Www Ird Govt Nzindexall Forms and GuidesView All Forms and Guides Ird Govt Nz 2019-2026

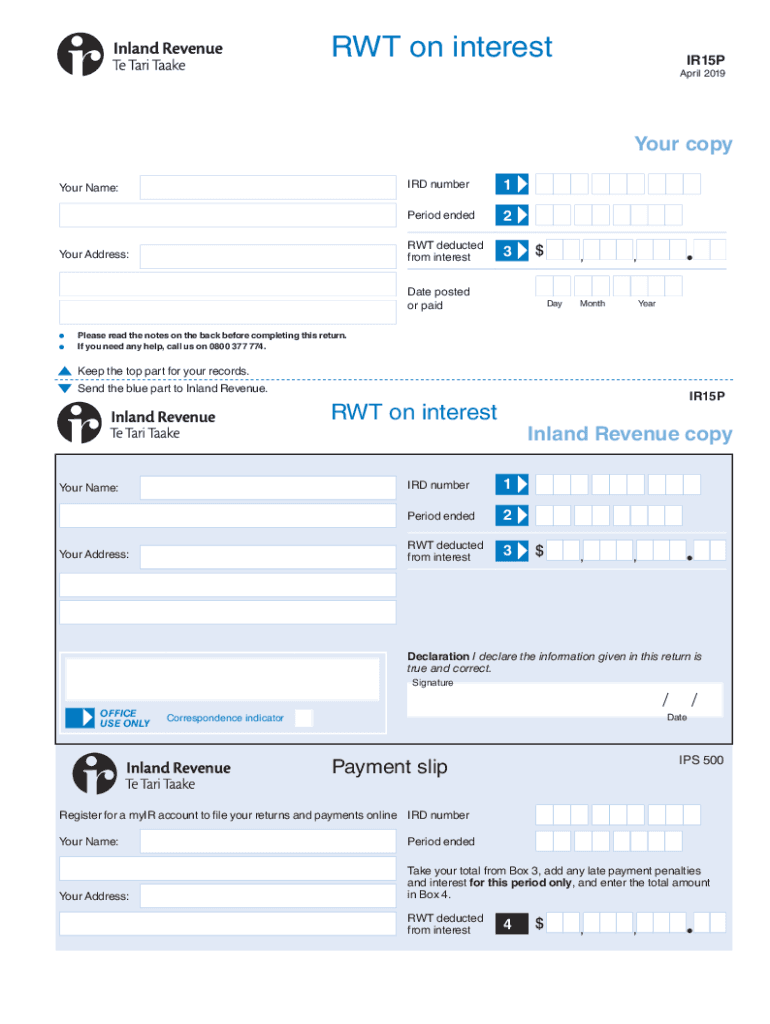

Understanding the IR15P Form

The IR15P form is a tax document used in the United States for specific reporting purposes. It is essential for individuals and businesses to understand the requirements and implications of this form to ensure compliance with IRS regulations. The form is primarily utilized for reporting certain types of income and deductions, making it a vital component of the tax filing process.

Steps to Complete the IR15P Form

Completing the IR15P form involves several key steps:

- Gather necessary documentation, including income statements and deduction records.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate channels, either electronically or by mail.

Filing Deadlines for the IR15P Form

It is crucial to be aware of the filing deadlines associated with the IR15P form. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for most taxpayers. However, extensions may be available under certain circumstances. Staying informed about these deadlines helps avoid penalties and ensures timely compliance.

Required Documents for Submission

When preparing to submit the IR15P form, specific documents are necessary to support the information reported. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Any other relevant financial documentation.

IRS Guidelines for the IR15P Form

The IRS provides guidelines that detail how to accurately complete and submit the IR15P form. These guidelines include instructions on eligibility, required information, and potential penalties for non-compliance. Familiarizing oneself with these guidelines is essential for a successful filing experience.

Penalties for Non-Compliance

Failure to file the IR15P form on time or inaccuracies in reporting can result in penalties. The IRS may impose fines based on the severity of the non-compliance, including late filing fees and interest on any unpaid taxes. Understanding these penalties emphasizes the importance of timely and accurate submissions.

Eligibility Criteria for the IR15P Form

Not everyone is required to file the IR15P form. Eligibility typically depends on factors such as income level, filing status, and specific financial circumstances. It is important for individuals and businesses to assess their eligibility to determine if they need to complete this form for their tax filings.

Quick guide on how to complete www ird govt nzindexall forms and guidesview all forms and guides ird govt nz

Effortlessly Complete Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz on Any Device

The management of documents online has increasingly gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Effortlessly Modify and eSign Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz

- Find Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details, then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious searches for forms, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www ird govt nzindexall forms and guidesview all forms and guides ird govt nz

Create this form in 5 minutes!

How to create an eSignature for the www ird govt nzindexall forms and guidesview all forms and guides ird govt nz

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir15p and how does it relate to airSlate SignNow?

The ir15p is a specific document type that can be efficiently managed using airSlate SignNow. This platform allows users to easily send, sign, and store ir15p documents securely. By utilizing airSlate SignNow, businesses can streamline their document workflows involving ir15p, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for managing ir15p documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes looking to manage ir15p documents. The pricing is designed to be cost-effective, allowing users to choose a plan that fits their needs without breaking the bank. You can explore various subscription options on our website to find the best fit for your organization.

-

What features does airSlate SignNow offer for handling ir15p documents?

airSlate SignNow provides a range of features specifically designed for handling ir15p documents, including customizable templates, automated workflows, and secure eSigning capabilities. These features enhance productivity and ensure that your ir15p documents are processed quickly and efficiently. Additionally, the platform offers real-time tracking and notifications for better document management.

-

Can I integrate airSlate SignNow with other tools for managing ir15p?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to manage ir15p documents alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, airSlate SignNow can connect with these platforms to enhance your workflow. This integration capability ensures that your ir15p documents are always accessible and manageable.

-

What are the benefits of using airSlate SignNow for ir15p documents?

Using airSlate SignNow for ir15p documents provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform simplifies the signing process, allowing users to complete transactions quickly and securely. Additionally, airSlate SignNow helps businesses maintain compliance with legal standards related to ir15p documentation.

-

Is airSlate SignNow user-friendly for managing ir15p documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage ir15p documents without extensive training. The intuitive interface allows users to navigate the platform effortlessly, ensuring that even those with minimal technical skills can send and sign ir15p documents with confidence.

-

How does airSlate SignNow ensure the security of ir15p documents?

airSlate SignNow prioritizes the security of your ir15p documents by implementing advanced encryption and compliance measures. The platform adheres to industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. With airSlate SignNow, you can trust that your ir15p documents are handled securely throughout the signing process.

Get more for Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz

- Self assessment questionnaire b ip pci security standards council form

- Kwit wypaty wynagrodzenia bedrukibbplb form

- Certificate of motor insurance form b beltelb bukb eltel uk

- Idaho department of correction sex offender idoc idaho form

- Jdf 1405 order re modification of child us state forms

- Expense approval form sample forms sampleforms

- Ccpt v cole credit property trust v inc ccpt v 2015 form

- Ds 2060 2014 2019 form

Find out other Www ird govt nzindexall forms and guidesView All Forms And Guides Ird govt nz

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word