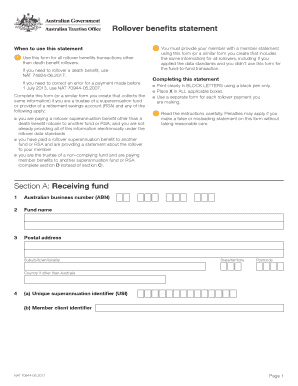

Rollover Benefits Statement Form

What is the Rollover Benefits Statement

The rollover benefits statement is a document that provides individuals with essential information regarding their retirement accounts when they are considering transferring funds from one retirement plan to another. This statement typically outlines the balance of the account, the types of investments held, and any fees associated with the account. It serves as a crucial tool for individuals looking to make informed decisions about their retirement savings.

Steps to complete the Rollover Benefits Statement

Completing a rollover benefits statement involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and account details. Next, review the statement for any discrepancies or missing information. It is important to fill in the required fields accurately, such as the amount to be rolled over and the receiving account details. Finally, ensure that you sign and date the document before submission to the relevant financial institution.

Key elements of the Rollover Benefits Statement

The rollover benefits statement includes several critical components that individuals should pay close attention to. These elements typically consist of:

- Account Balance: The total amount available for rollover.

- Investment Types: A breakdown of how the funds are invested.

- Fees: Any applicable fees that may affect the rollover.

- Contact Information: Details for the financial institution managing the account.

How to obtain the Rollover Benefits Statement

Individuals can obtain their rollover benefits statement by contacting their current retirement plan administrator or financial institution. Many institutions provide these statements online through secure portals, allowing users to download or print their statements directly. If online access is not available, individuals may request a physical copy via mail or by visiting the institution in person.

Legal use of the Rollover Benefits Statement

The rollover benefits statement is a legally recognized document that facilitates the transfer of funds between retirement accounts. It is essential for individuals to ensure that the information provided is accurate and complies with IRS regulations. Misrepresentation or errors in the statement can lead to penalties or tax implications, making it crucial to review the document thoroughly before submission.

Examples of using the Rollover Benefits Statement

Individuals may use the rollover benefits statement in various scenarios, such as:

- Transferring funds from a 401(k) to an IRA.

- Rolling over a pension plan into a new employer's retirement plan.

- Changing financial institutions while maintaining retirement savings.

These examples illustrate the versatility of the rollover benefits statement in managing retirement funds effectively.

Quick guide on how to complete rollover benefits statement

Accomplish Rollover Benefits Statement effortlessly on any device

Digital document management has gained traction among organizations and individuals. It presents an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and secure it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Rollover Benefits Statement on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to alter and electronically sign Rollover Benefits Statement seamlessly

- Find Rollover Benefits Statement and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Rollover Benefits Statement to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rollover benefits statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rollover benefits statement?

A rollover benefits statement is a document that outlines the benefits available to you when transferring funds from one retirement account to another. Understanding how to complete a rollover benefits statement is crucial for ensuring that you maximize your retirement savings and avoid unnecessary taxes.

-

How can airSlate SignNow help me with my rollover benefits statement?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning your rollover benefits statement. With our solution, you can streamline the process and ensure that all necessary information is accurately captured, making it easier to understand how to complete a rollover benefits statement.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSigning. These features are designed to simplify the process of managing documents, including how to complete a rollover benefits statement, ensuring that you have everything you need at your fingertips.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their documents efficiently. Our pricing plans are designed to fit various budgets, making it easier for you to learn how to complete a rollover benefits statement without breaking the bank.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, including CRM and accounting tools. This allows you to seamlessly manage your documents and learn how to complete a rollover benefits statement within your existing workflows.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including enhanced security, faster turnaround times, and improved compliance. By understanding how to complete a rollover benefits statement with our platform, you can ensure that your documents are signed quickly and securely.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you learn how to complete a rollover benefits statement using our platform, you can trust that your sensitive information is protected throughout the process.

Get more for Rollover Benefits Statement

- Ccpt v cole credit property trust v inc ccpt v 2015 form

- Ds 2060 2014 2019 form

- Customerproject information sheet

- Disciplinary rules and procedures for offenders texas tdcj state tx form

- Application for a license to operate a refrigerated warehouse form

- Character reference form llr sc

- Suffolk county lodge 124 form

- Cowichan valley regional district cvrdbcca cvrd bc form

Find out other Rollover Benefits Statement

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile