cost to use airSlate SignNow for Form O 255 CT gov?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features that streamline the completion of Form O 255 CT gov. Check our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for managing Form O 255 CT gov?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage. These tools make it easy to create, send, and eSign Form O 255 CT gov efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for Form O 255 CT gov?

Yes, airSlate SignNow offers integrations with various applications, including CRM and accounting software. This allows you to streamline your workflow when handling Form O 255 CT gov. Check our integrations page for a full list of compatible applications.

-

Is airSlate SignNow secure for handling sensitive documents like Form O 255 CT gov?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your Form O 255 CT gov and other sensitive documents are protected, ensuring that your data remains confidential and secure.

-

How can airSlate SignNow improve my business's efficiency with Form O 255 CT gov?

By using airSlate SignNow, you can automate the document signing process, reducing the time spent on manual tasks. This efficiency allows your team to focus on more critical business activities while ensuring that Form O 255 CT gov is completed accurately and promptly.

-

What support options are available for users of airSlate SignNow for Form O 255 CT gov?

We offer comprehensive support options, including a knowledge base, live chat, and email support. Our team is ready to assist you with any questions regarding Form O 255 CT gov or using our platform. You can access support resources directly from your account.

Get more for Form O 255 CT gov

Find out other Form O 255 CT gov

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free