Printable Sales Tax Payment Form Colorado 2018

What is the 2015 Colorado Tax Form?

The 2015 Colorado tax form is an official document used by residents of Colorado to report their income and calculate their state tax obligations for the year 2015. This form is essential for ensuring compliance with state tax laws and is utilized by various taxpayers, including individuals, businesses, and self-employed persons. It includes sections for reporting income, deductions, and credits, which ultimately determine the amount of tax owed or refunded. Understanding the structure and purpose of this form is crucial for accurate tax filing.

Steps to Complete the 2015 Colorado Tax Form

Completing the 2015 Colorado tax form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any records of deductions or credits.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Enter all sources of income, including wages, interest, and dividends, in the designated sections.

- Claim deductions and credits: Identify and apply any applicable deductions or credits to reduce your taxable income.

- Calculate tax liability: Use the provided tax tables or formulas to determine your total tax owed.

- Review and sign: Carefully check all entries for accuracy and sign the form to validate it.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the 2015 Colorado tax form. The standard deadline for filing state tax returns is typically April 15 of the following year, which means the due date for the 2015 tax form was April 18, 2016, due to the Emancipation Day holiday. If additional time is needed, taxpayers can file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods

The 2015 Colorado tax form can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved e-filing services, which often provide a faster processing time and confirmation of receipt.

- By mail: Completed forms can be printed and mailed to the appropriate Colorado Department of Revenue address. Ensure that the form is sent well before the deadline to allow for processing time.

- In-person: Some taxpayers may choose to deliver their forms directly to a local Department of Revenue office, although this method is less common.

Key Elements of the 2015 Colorado Tax Form

The 2015 Colorado tax form includes several key elements that taxpayers must understand:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, business income, and investment earnings.

- Deductions and Credits: Various deductions and tax credits are available to reduce taxable income, and taxpayers should be aware of which ones they qualify for.

- Tax Calculation: The form provides a method for calculating the total tax owed based on reported income and applicable deductions.

- Signature Section: A signature is required to validate the form, confirming that the information provided is accurate and complete.

Legal Use of the 2015 Colorado Tax Form

The 2015 Colorado tax form is legally binding once it is signed and submitted. It must be filled out accurately to comply with state tax laws. Falsifying information or failing to report income can result in penalties, interest, or legal action by the Colorado Department of Revenue. Taxpayers are encouraged to seek assistance if they are unsure about any part of the form to ensure compliance and avoid potential issues.

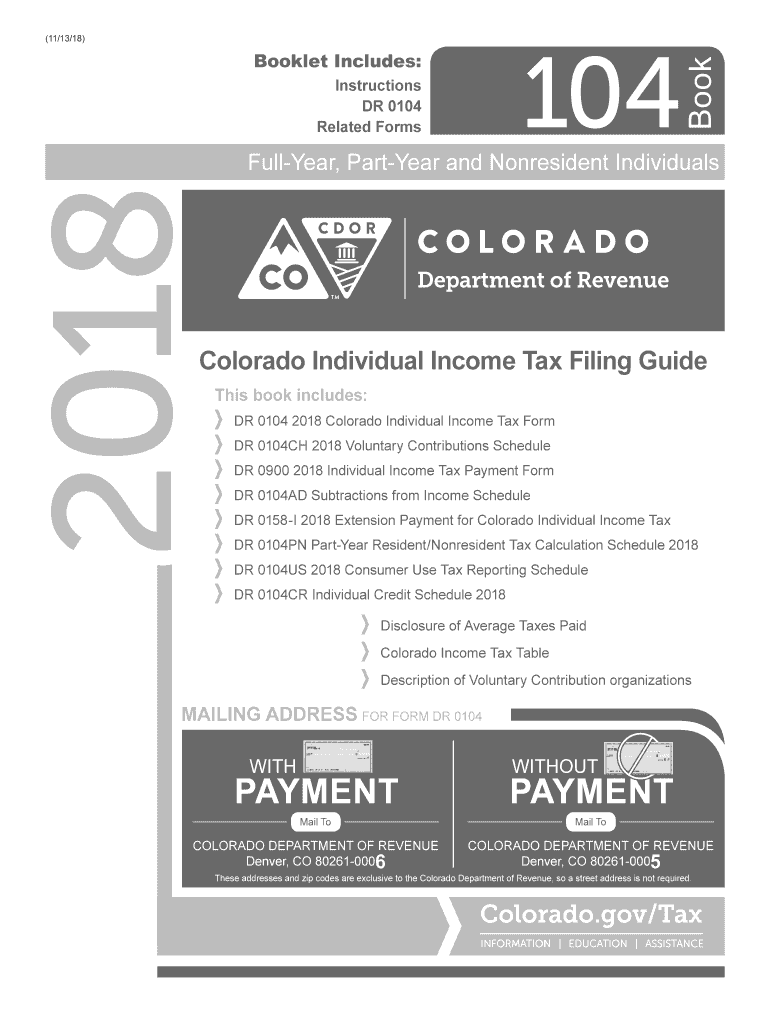

Quick guide on how to complete colorado tax form 2018 2019

Your assistance manual on how to prepare your Printable Sales Tax Payment Form Colorado

If you’re interested in learning how to generate and submit your Printable Sales Tax Payment Form Colorado, here are a few brief guidelines to make tax submission much simpler.

To begin, you just need to register your airSlate SignNow account to revolutionize how you manage documentation online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to modify information when necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Printable Sales Tax Payment Form Colorado in just a few moments:

- Create your account and start working on PDFs in minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Select Get form to access your Printable Sales Tax Payment Form Colorado in our editor.

- Complete the required fields with your details (text, numbers, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that paper filing can increase return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct colorado tax form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the colorado tax form 2018 2019

How to generate an eSignature for the Colorado Tax Form 2018 2019 in the online mode

How to make an electronic signature for the Colorado Tax Form 2018 2019 in Google Chrome

How to generate an eSignature for signing the Colorado Tax Form 2018 2019 in Gmail

How to generate an eSignature for the Colorado Tax Form 2018 2019 right from your mobile device

How to create an electronic signature for the Colorado Tax Form 2018 2019 on iOS

How to generate an eSignature for the Colorado Tax Form 2018 2019 on Android devices

People also ask

-

What is the 2015 Colorado tax form and why do I need it?

The 2015 Colorado tax form is an essential document for individuals and businesses to report income, deductions, and credits to the state of Colorado. Completing this form accurately helps ensure compliance with state tax regulations, allowing you to avoid penalties and receive any due refunds. Utilizing tools like airSlate SignNow can simplify the eSigning and submission process for your 2015 Colorado tax form.

-

How can airSlate SignNow help with the 2015 Colorado tax form?

airSlate SignNow provides an intuitive platform for eSigning and managing your 2015 Colorado tax form digitally. Our solution streamlines the document signing process, allowing you to securely sign and send your forms with ease. This saves time and increases efficiency during tax season.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as eSignature, document templates, and real-time tracking specifically designed for managing tax documents like the 2015 Colorado tax form. You can create and customize templates to fit your needs, ensuring your tax forms are always ready for eSigning. These features enhance productivity and reduce errors.

-

Is airSlate SignNow a cost-effective solution for managing the 2015 Colorado tax form?

Yes, airSlate SignNow is a cost-effective solution for handling the 2015 Colorado tax form. We offer various pricing plans to fit different business needs, ensuring you get powerful features without breaking the bank. Investing in our platform can ultimately save you time and money during tax preparation.

-

Can I integrate airSlate SignNow with other software for my 2015 Colorado tax form?

Absolutely! airSlate SignNow easily integrates with a variety of applications, allowing you to seamlessly manage your 2015 Colorado tax form alongside your existing software tools. This integration supports a smoother workflow, which is crucial during tax season when efficiency is key.

-

What types of documents besides tax forms can I manage with airSlate SignNow?

In addition to the 2015 Colorado tax form, airSlate SignNow allows you to manage various documents such as contracts, agreements, and invoices. Our platform is versatile, making it an excellent choice for any businesses that require secure document management and eSigning capabilities year-round.

-

Is it safe to use airSlate SignNow for sensitive tax documents like the 2015 Colorado tax form?

Yes, using airSlate SignNow for sensitive tax documents such as the 2015 Colorado tax form is secure. Our platform adheres to strict security standards, including encryption and compliance with data protection regulations. You can trust us to safeguard your confidential information while managing your tax forms.

Get more for Printable Sales Tax Payment Form Colorado

- Scr 15 01 15a form 15a notice of motion ontariocourtforms on

- American heritage girls registration form

- F24 semplificato form

- Configuring ipv4 static and default routes form

- Federal civil service commission form download

- Eyebrow consent form

- Full covenant amp warranty fidelity national title form

- Kitchen manager contract template form

Find out other Printable Sales Tax Payment Form Colorado

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document