IRS Audit Letter CP215 Sample PDF Taxaudit Com 2022-2026

Understanding the IRS Audit Letter CP215

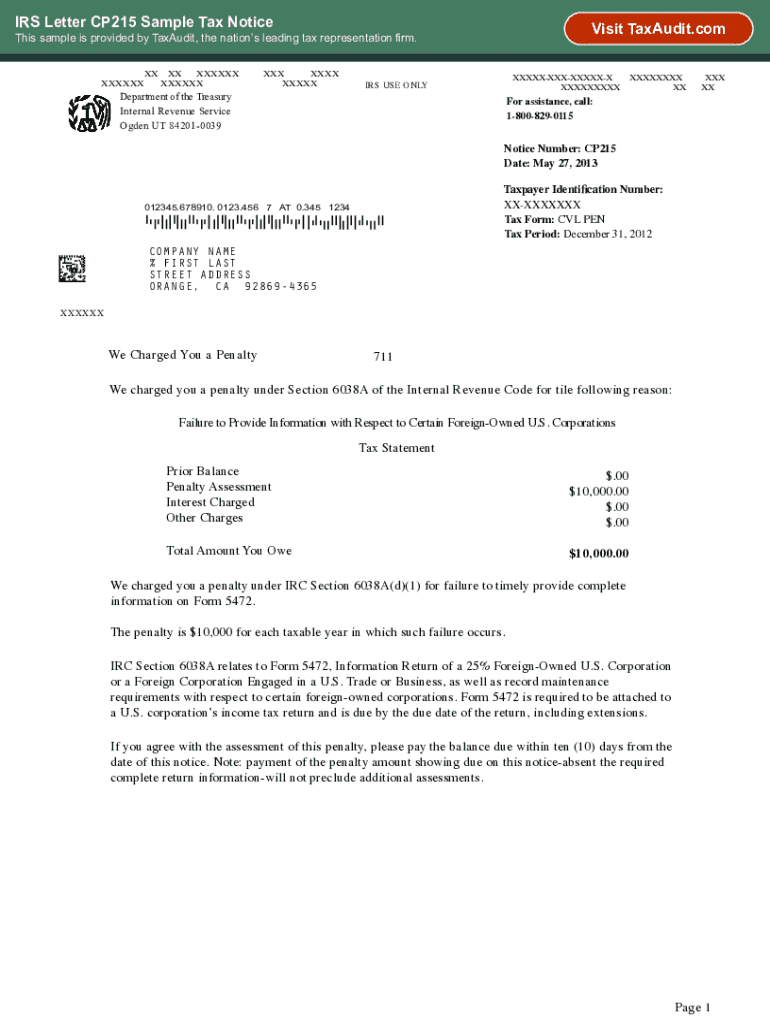

The IRS Audit Letter CP215 is an official communication from the Internal Revenue Service that notifies taxpayers of discrepancies or issues related to their tax returns. This letter serves as a formal notice that the IRS has identified potential adjustments to a taxpayer's account, often due to missing information or errors in the submitted documents. It is essential for recipients to carefully review the contents of the CP215 to understand the nature of the audit and the necessary steps to address any concerns raised by the IRS.

Key Elements of the IRS Audit Letter CP215

The CP215 contains several critical components that taxpayers should be aware of. These include:

- Taxpayer Information: This section includes the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Audit Details: The letter outlines the specific tax year under review and the reasons for the audit, including any discrepancies found.

- Action Required: It specifies what actions the taxpayer needs to take, such as providing additional documentation or responding by a certain date.

- Potential Penalties: The letter may indicate possible penalties for non-compliance or failure to respond adequately.

Steps to Respond to the IRS Audit Letter CP215

Responding to the CP215 requires careful attention to detail. Here are the steps taxpayers should follow:

- Review the Letter: Read the CP215 thoroughly to understand the issues raised and the required response.

- Gather Documentation: Collect any necessary documents that support your tax return and address the discrepancies mentioned.

- Prepare a Response: Draft a clear and concise response to the IRS, including any additional information or corrections.

- Submit on Time: Ensure your response is sent by the deadline specified in the letter to avoid further penalties.

Penalties for Non-Compliance with the CP215

Failure to respond to the IRS Audit Letter CP215 can lead to significant penalties. These may include:

- Increased Tax Liability: If the IRS determines that additional taxes are owed, the taxpayer may face increased liability.

- Interest Accrual: Interest may accrue on any unpaid balance from the date the tax was originally due.

- Additional Penalties: The IRS may impose further penalties for failure to respond or provide requested information.

Legal Use of the IRS Audit Letter CP215

The CP215 is a legally binding document, and taxpayers should treat it with seriousness. It is important to understand that:

- Legal Obligations: Taxpayers have a legal obligation to respond to the IRS and provide accurate information.

- Documentation: Keeping copies of all correspondence with the IRS is crucial for legal and tax records.

- Rights of the Taxpayer: Taxpayers have the right to seek assistance from tax professionals when responding to audits.

Obtaining the IRS Audit Letter CP215 Sample PDF

To assist taxpayers in understanding the CP215, obtaining a sample PDF of the letter can be helpful. This sample can provide clarity on:

- Format: Understanding the layout and structure of the letter.

- Content: Familiarizing oneself with the type of information typically included in the CP215.

- Response Preparation: Using the sample as a guide to prepare a proper response.

Quick guide on how to complete irs audit letter cp215 sample pdf taxaudit com

Complete IRS Audit Letter CP215 Sample PDF Taxaudit com seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Manage IRS Audit Letter CP215 Sample PDF Taxaudit com on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign IRS Audit Letter CP215 Sample PDF Taxaudit com effortlessly

- Find IRS Audit Letter CP215 Sample PDF Taxaudit com and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to store your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from your preferred device. Modify and electronically sign IRS Audit Letter CP215 Sample PDF Taxaudit com and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs audit letter cp215 sample pdf taxaudit com

Create this form in 5 minutes!

How to create an eSignature for the irs audit letter cp215 sample pdf taxaudit com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cp215 and how does it relate to airSlate SignNow?

The cp215 is a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing cp215, businesses can improve efficiency and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost for using cp215?

Pricing for airSlate SignNow varies based on the plan selected, but it remains a cost-effective solution for businesses looking to utilize cp215. The plans are designed to accommodate different business sizes and needs, ensuring that you get the best value for your investment. For detailed pricing information, visit our pricing page.

-

What features does cp215 offer in airSlate SignNow?

The cp215 feature in airSlate SignNow includes advanced eSigning capabilities, customizable templates, and real-time tracking of document status. These features help businesses manage their documents more effectively and ensure compliance with legal standards. Additionally, cp215 integrates seamlessly with other tools to enhance productivity.

-

What are the benefits of using cp215 with airSlate SignNow?

Using cp215 with airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for document transactions. Businesses can also enjoy faster turnaround times and improved customer satisfaction by streamlining their signing processes. Overall, cp215 helps organizations operate more effectively.

-

Can cp215 integrate with other software applications?

Yes, cp215 is designed to integrate with various software applications, enhancing the functionality of airSlate SignNow. This allows businesses to connect their existing tools and workflows, making it easier to manage documents and eSignatures. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is cp215 suitable for small businesses?

Absolutely! cp215 is an ideal solution for small businesses looking to streamline their document management processes. With its user-friendly interface and cost-effective pricing, small businesses can leverage the power of airSlate SignNow to improve their operations without breaking the bank. It's designed to scale as your business grows.

-

How secure is the cp215 feature in airSlate SignNow?

The cp215 feature in airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents. This ensures that all eSignatures and sensitive information remain confidential and secure. Businesses can trust cp215 to meet compliance standards and safeguard their data.

Get more for IRS Audit Letter CP215 Sample PDF Taxaudit com

Find out other IRS Audit Letter CP215 Sample PDF Taxaudit com

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation