Form 8603 2016-2026

What is the Form 8603

The Form 8603, also known as the Mortgage Interest Credit Certificate, is a tax form used by homeowners in the United States to claim a credit for mortgage interest paid on a qualified residence. This form is particularly beneficial for first-time homebuyers or those who meet certain income requirements. By utilizing this form, eligible taxpayers can reduce their overall tax liability, making homeownership more affordable.

How to use the Form 8603

To effectively use Form 8603, taxpayers must first determine their eligibility for the mortgage interest credit. This involves reviewing the income limits and ensuring that the mortgage is for a primary residence. Once eligibility is confirmed, the form must be filled out accurately, detailing the amount of mortgage interest paid during the tax year. After completing the form, it should be submitted along with the annual tax return to the IRS.

Steps to complete the Form 8603

Completing Form 8603 involves several key steps:

- Gather necessary documents, including mortgage statements and income information.

- Confirm eligibility by checking income limits and mortgage requirements.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the mortgage interest credit based on the provided guidelines.

- Attach the completed form to your tax return before submission.

Legal use of the Form 8603

Form 8603 must be used in compliance with IRS regulations. It is essential that the information provided is truthful and accurate, as any discrepancies may lead to penalties or audits. Homeowners should retain all supporting documentation related to their mortgage interest payments, as this may be required for verification during tax assessments.

Eligibility Criteria

To qualify for the mortgage interest credit using Form 8603, taxpayers must meet specific eligibility criteria. These include:

- Being a first-time homebuyer or having not owned a home in the past three years.

- Meeting income limits set by the IRS, which may vary by location.

- Using the mortgage for a primary residence, not for investment properties.

Form Submission Methods

Form 8603 can be submitted through various methods, including:

- Online submission via e-filing, which is the fastest and most efficient method.

- Mailing a paper copy of the form along with the tax return to the appropriate IRS address.

- In-person submission at designated IRS offices, though this option may be less common.

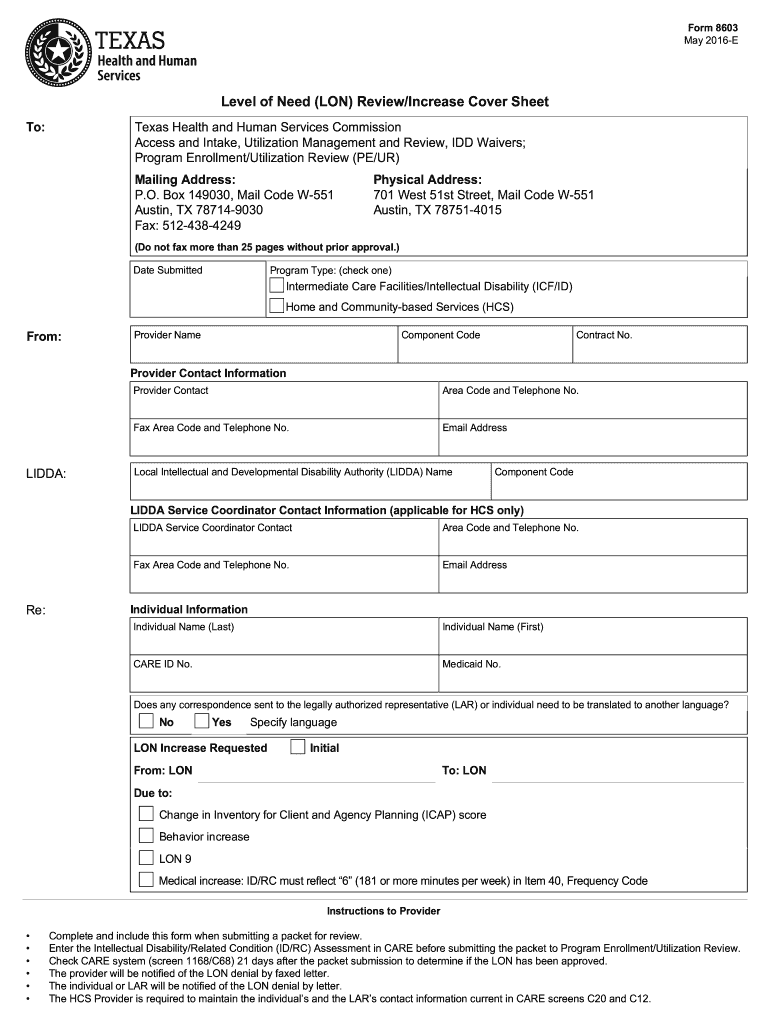

Quick guide on how to complete level of need lon reviewincrease cover sheet

Prepare Form 8603 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 8603 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 8603 effortlessly

- Locate Form 8603 and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8603 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct level of need lon reviewincrease cover sheet

FAQs

-

How much does an entry-level yacht cost in India? What is the minimum amount of money one would need to shell out for a decent (average furnishing, maybe an equivalent of 2 rooms' covered space/ something like a 50 feet long yacht) yacht?

I own a 36 foot power yacht currently, and in the past have owned yachts up to 50 feet in size. I’ve been boating for nearly 40 years. And the main thing you need to understand about owning a yacht is that the cost of the yacht itself is just a fraction of the total expense involved.Consider fuel costs. If you buy a 50 foot motor yacht that planes, you will burn anywhere from 30 to 100 gallons of fuel per hour at cruising speed (depending on the yacht). With diesel costing about $3.75/gallon here in the US, that’s $112 to $375 per hour just to take the yacht out of the slip. Multiply that times six or seven hours of running time for an idea what you’ll pay per day to go fast in a motor yacht. Slowing down will signNowly reduce your fuel burn, and they do make motor yachts designed for fuel economy (“trawler” yachts) but not everyone has the temperament for going slow. Of course you could buy a sailing yacht. Sailboats burn much less fuel, say 4 gallons per hour for a 50 footer, so there’s signNow savings. But the wind rarely cooperates with a day sailor’s agenda, so most sailors still spend the majority of their time under power. You could still easily spend about $120/day on fuel for eight hours on the water.Now consider dockage. I have no idea what it costs in India, but here in the U.S. a good marina will charge about $12 to $20 per foot per month, plus electricity. So for a 50 foot boat (sail or power) you could expect to pay as much as $1,000 per month. In places like Newport Beach, California, or New York City, double that.Almost all marinas here in the US require yacht insurance, and the good ones in India probably do too. That would be another $1500 to $7500 per year, depending on factors such as the value of the yacht and where it will be berthed during the hurricane season.Maintenance is your next major expense, and it can be substantial. For example, I spend about $1,000 per year just to have a diver clean the bottom once per month. To clean the topsides costs another $1,200 per year, and an annual detailed cleaning and wax job costs $3,000. Recently a seal failed in my yacht’s hydraulic steering system. That cost over $400 to repair. The month before that, I paid over $500 to relocate a seawater strainer for the air conditioning system. A couple of weeks before that, I paid $175 to have an electrical problem diagnosed. In a few months I’ll need to have the bottom painted, which will cost about $4,000. And on and on and on it goes. You should budget anywhere from $500 to $3000 per month to maintain a 50 foot yacht, depending on the age and condition. Of course, all of this assumes you want a yacht that’s seaworthy, rather than a “floating condo” at the marina. If you never plan to take the yacht out of the slip, you can cut back on maintenance. But that would be like buying a Ferrari and never backing it out of the garage. Ridiculous, no?Hopefully you now understand that buying the yacht is just the beginning of the costs. Here in the States we have a saying: “B.O.A.T. stands for ‘break out another thousand.’” And another saying: “A yacht is a hole in the water where you throw your money.” And another: “The two happiest days in a yachter’s life are the day he buys his yacht, and the day he sells it.”None of this is meant to discourage you. As I mentioned, I’ve been “messing about in boats” for about 40 years, so clearly, I love it. But I’ve seen too many people get into boating without first understanding the costs, and some of them got hurt financially, so I thought you ought to know.As for the purchase cost, you should be able to get a good idea what’s available with an online search. Yachtword.com is the largest online marketplace for yachts, but it doesn’t currently show any for sale in India. Happy cruising!

-

One of my friends lives far away from my school but he still wants to go to this school. He is using our address. How do we fill out the school form? We don't know what to exactly put on the form, we need massive help. We need to finish this today.

My district has a window of time that allows students to transfer to chosen schools. Almost all transfers are accepted.There is a specific procedure to do this correctly.If the student lives in a different district, they have to officially notify that district that they are planning on going to a neighboring district. Paperwork must be signed by both districts.Please contact all the districts involved. They can help you with the steps.Each year the student must reapply for the transfer. My district only denies transfers when attendance or behavior has been an issue.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How do SENSEX or NIFTY 50 index always increase in value over the long term while the companies forming part of the index move in and out? Is it possible that after 20 years from now, the SENSEX or NIFTY 50 value may fall to levels of today?

The answer lies in your question itself. It happens because poor performing companies are removed and strong performing companies are added thereby ensuring that the index continues to perform well. Also weightage of the companies changes as well

-

I’ve been out of work for a month. I need to file a disability claim signed by 1 doctor. I have seen 4 doctors and spent 2 days in the hospital. How do I consolidate all records, so 1 of my doctors can review and sign my disability claim form?

You should have a primary care doctor who is your main point of contact for all of your health care. You can request that the other doctors that you have seen send their records to your primary care doctor. His office should help you with your disability claim.You are entitled to get copies of your own medical records from your doctors and the hospital. All you have to do is call and ask. They will have you sign a release and will then give you their records. There might be a charge for this. Once you have all of your own medical records, you can take them wherever you wish.I keep copies of all of my own medical records. If I go to a new doctor, I pull out the pertinent reports and take them with me. I am the only one who has copies of all of my medical reports.

Create this form in 5 minutes!

How to create an eSignature for the level of need lon reviewincrease cover sheet

How to generate an eSignature for your Level Of Need Lon Reviewincrease Cover Sheet in the online mode

How to generate an eSignature for your Level Of Need Lon Reviewincrease Cover Sheet in Chrome

How to generate an eSignature for putting it on the Level Of Need Lon Reviewincrease Cover Sheet in Gmail

How to make an electronic signature for the Level Of Need Lon Reviewincrease Cover Sheet from your smart phone

How to generate an eSignature for the Level Of Need Lon Reviewincrease Cover Sheet on iOS

How to make an eSignature for the Level Of Need Lon Reviewincrease Cover Sheet on Android OS

People also ask

-

What is Form 8603 and why is it important?

Form 8603 is used by homeowners in the United States to claim the First-Time Homebuyer Credit. Understanding how to properly fill out Form 8603 is vital to ensure you receive the tax benefits you are eligible for. airSlate SignNow can help streamline this process by providing a user-friendly platform for eSigning and submitting your forms securely.

-

How can airSlate SignNow assist with filling out Form 8603?

airSlate SignNow offers an intuitive interface that simplifies the process of completing Form 8603. You can easily upload your documents, collaborate with others, and add necessary signatures directly on the form. This ensures that you have all required information completed accurately and quickly.

-

Is there a cost associated with using airSlate SignNow for Form 8603?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for individuals and businesses. Depending on your needs, you can choose a plan that fits best, providing value while ensuring you can handle documents like Form 8603 efficiently. A free trial is often available to test features before committing.

-

What features does airSlate SignNow provide for managing Form 8603?

airSlate SignNow provides features such as document templates, collaborative signing, and tracking capabilities to manage your Form 8603 efficiently. This streamlines the process of preparing and submitting the forms, helping you focus on what matters most without worrying about paperwork.

-

Can I integrate airSlate SignNow with other software for Form 8603 management?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and cloud storage applications, allowing you to manage Form 8603 alongside other business processes. This compatibility enhances your workflow and ensures that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow to eSign Form 8603?

Using airSlate SignNow for eSigning Form 8603 provides enhanced security, speed, and convenience. You can sign and send your form from anywhere, reducing the time spent on paperwork while ensuring that your sensitive information is protected at all times.

-

How secure is airSlate SignNow when signing Form 8603?

airSlate SignNow is committed to maintaining the highest security standards, ensuring that your Form 8603 and any other documents are protected. With strong encryption and authentication measures in place, you can feel confident that your data is safe while using the platform.

Get more for Form 8603

Find out other Form 8603

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF