Remission of Late Payment Penalty Form Cuyahoga County 2015

What is the Remission Of Late Payment Penalty Form Cuyahoga County

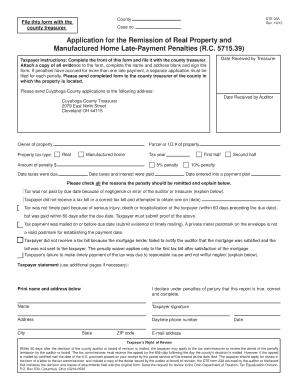

The Remission Of Late Payment Penalty Form Cuyahoga County is a specific document used by taxpayers in Cuyahoga County, Ohio, to request the cancellation of penalties incurred due to late payments. This form is essential for individuals or businesses seeking relief from financial penalties that may have arisen from delayed tax payments. By submitting this form, taxpayers can provide justification for their late payments and potentially have the penalties waived, depending on the circumstances outlined in their request.

How to use the Remission Of Late Payment Penalty Form Cuyahoga County

To use the Remission Of Late Payment Penalty Form Cuyahoga County effectively, taxpayers should first ensure they meet the eligibility criteria for remission. Once eligibility is confirmed, the form must be filled out accurately, providing all required information, including personal details, tax identification numbers, and a clear explanation of the reasons for the late payment. After completing the form, it should be submitted through the appropriate channels, which may include online submission, mailing, or in-person delivery to the relevant county office.

Steps to complete the Remission Of Late Payment Penalty Form Cuyahoga County

Completing the Remission Of Late Payment Penalty Form Cuyahoga County involves several key steps:

- Gather necessary documents, such as tax statements and any correspondence related to the late payment.

- Fill out the form with accurate information, ensuring all sections are completed.

- Provide a detailed explanation of the circumstances that led to the late payment.

- Review the form for accuracy and completeness before submission.

- Submit the form according to the guidelines provided, ensuring it reaches the appropriate office by any specified deadlines.

Eligibility Criteria

Eligibility for the Remission Of Late Payment Penalty Form Cuyahoga County typically includes factors such as the nature of the late payment, the taxpayer's history of compliance, and any extenuating circumstances that may have contributed to the delay. Taxpayers must demonstrate that the late payment was not due to willful neglect and that they have taken steps to rectify the situation. Specific eligibility requirements may vary, so it is advisable to consult the county's guidelines or contact the tax office for clarification.

Form Submission Methods

The Remission Of Late Payment Penalty Form Cuyahoga County can be submitted through various methods to accommodate different preferences. Taxpayers may choose to submit the form online via the county's official website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the designated tax office, allowing for physical documentation. For those who prefer direct interaction, in-person submission is also an option, enabling taxpayers to ask questions and receive immediate feedback on their requests.

Key elements of the Remission Of Late Payment Penalty Form Cuyahoga County

Key elements of the Remission Of Late Payment Penalty Form Cuyahoga County include:

- Taxpayer identification information, including name and address.

- Details regarding the tax account and the specific penalties being contested.

- A comprehensive explanation of the reasons for the late payment.

- Any supporting documentation that substantiates the request for remission.

- Signature of the taxpayer or authorized representative, affirming the accuracy of the information provided.

Quick guide on how to complete remission of late payment penalty form cuyahoga county

Effortlessly Prepare Remission Of Late Payment Penalty Form Cuyahoga County on Any Device

The management of online documents has gained traction among both organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the required form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without complications. Handle Remission Of Late Payment Penalty Form Cuyahoga County on any platform with the airSlate SignNow apps available for Android or iOS and enhance any document-related workflow today.

The Easiest Way to Edit and Electronically Sign Remission Of Late Payment Penalty Form Cuyahoga County Effortlessly

- Locate Remission Of Late Payment Penalty Form Cuyahoga County and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form hunting, or mistakes requiring the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Remission Of Late Payment Penalty Form Cuyahoga County to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct remission of late payment penalty form cuyahoga county

Create this form in 5 minutes!

How to create an eSignature for the remission of late payment penalty form cuyahoga county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Remission Of Late Payment Penalty Form Cuyahoga County?

The Remission Of Late Payment Penalty Form Cuyahoga County is a document that allows individuals or businesses to request the waiver of late payment penalties imposed by the county. This form is essential for those who have missed payment deadlines and seek relief from additional charges.

-

How can airSlate SignNow help with the Remission Of Late Payment Penalty Form Cuyahoga County?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the Remission Of Late Payment Penalty Form Cuyahoga County. With our solution, you can streamline the process, ensuring that your form is submitted quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for the Remission Of Late Payment Penalty Form Cuyahoga County?

airSlate SignNow offers various pricing plans to accommodate different needs, including a free trial. Our plans are designed to be cost-effective, making it easy for users to manage the Remission Of Late Payment Penalty Form Cuyahoga County without breaking the bank.

-

Is it secure to use airSlate SignNow for the Remission Of Late Payment Penalty Form Cuyahoga County?

Yes, airSlate SignNow prioritizes security and compliance. When you use our platform for the Remission Of Late Payment Penalty Form Cuyahoga County, your documents are protected with advanced encryption and secure storage, ensuring your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other applications for the Remission Of Late Payment Penalty Form Cuyahoga County?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage the Remission Of Late Payment Penalty Form Cuyahoga County alongside your existing tools. This enhances your workflow and improves efficiency.

-

What features does airSlate SignNow offer for the Remission Of Late Payment Penalty Form Cuyahoga County?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders for the Remission Of Late Payment Penalty Form Cuyahoga County. These tools help ensure that your documents are completed accurately and on time.

-

How long does it take to complete the Remission Of Late Payment Penalty Form Cuyahoga County using airSlate SignNow?

Using airSlate SignNow, you can complete the Remission Of Late Payment Penalty Form Cuyahoga County in just a few minutes. Our user-friendly interface and efficient eSigning process signNowly reduce the time required to finalize your documents.

Get more for Remission Of Late Payment Penalty Form Cuyahoga County

- Me judgment form

- Unconditional release final payment form

- Maine landlord notice form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises maine form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497310773 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair maine form

- Letter notice demand form

- Maine letter tenant form

Find out other Remission Of Late Payment Penalty Form Cuyahoga County

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online