Revenue Division Directory Form

Understanding the Revenue Division Directory

The Revenue Division Directory serves as a comprehensive resource for businesses operating in Saskatchewan. It provides essential information regarding various revenue-related matters, including tax obligations, compliance requirements, and available resources. By accessing the directory, businesses can ensure they are informed about the necessary steps to maintain compliance with state regulations.

Steps to Utilize the Revenue Division Directory

To effectively use the Revenue Division Directory, follow these steps:

- Identify the specific information you need regarding taxes or compliance.

- Navigate through the directory to locate the relevant section that addresses your inquiry.

- Review the guidelines and resources provided to understand your obligations.

- Contact the Revenue Division directly if you have further questions or need clarification.

Obtaining the Revenue Division Directory

Accessing the Revenue Division Directory is straightforward. It is typically available online through the official state website. Businesses can download or view the directory in various formats, ensuring easy access to the information needed for compliance and reporting.

Legal Considerations for Using the Revenue Division Directory

Understanding the legal implications of the Revenue Division Directory is crucial for businesses. The directory outlines the legal requirements for tax filings and compliance. It is important to adhere to these guidelines to avoid potential penalties or legal issues. Familiarizing yourself with the directory can help ensure that your business meets all necessary legal obligations.

Key Components of the Revenue Division Directory

The Revenue Division Directory includes several key components that are vital for businesses:

- Contact information for revenue officials and departments.

- Detailed descriptions of various tax types and filing requirements.

- Deadlines for submissions and important dates related to tax obligations.

- Guidance on compliance and reporting procedures.

Examples of Directory Usage in Business Scenarios

Businesses can leverage the Revenue Division Directory in various scenarios, such as:

- Determining tax rates applicable to specific business activities.

- Understanding the process for filing tax returns and making payments.

- Accessing resources for tax credits and incentives available to businesses.

Eligibility Criteria for Revenue Division Resources

Eligibility criteria for utilizing resources within the Revenue Division Directory can vary based on business type and size. It is essential for businesses to review these criteria to ensure they qualify for specific programs or resources. Understanding these requirements can facilitate better planning and compliance with state regulations.

Quick guide on how to complete revenue division directory

Complete Revenue Division Directory effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Handle Revenue Division Directory on any device with airSlate SignNow apps for Android or iOS and simplify any document-centric task today.

How to modify and electronically sign Revenue Division Directory effortlessly

- Locate Revenue Division Directory and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Revenue Division Directory and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenue division directory

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

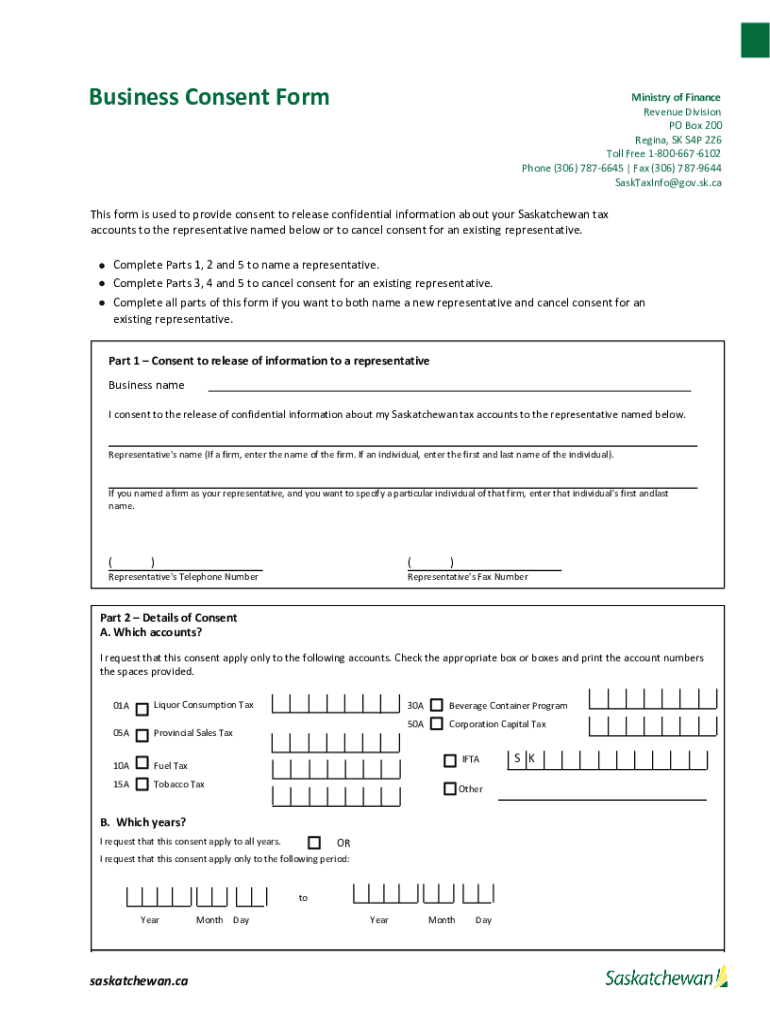

What is Saskatchewan business consent and why is it important?

Saskatchewan business consent refers to the legal permission required for businesses to operate and manage customer data in Saskatchewan. It is crucial for ensuring compliance with local regulations and protecting customer privacy. Understanding this concept helps businesses avoid legal issues and build trust with their clients.

-

How can airSlate SignNow help with obtaining Saskatchewan business consent?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign documents that include consent forms. This ensures that all necessary permissions are obtained efficiently and securely. By using our solution, businesses can easily manage their consent processes while remaining compliant with Saskatchewan regulations.

-

What features does airSlate SignNow offer for managing Saskatchewan business consent?

Our platform offers features such as customizable templates, automated workflows, and secure eSigning capabilities specifically designed for managing Saskatchewan business consent. These tools simplify the process of obtaining and tracking consent, making it easier for businesses to stay organized and compliant. Additionally, our user-friendly interface ensures a smooth experience for both businesses and their clients.

-

Is airSlate SignNow cost-effective for small businesses in Saskatchewan?

Yes, airSlate SignNow is a cost-effective solution for small businesses in Saskatchewan looking to manage their consent processes. Our pricing plans are designed to accommodate various business sizes and budgets, ensuring that even small enterprises can access essential tools for obtaining Saskatchewan business consent. This affordability allows businesses to focus on growth while maintaining compliance.

-

Can airSlate SignNow integrate with other software for managing Saskatchewan business consent?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing businesses to seamlessly manage their consent processes alongside other tools they use. This flexibility enhances productivity and ensures that all aspects of obtaining Saskatchewan business consent are efficiently handled within a unified system.

-

What are the benefits of using airSlate SignNow for Saskatchewan business consent?

Using airSlate SignNow for Saskatchewan business consent provides numerous benefits, including enhanced security, improved efficiency, and better compliance management. Our platform ensures that all consent documents are securely stored and easily accessible, reducing the risk of data bsignNowes. Additionally, the automated processes save time and resources, allowing businesses to focus on their core operations.

-

How does airSlate SignNow ensure the security of Saskatchewan business consent documents?

airSlate SignNow prioritizes the security of Saskatchewan business consent documents through advanced encryption and secure storage solutions. Our platform complies with industry standards to protect sensitive information, ensuring that all consent forms are safe from unauthorized access. This commitment to security helps businesses maintain trust with their clients and comply with legal requirements.

Get more for Revenue Division Directory

Find out other Revenue Division Directory

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP