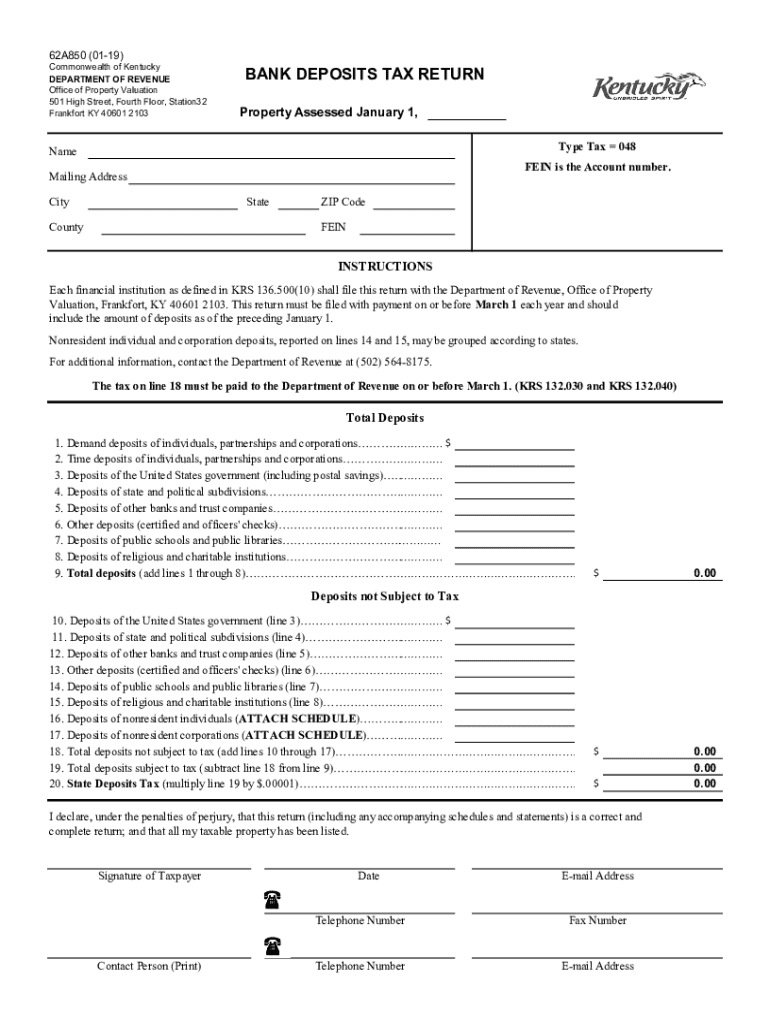

Bank Deposits Tax Return 2019

What is the Bank Deposits Tax Return

The Bank Deposits Tax Return is a specific tax form used by individuals and businesses to report income generated from bank deposits. This form helps the Internal Revenue Service (IRS) track the financial activities of taxpayers, ensuring compliance with federal tax laws. It is particularly relevant for those who may have income from interest earned on savings accounts, certificates of deposit, or other interest-bearing accounts. Understanding this form is essential for accurate tax reporting and avoiding potential penalties.

How to use the Bank Deposits Tax Return

Using the Bank Deposits Tax Return involves several steps to ensure accurate reporting of your financial information. First, gather all relevant documents, including bank statements and records of interest income. Next, fill out the form with precise details about your deposits and the corresponding interest earned. It is crucial to report all income accurately, as discrepancies can lead to audits or penalties. After completing the form, review it thoroughly for any errors before submission.

Steps to complete the Bank Deposits Tax Return

Completing the Bank Deposits Tax Return requires careful attention to detail. Follow these steps:

- Gather documentation: Collect bank statements and any other records that show interest income.

- Fill out the form: Enter your personal information, including your Social Security number and address.

- Report income: List all bank deposits and the interest earned during the tax year.

- Review: Check for accuracy and completeness before finalizing the form.

- Submit: File the form electronically or by mail, depending on your preference.

Required Documents

To complete the Bank Deposits Tax Return, specific documents are necessary. These typically include:

- Bank statements detailing all deposits and interest earned.

- Form 1099-INT, which reports interest income from banks.

- Any additional documentation that supports your income claims, such as certificates of deposit.

IRS Guidelines

The IRS provides specific guidelines for completing the Bank Deposits Tax Return. It is essential to adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Filing deadlines, which typically align with the annual tax return due date.

- Accurate reporting of all income sources, including interest from various accounts.

- Understanding the implications of any discrepancies in reported income.

Penalties for Non-Compliance

Failure to comply with the requirements of the Bank Deposits Tax Return can result in significant penalties. Common consequences include:

- Fines imposed by the IRS for underreporting income.

- Interest on unpaid taxes due to discrepancies.

- Potential audits, which can lead to further scrutiny of financial records.

Quick guide on how to complete bank deposits tax return

Complete Bank Deposits Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly and without interruptions. Handle Bank Deposits Tax Return on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Bank Deposits Tax Return without hassle

- Find Bank Deposits Tax Return and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget lost or misplaced documents, tedious form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs within a few clicks from a device of your choice. Modify and eSign Bank Deposits Tax Return and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bank deposits tax return

Create this form in 5 minutes!

How to create an eSignature for the bank deposits tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Bank Deposits Tax Return?

A Bank Deposits Tax Return is a document that reports the income generated from bank deposits for tax purposes. It is essential for individuals and businesses to accurately report this income to comply with tax regulations. Understanding how to prepare a Bank Deposits Tax Return can help you avoid penalties and ensure you maximize your deductions.

-

How can airSlate SignNow help with my Bank Deposits Tax Return?

airSlate SignNow simplifies the process of preparing and submitting your Bank Deposits Tax Return by allowing you to eSign and send documents securely. Our platform ensures that all your financial documents are organized and easily accessible, making tax season less stressful. With airSlate SignNow, you can focus on your finances while we handle the paperwork.

-

What features does airSlate SignNow offer for managing Bank Deposits Tax Returns?

airSlate SignNow offers features such as document templates, secure eSigning, and cloud storage to help you manage your Bank Deposits Tax Return efficiently. You can create, edit, and send documents directly from our platform, ensuring that all your tax-related paperwork is in one place. This streamlines the process and saves you valuable time.

-

Is airSlate SignNow cost-effective for small businesses handling Bank Deposits Tax Returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their Bank Deposits Tax Returns. Our pricing plans are flexible and cater to various business sizes, ensuring you only pay for what you need. By using our platform, you can reduce administrative costs and improve your overall efficiency.

-

Can I integrate airSlate SignNow with my accounting software for Bank Deposits Tax Returns?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to streamline your Bank Deposits Tax Return process. This integration ensures that your financial data is synchronized, reducing the risk of errors and saving you time during tax preparation. You can easily manage your documents and financial records in one cohesive system.

-

What are the benefits of using airSlate SignNow for my Bank Deposits Tax Return?

Using airSlate SignNow for your Bank Deposits Tax Return offers numerous benefits, including enhanced security, ease of use, and improved collaboration. Our platform allows you to securely eSign documents and share them with your accountant or tax advisor effortlessly. This not only speeds up the process but also ensures that your sensitive information is protected.

-

How does airSlate SignNow ensure the security of my Bank Deposits Tax Return documents?

airSlate SignNow prioritizes the security of your Bank Deposits Tax Return documents by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect your data from unauthorized access. You can trust that your financial information is safe while using our services.

Get more for Bank Deposits Tax Return

Find out other Bank Deposits Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors