Deed of Gift for Defunct Securities 2023-2026

What is the deed of gift for defunct securities

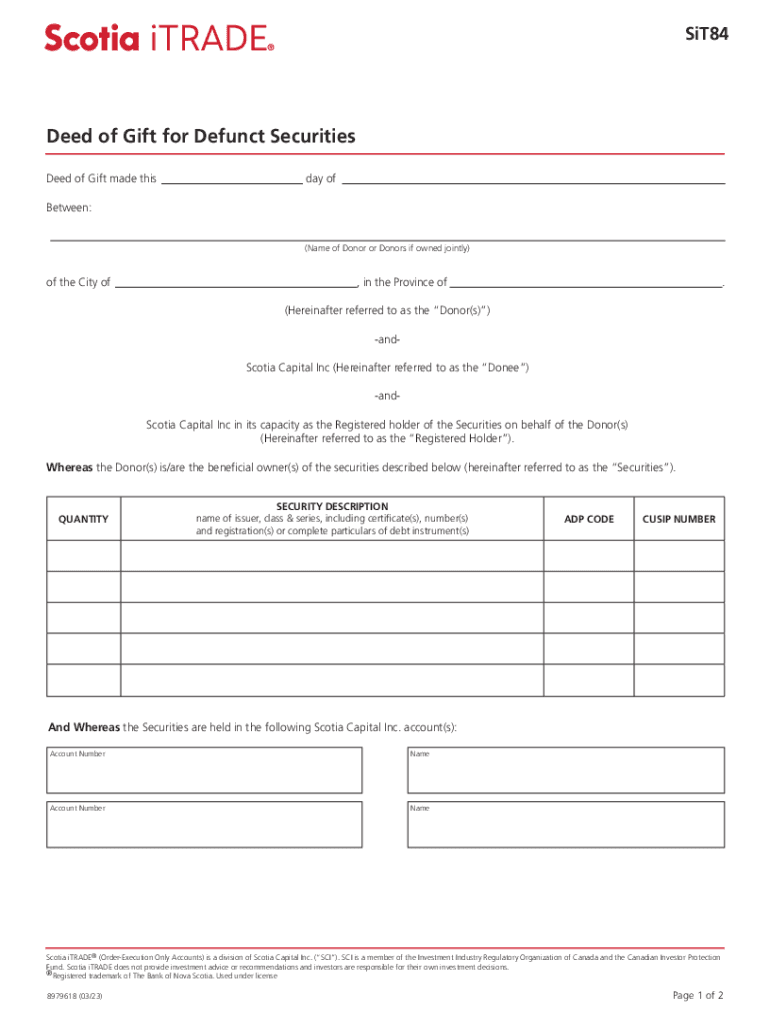

The deed of gift for defunct securities is a legal document used to transfer ownership of securities that are no longer active or have ceased trading. This document serves as a formal declaration of the donor's intention to give these securities to a recipient, often for estate planning or charitable purposes. It outlines the details of the securities being transferred, including their type, quantity, and any relevant identifiers. Understanding this deed is crucial for individuals or entities looking to manage defunct securities effectively.

How to use the deed of gift for defunct securities

Using the deed of gift for defunct securities involves several key steps. First, the donor must gather all pertinent information about the securities, including their current status and any documentation proving their defunct nature. Next, the donor completes the deed of gift, ensuring all required details are accurately filled out. Once the document is signed and dated, it should be delivered to the recipient. It is advisable for both parties to retain copies for their records. Consulting with a legal professional can provide additional guidance to ensure compliance with any applicable laws.

Steps to complete the deed of gift for defunct securities

Completing the deed of gift for defunct securities requires careful attention to detail. Follow these steps:

- Identify the securities to be transferred and confirm their defunct status.

- Gather relevant information, including the names and addresses of both the donor and recipient.

- Fill out the deed of gift form, ensuring all sections are completed accurately.

- Sign and date the document in the presence of a witness, if required by state law.

- Provide a copy of the signed deed to the recipient and retain a copy for your records.

Key elements of the deed of gift for defunct securities

Several key elements must be included in the deed of gift for defunct securities to ensure its validity:

- Donor Information: Full name and contact details of the person giving the securities.

- Recipient Information: Full name and contact details of the person receiving the securities.

- Description of Securities: Detailed description, including the type and quantity of securities.

- Statement of Intent: A clear declaration that the donor intends to gift the securities without any expectation of compensation.

- Signatures: Signatures of both the donor and recipient, along with the date of signing.

Legal use of the deed of gift for defunct securities

The legal use of the deed of gift for defunct securities is essential for ensuring that the transfer of ownership is recognized by relevant authorities. This document acts as proof of the donor's intention to gift the securities and can be critical in estate planning or when dealing with inheritance issues. It is important to comply with state laws regarding the execution and witnessing of the deed, as these requirements can vary. Proper legal usage helps prevent disputes and ensures that the transfer is valid and enforceable.

Examples of using the deed of gift for defunct securities

There are various scenarios in which the deed of gift for defunct securities may be utilized:

- An individual wishes to transfer ownership of defunct stocks from a family estate to a charitable organization.

- A donor wants to gift defunct securities to a family member as part of their estate planning strategy.

- An investor decides to donate defunct securities to a non-profit for tax benefits, using the deed to formalize the transfer.

Quick guide on how to complete deed of gift for defunct securities

Effortlessly Prepare Deed Of Gift For Defunct Securities on Any Device

Digital document management has gained traction among businesses and individuals. It represents an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to generate, alter, and eSign your documents swiftly without delays. Manage Deed Of Gift For Defunct Securities on any device using airSlate SignNow's Android or iOS applications, and simplify any document-related tasks today.

How to Modify and eSign Deed Of Gift For Defunct Securities with Ease

- Locate Deed Of Gift For Defunct Securities and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate new printed copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Adjust and eSign Deed Of Gift For Defunct Securities to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct deed of gift for defunct securities

Create this form in 5 minutes!

How to create an eSignature for the deed of gift for defunct securities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a deed of gift for defunct securities?

A deed of gift for defunct securities is a legal document that transfers ownership of securities that are no longer active or tradable. This document is essential for ensuring that the transfer is recognized legally and can help beneficiaries claim any potential value from these securities.

-

How can airSlate SignNow help with creating a deed of gift for defunct securities?

airSlate SignNow provides an easy-to-use platform for creating and signing a deed of gift for defunct securities. With customizable templates and eSignature capabilities, you can efficiently prepare and execute this important document without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for a deed of gift for defunct securities?

airSlate SignNow offers various pricing plans to suit different business needs, including options for individuals and teams. You can choose a plan that fits your budget while gaining access to features that simplify the process of creating a deed of gift for defunct securities.

-

Are there any integrations available with airSlate SignNow for managing deeds of gift for defunct securities?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow when managing deeds of gift for defunct securities. These integrations allow you to connect with tools you already use, streamlining the document management process.

-

What are the benefits of using airSlate SignNow for a deed of gift for defunct securities?

Using airSlate SignNow for a deed of gift for defunct securities offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are legally binding and easily accessible, making the transfer process smoother.

-

Is it secure to use airSlate SignNow for sensitive documents like a deed of gift for defunct securities?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive documents, including a deed of gift for defunct securities. With encryption and secure cloud storage, you can trust that your information is safe and confidential.

-

Can I track the status of my deed of gift for defunct securities with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your deed of gift for defunct securities. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Deed Of Gift For Defunct Securities

- 2020 california form 589 nonresident reduced withholding request 2020 california form 589 nonresident reduced withholding

- California form 3500 a submission of exemption request california form 3500 a submission of exemption request

- Form drs pw portalctgov

- Cdtfa 501 wg winegrower tax return form

- Form ct 706 nt estate tax return for nontaxable estates

- Fillable online 2014 municipal data sheet riverton new form

- Cdtfa 106 vehiclevessel use tax clearance request cdtfa 106 vehiclevessel use tax clearance request form

- Government entity diesel fuel tax return cdtfa 501 dg government entity diesel fuel tax return form

Find out other Deed Of Gift For Defunct Securities

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy