5010 R Income Tax and Benefit Return for BC Only Form

What is the 5010 R Income Tax and Benefit Return for BC Only

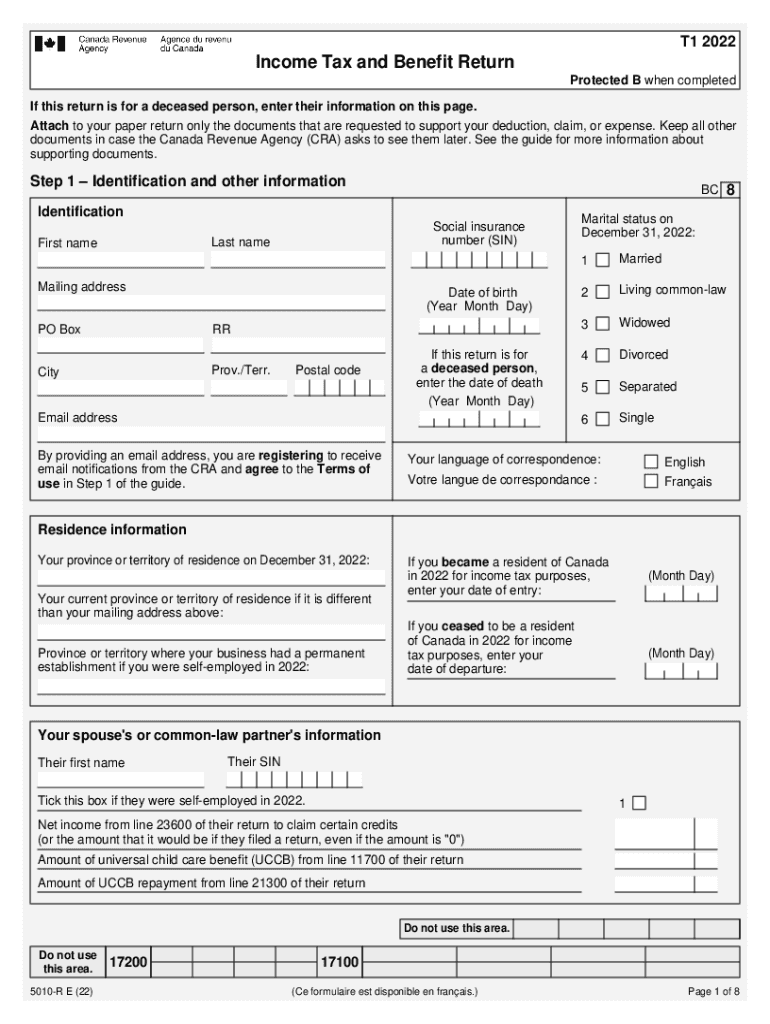

The 5010 R Income Tax and Benefit Return is a specific form used by residents of British Columbia, Canada, to report their income and claim various tax benefits. This form is essential for individuals who need to file their annual income tax returns and is designed to ensure that taxpayers receive the appropriate credits and deductions available to them. It is important to understand that this form is tailored for British Columbia and may differ from income tax forms used in other provinces or countries.

Key Elements of the 5010 R Income Tax and Benefit Return for BC Only

The 5010 R form includes several key sections that taxpayers must complete accurately. These sections typically cover personal information, income sources, deductions, and credits. Taxpayers will need to provide details such as their total income, eligible expenses, and any tax credits they wish to claim. Understanding these elements is crucial for ensuring that the return is filled out correctly and that taxpayers maximize their potential benefits.

Steps to Complete the 5010 R Income Tax and Benefit Return for BC Only

Completing the 5010 R form involves a series of steps that taxpayers should follow to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and receipts for deductions. Next, fill out the personal information section, followed by the income details. After that, calculate any eligible deductions and credits. Finally, review the completed form for accuracy before submission. It is advisable to keep copies of all documents submitted for personal records.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the 5010 R Income Tax and Benefit Return. Typically, the deadline for filing personal income tax returns in Canada is April 30 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any specific deadlines related to claiming certain benefits or credits, as these can vary.

Form Submission Methods (Online / Mail / In-Person)

The 5010 R Income Tax and Benefit Return can be submitted through various methods. Taxpayers have the option to file online using certified tax software, which can streamline the process and ensure accuracy. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own advantages, and taxpayers should choose the one that best fits their needs and preferences.

Eligibility Criteria

To file the 5010 R Income Tax and Benefit Return, taxpayers must meet certain eligibility criteria. Generally, individuals must be residents of British Columbia and have earned income during the tax year. Additionally, specific requirements may apply based on age, income level, and other factors. Understanding these criteria is essential for ensuring that taxpayers are eligible to file and claim any associated benefits.

Quick guide on how to complete 5010 r income tax and benefit return for bc only

Manage 5010 R Income Tax And Benefit Return for BC Only effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Handle 5010 R Income Tax And Benefit Return for BC Only on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign 5010 R Income Tax And Benefit Return for BC Only with ease

- Obtain 5010 R Income Tax And Benefit Return for BC Only and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 5010 R Income Tax And Benefit Return for BC Only and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5010 r income tax and benefit return for bc only

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax benefit return?

An income tax benefit return is a document that outlines the deductions and credits you can claim to reduce your taxable income. By utilizing tools like airSlate SignNow, you can easily manage and eSign your tax documents, ensuring you maximize your income tax benefit return efficiently.

-

How can airSlate SignNow help with my income tax benefit return?

airSlate SignNow streamlines the process of preparing and signing documents related to your income tax benefit return. With its user-friendly interface, you can quickly gather necessary signatures and ensure all forms are completed accurately, saving you time and reducing stress during tax season.

-

Is airSlate SignNow cost-effective for managing income tax benefit returns?

Yes, airSlate SignNow offers a cost-effective solution for managing your income tax benefit return. With various pricing plans, you can choose one that fits your budget while still accessing powerful features that simplify document management and eSigning.

-

What features does airSlate SignNow offer for income tax benefit returns?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing your income tax benefit return. These features help ensure that your documents are completed correctly and submitted on time.

-

Can I integrate airSlate SignNow with other tax software for my income tax benefit return?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, allowing you to enhance your workflow when preparing your income tax benefit return. This integration ensures that all your documents are in one place, making the process more efficient.

-

What are the benefits of using airSlate SignNow for my income tax benefit return?

Using airSlate SignNow for your income tax benefit return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can easily track the status of your documents and ensure that everything is signed and submitted correctly.

-

Is it safe to use airSlate SignNow for sensitive income tax benefit return documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive income tax benefit return documents. You can trust that your information is secure while using our platform for eSigning and document management.

Get more for 5010 R Income Tax And Benefit Return for BC Only

- Florida clinic observership form

- Standard disclosure form 2003

- Well child visits including neonatal preschool before and during middle school before and form

- Form 1139 instructions

- Dhs 1139 instructions for new providers med med quest form

- Application for medical marijuana in illinois form

- Chicago title alta statement form

- Il form 444 2790 2004

Find out other 5010 R Income Tax And Benefit Return for BC Only

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form