pdfFiller Refund 2018-2026

What is the Pdffiller Refund?

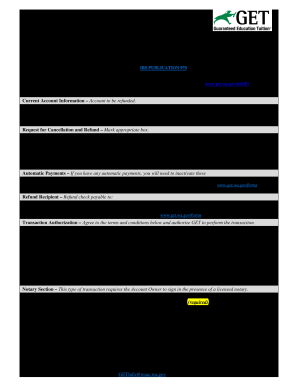

The Pdffiller Refund is a process that allows users to reclaim fees associated with the Pdffiller service. This refund may apply to various scenarios, such as subscription cancellations or unsatisfactory service experiences. Understanding the specifics of this refund process is essential for users looking to manage their finances effectively. The Pdffiller Refund is governed by the terms of service outlined by the provider, ensuring that users are aware of their rights and obligations when seeking a refund.

How to use the Pdffiller Refund

Using the Pdffiller Refund involves several straightforward steps. Users must first ensure they meet the eligibility criteria, which typically includes having an active account and a valid reason for requesting a refund. Next, users should gather any necessary documentation, such as proof of payment or correspondence with customer service. Following that, the refund request can be submitted through the designated channels, which may include an online form or direct communication with customer support. It is important to keep records of all communications and submissions for future reference.

Steps to complete the Pdffiller Refund

Completing the Pdffiller Refund process requires careful attention to detail. Here are the essential steps:

- Review the terms of service to confirm eligibility for a refund.

- Collect relevant documents, including payment receipts and account information.

- Access the refund request form on the official Pdffiller website.

- Fill out the form accurately, providing all requested information.

- Submit the form and retain a copy for your records.

- Monitor your email for confirmation or further instructions from Pdffiller.

Legal use of the Pdffiller Refund

The legal use of the Pdffiller Refund is governed by consumer protection laws and the specific terms set forth by the service provider. Users should be aware that refunds are typically only granted under certain conditions, such as service dissatisfaction or billing errors. Familiarizing oneself with these legal frameworks can help users navigate the refund process more effectively and ensure compliance with relevant regulations.

Eligibility Criteria

To qualify for the Pdffiller Refund, users must meet specific eligibility criteria. Common requirements include:

- An active account with Pdffiller at the time of the refund request.

- A valid reason for the refund, such as cancellation of service or dissatisfaction.

- Submission of the refund request within the stipulated time frame, often outlined in the terms of service.

It is advisable for users to review these criteria carefully to avoid delays or denials in their refund requests.

Required Documents

When requesting a Pdffiller Refund, users should prepare several key documents to support their claim. Essential documents typically include:

- Proof of payment, such as receipts or bank statements.

- Any correspondence with customer support regarding the refund.

- Account information, including the email associated with the Pdffiller account.

Having these documents ready can streamline the refund process and enhance the chances of a successful claim.

Quick guide on how to complete tax education services llc cpe4u colorado

Prepare Pdffiller Refund effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Pdffiller Refund on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Pdffiller Refund with ease

- Find Pdffiller Refund and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just a moment and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Pdffiller Refund and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax education services llc cpe4u colorado

FAQs

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the tax education services llc cpe4u colorado

How to create an electronic signature for your Tax Education Services Llc Cpe4u Colorado in the online mode

How to make an electronic signature for your Tax Education Services Llc Cpe4u Colorado in Chrome

How to make an eSignature for signing the Tax Education Services Llc Cpe4u Colorado in Gmail

How to create an electronic signature for the Tax Education Services Llc Cpe4u Colorado from your smartphone

How to generate an eSignature for the Tax Education Services Llc Cpe4u Colorado on iOS devices

How to make an electronic signature for the Tax Education Services Llc Cpe4u Colorado on Android devices

People also ask

-

What is cpe4u?

cpe4u is a powerful tool integrated with airSlate SignNow that enhances document management and electronic signatures. It allows businesses to streamline their workflow and improve efficiency by facilitating easy eSigning of documents.

-

How can airSlate SignNow with cpe4u improve my team's productivity?

By using cpe4u alongside airSlate SignNow, your team can signNowly reduce the time spent on document handling. The intuitive interface enables users to easily send, sign, and manage documents, which ultimately leads to faster turnaround times and increased productivity.

-

What features does cpe4u offer with airSlate SignNow?

cpe4u offers a range of features when paired with airSlate SignNow, including customizable templates, automated workflows, and real-time tracking. These features empower businesses to enhance their document processes and maintain full control over their eSigning needs.

-

What are the pricing options for airSlate SignNow with cpe4u?

Pricing for airSlate SignNow with cpe4u is designed to be cost-effective and flexible, catering to various business sizes and needs. You can choose from different plans that suit your budget and requirements, ensuring you get the best value for your investment.

-

Is cpe4u suitable for small businesses?

Yes, cpe4u is highly suitable for small businesses looking to simplify their document processes. With affordable pricing and user-friendly features, airSlate SignNow equipped with cpe4u helps small teams manage their eSigning and document needs efficiently.

-

Can cpe4u integrate with other software solutions?

Absolutely! cpe4u can seamlessly integrate with various software solutions, enhancing the capabilities of airSlate SignNow. This integration allows businesses to connect their existing tools and streamline their document workflows across platforms.

-

What are the security measures in place for cpe4u and airSlate SignNow?

Security is a top priority for cpe4u and airSlate SignNow. They use advanced encryption technologies, ensuring that all documents and signatures are protected. This robust security framework helps businesses maintain compliance and safeguard their sensitive information.

Get more for Pdffiller Refund

- Hoff cutler scholar nomination forms ohio university ohio

- Mca iii test preparation grade 8 my hrw form

- Form number 4535

- Change of address meabf chicago meabf form

- Secondary resource interventions handout farmer 07 23 15 form

- Swabi conjunctions pdf form

- 3 1 practice inequalities and their graphs form g

- Termination of independent contractor agreement template form

Find out other Pdffiller Refund

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement