Irs Notice Cp215 2014

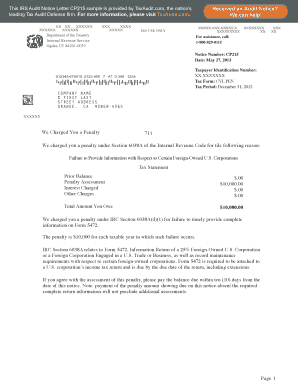

What is the IRS Notice CP215

The IRS Notice CP215 is a communication sent by the Internal Revenue Service to taxpayers regarding their tax accounts. This notice typically informs individuals about changes or updates related to their tax returns, often concerning adjustments made by the IRS. It is essential for taxpayers to understand the implications of this notice, as it can affect their tax obligations or refunds. The CP215 may also provide information about additional documentation required or changes in filing status that need to be addressed.

How to Use the IRS Notice CP215

Using the IRS Notice CP215 effectively involves reviewing the information contained within the notice carefully. Taxpayers should verify the details against their own records to ensure accuracy. If the notice indicates that additional information is needed or if there are discrepancies, it is crucial to respond promptly. This may involve gathering supporting documents or correcting any errors in the tax return. Keeping a copy of the notice for personal records is also advisable, as it can be useful for future reference or in case of further inquiries from the IRS.

Steps to Complete the IRS Notice CP215

Completing the IRS Notice CP215 involves several key steps:

- Review the Notice: Carefully read the notice to understand what changes have been made and why.

- Gather Required Documentation: Collect any necessary documents that support your tax return or clarify discrepancies.

- Respond to the IRS: If required, provide the requested information or corrections by the specified deadline.

- Keep Records: Maintain a copy of the notice and any correspondence with the IRS for your records.

Key Elements of the IRS Notice CP215

The IRS Notice CP215 contains several important elements that taxpayers should be aware of:

- Taxpayer Information: The notice includes the taxpayer's name, address, and identification number.

- Details of Changes: A clear explanation of the changes made to the tax account is provided.

- Action Required: Instructions on what actions the taxpayer needs to take, if any, are outlined.

- Contact Information: The notice provides contact details for the IRS, should further clarification be needed.

Filing Deadlines / Important Dates

Filing deadlines associated with the IRS Notice CP215 can vary based on the specific circumstances outlined in the notice. Taxpayers should pay close attention to any dates mentioned, as failing to respond by these deadlines may result in penalties or further complications with their tax account. It is advisable to mark these dates on a calendar and ensure that all necessary actions are completed in a timely manner.

Penalties for Non-Compliance

Failure to comply with the instructions provided in the IRS Notice CP215 can lead to various penalties. These may include additional tax liabilities, interest on unpaid amounts, or even legal action in severe cases. It is crucial for taxpayers to address any issues raised in the notice promptly to avoid these potential consequences. Understanding the implications of non-compliance can help individuals take the necessary steps to remain in good standing with the IRS.

Quick guide on how to complete irs notice cp215

Complete Irs Notice Cp215 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Notice Cp215 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Irs Notice Cp215 with ease

- Obtain Irs Notice Cp215 and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your preference. Modify and eSign Irs Notice Cp215 and guarantee superior communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs notice cp215

Create this form in 5 minutes!

How to create an eSignature for the irs notice cp215

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS CP215 notice?

The IRS CP215 notice is a communication from the IRS that informs taxpayers about changes to their tax account. It typically relates to adjustments made to tax returns or payments. Understanding the IRS CP215 is crucial for ensuring compliance and addressing any discrepancies.

-

How can airSlate SignNow help with IRS CP215 documentation?

airSlate SignNow provides a seamless way to eSign and send documents related to your IRS CP215 notice. With its user-friendly interface, you can quickly prepare and share necessary forms, ensuring timely responses to the IRS. This helps maintain compliance and reduces the risk of penalties.

-

What features does airSlate SignNow offer for managing IRS CP215 notices?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IRS CP215 notices. These tools streamline the process of responding to the IRS, making it easier to handle your tax documentation efficiently. Additionally, you can store and organize your documents securely.

-

Is airSlate SignNow cost-effective for handling IRS CP215 notices?

Yes, airSlate SignNow is a cost-effective solution for managing IRS CP215 notices. With various pricing plans available, businesses can choose an option that fits their budget while still accessing powerful eSigning features. This affordability makes it an ideal choice for small to medium-sized businesses.

-

Can I integrate airSlate SignNow with other tools for IRS CP215 management?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your ability to manage IRS CP215 notices. Whether you use CRM systems, cloud storage, or accounting software, these integrations help streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for IRS CP215 responses?

Using airSlate SignNow for IRS CP215 responses offers numerous benefits, including faster document turnaround times and enhanced security. The platform ensures that your sensitive information is protected while allowing you to respond to IRS notices promptly. This can signNowly reduce stress during tax season.

-

How secure is airSlate SignNow when dealing with IRS CP215 documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your IRS CP215 documents. This ensures that your sensitive tax information remains confidential and secure throughout the signing process. You can trust airSlate SignNow to handle your documents safely.

Get more for Irs Notice Cp215

- Export bill application form

- Interconnection service agreement among pjm form

- Acams recertification form

- Tinnitus handicap inventory thi instructions the purpose of this form

- Consova com centura form

- Aviz accept asociatia de proprietari form

- Dgdf rp fo 001 form

- Hkjr authorship contribution form hong kong journal of

Find out other Irs Notice Cp215

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple