APPLICATION for STANDBY LETTER of CREDIT or DEMAND Form

What is the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND

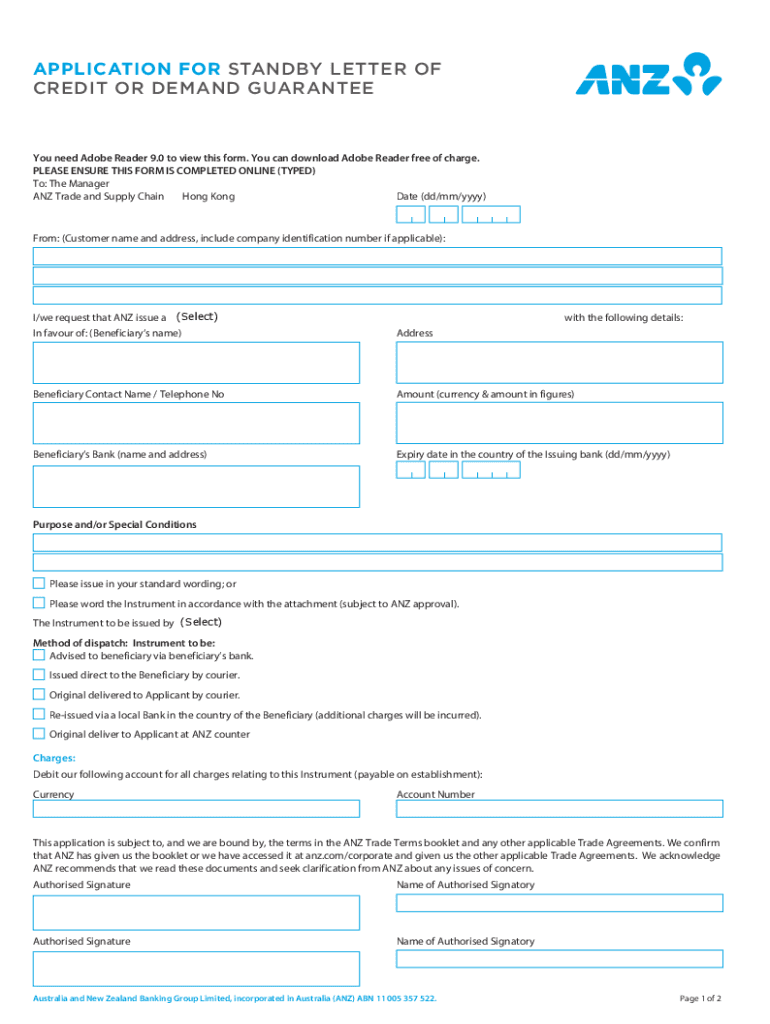

The APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND is a formal document used in financial transactions to request a standby letter of credit. This type of credit serves as a guarantee from a bank or financial institution that a specified amount will be paid to a beneficiary if certain conditions are met. Standby letters of credit are often utilized in business dealings, such as securing loans, ensuring contract performance, or facilitating international trade. They provide a safety net for parties involved in transactions, ensuring that obligations are fulfilled even if one party defaults.

How to use the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND

Using the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND involves several key steps. Initially, the applicant must accurately fill out the form with pertinent information, including details about the parties involved, the amount of credit requested, and the specific conditions under which the credit will be drawn. Once completed, the application is submitted to the issuing bank for review. The bank will assess the application based on the applicant's creditworthiness and the nature of the transaction. If approved, the standby letter of credit will be issued, providing the necessary financial assurance to the beneficiary.

Steps to complete the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND

Completing the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND requires careful attention to detail. Follow these steps:

- Gather necessary information, including your business details and the beneficiary's information.

- Clearly define the purpose of the standby letter of credit.

- Specify the amount of credit requested and the duration for which it is valid.

- Outline the conditions under which the credit can be drawn.

- Review the application for accuracy and completeness.

- Submit the application to your bank, either online or in person.

Key elements of the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND

Several key elements are essential when completing the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND. These include:

- Applicant Information: Name, address, and contact details of the applicant.

- Beneficiary Information: Details of the party that will receive the funds.

- Credit Amount: The total amount of the standby letter of credit.

- Conditions for Payment: Specific terms that must be met for the beneficiary to draw on the credit.

- Expiration Date: The date until which the standby letter of credit is valid.

Eligibility Criteria

To successfully apply for a standby letter of credit, applicants must meet certain eligibility criteria. Typically, the applicant should have a good credit history and a solid financial standing. Banks may require documentation, such as financial statements, business plans, or proof of the underlying transaction that necessitates the standby letter of credit. Additionally, the applicant must demonstrate the ability to fulfill the obligations outlined in the letter of credit to ensure the bank's confidence in issuing the credit.

Form Submission Methods

The APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND can be submitted through various methods, depending on the policies of the issuing bank. Common submission methods include:

- Online Submission: Many banks offer digital platforms where applicants can fill out and submit the application electronically.

- Mail: Applicants may also choose to print the completed form and send it via postal mail to the bank's designated department.

- In-Person: Visiting a local bank branch allows applicants to submit the application directly and discuss any questions with bank representatives.

Quick guide on how to complete application for standby letter of credit or demand

Effortlessly Prepare APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND effortlessly

- Obtain APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or an invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from the device you prefer. Edit and eSign APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for standby letter of credit or demand

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND?

An APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND is a formal request made by a party to a bank to issue a standby letter of credit. This document serves as a guarantee for payment in case the applicant fails to fulfill contractual obligations. It is commonly used in international trade and large transactions.

-

How can airSlate SignNow help with the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND?

airSlate SignNow streamlines the process of creating and signing the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND. Our platform allows users to easily fill out, eSign, and send documents securely, ensuring that all parties can access and manage their agreements efficiently.

-

What are the pricing options for using airSlate SignNow for my APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for managing documents like the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND. Visit our pricing page for detailed information.

-

What features does airSlate SignNow provide for the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which enhance the management of the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND. Additionally, users can collaborate in real-time, ensuring that all necessary parties can contribute to the document efficiently.

-

Are there any benefits to using airSlate SignNow for my APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND?

Using airSlate SignNow for your APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of errors and delays.

-

Can I integrate airSlate SignNow with other tools for my APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND?

Yes, airSlate SignNow supports integrations with various third-party applications, allowing you to streamline your workflow for the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND. Whether you use CRM systems, project management tools, or cloud storage services, our platform can connect seamlessly to enhance your document management process.

-

Is it easy to eSign the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes eSigning the APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND quick and straightforward. Users can sign documents from any device, ensuring that the signing process is convenient and accessible.

Get more for APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND

- Form 1120 pcabout form 1120 pc us property and

- Form 886 h eic rev 10 2019 documents you need to provide you can claim the earned income credit on the basis of a qualifying

- About publication 503 internal revenue service form

- Form 12203 a request for appeal internal revenue service

- Form 433 b sp rev 2 2019 collection information statement for businesses spanish version

- 2019 instructions for form 4562 instructions for form 4562 depreciation and amortization including information on listed

- Notice 1036 rev december 2018 early release copies of the 2019 percentage method tables for income tax withholding form

- Form 6524 rev 5 2019

Find out other APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement