Application for the Remission of Real Property and Manufactured Home Late Payment Penalties 2017

Understanding the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

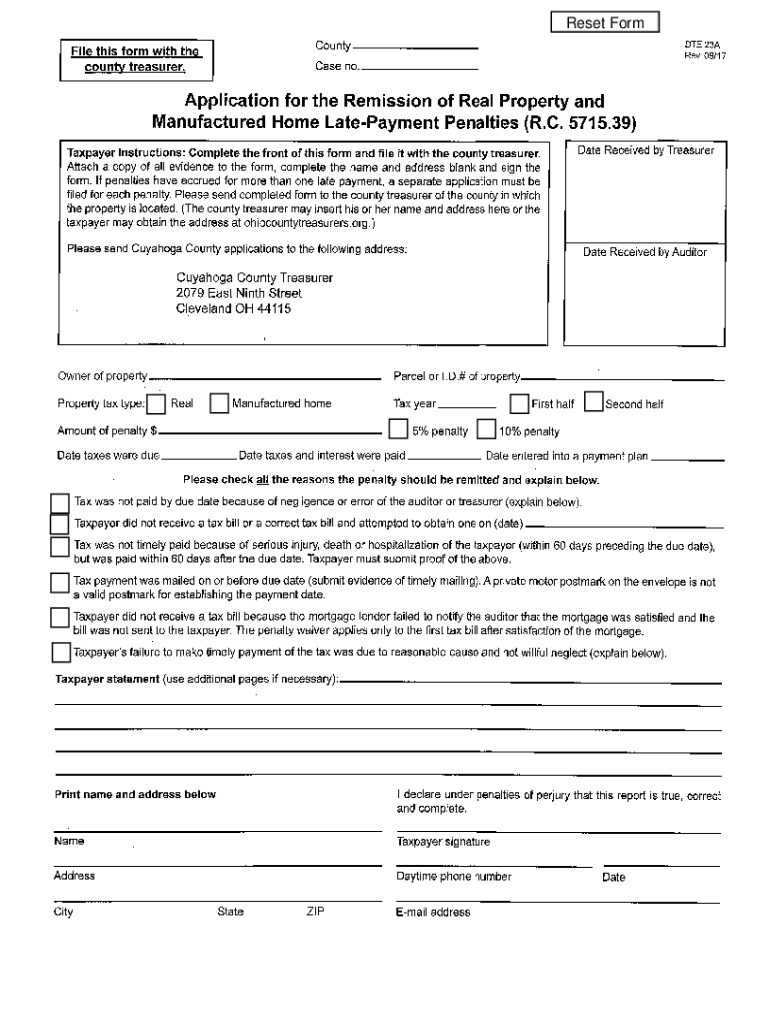

The Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties is a formal request used by property owners to seek relief from penalties associated with late payments on real property and manufactured homes. This application is particularly relevant for individuals who may have faced financial hardships or unforeseen circumstances that led to delayed payments. By submitting this application, property owners can potentially reduce or eliminate the penalties imposed for late payments, thus alleviating some financial burdens.

Steps to Complete the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

Completing the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties involves several key steps:

- Gather necessary information, including property details and payment history.

- Clearly state the reasons for the late payment, providing any supporting documentation.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for completeness and accuracy before submission.

Following these steps can increase the likelihood of a favorable outcome when seeking remission of penalties.

Eligibility Criteria for the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

To be eligible for the remission of late payment penalties, applicants must meet specific criteria. Generally, eligibility includes:

- Proof of ownership of the real property or manufactured home.

- Demonstration of financial hardship or extenuating circumstances that caused the late payment.

- Submission of the application within the designated time frame after the penalty has been assessed.

Meeting these criteria is essential for a successful application process.

How to Obtain the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

The application form can typically be obtained through local government offices, such as the county tax assessor's office or online through official state or county websites. It is important to ensure that you are using the most current version of the form, as requirements may vary by jurisdiction. If you have difficulty locating the form, consider contacting your local tax office for assistance.

Required Documents for the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

When submitting the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties, applicants should include several key documents to support their request:

- Proof of ownership, such as a deed or title.

- Documentation of the circumstances leading to the late payment, which may include financial statements or medical records.

- Any previous correspondence regarding the penalties or payment history.

Providing comprehensive documentation can strengthen the application and improve the chances of approval.

Form Submission Methods for the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

The Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties can usually be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing the completed application to the appropriate office.

- In-person submission at designated government offices.

It is advisable to check the specific submission guidelines for your area to ensure compliance with local requirements.

Quick guide on how to complete application for the remission of real property and manufactured home late payment penalties

Complete Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties without hassle

- Find Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark essential sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for the remission of real property and manufactured home late payment penalties

Create this form in 5 minutes!

How to create an eSignature for the application for the remission of real property and manufactured home late payment penalties

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties?

The Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties is a formal request that allows property owners to seek forgiveness for late payment penalties on their real property and manufactured homes. This application can help alleviate financial burdens and provide relief to those who qualify.

-

How can airSlate SignNow assist with the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties?

airSlate SignNow streamlines the process of submitting the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties by allowing users to easily create, send, and eSign documents. Our platform ensures that your application is completed accurately and submitted promptly, enhancing your chances of approval.

-

What are the costs associated with using airSlate SignNow for my application?

airSlate SignNow offers a cost-effective solution for managing your Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties. Pricing plans are flexible and designed to fit various business needs, ensuring you only pay for the features you require.

-

Are there any specific features that support the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties?

Yes, airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning that are particularly beneficial for the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties. These tools simplify the application process and enhance document management.

-

What benefits can I expect from using airSlate SignNow for my application?

Using airSlate SignNow for your Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. Our platform helps you stay organized and ensures that your application is submitted correctly.

-

Can I integrate airSlate SignNow with other software for my application?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties. This connectivity allows for a more streamlined workflow and better data management.

-

Is there customer support available for assistance with my application?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to the Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties. Our team is available to guide you through the process and ensure a smooth experience.

Get more for Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

- App test form

- Research collection eth zurichs new publication platform

- Aws membership renewal form

- Lash consent formpages beauty secrets by heather

- Nb 12 rev 25 r applicationdocx form

- Creating a new project and uploading sheetsplangrid form

- Information and services agreement

- Wireless equipment replacement affidavit faqs form

Find out other Application For The Remission Of Real Property And Manufactured Home Late Payment Penalties

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple