Form 1120 Schedule PH U S Personal Holding Company PHC Tax

What is the Form 1120 Schedule PH U S Personal Holding Company PHC Tax

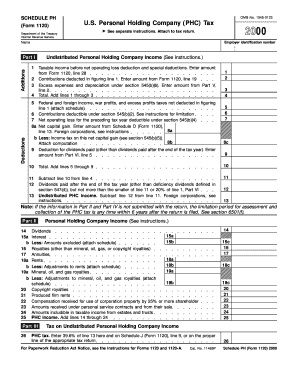

The Form 1120 Schedule PH is a tax form used by corporations classified as Personal Holding Companies (PHCs) in the United States. A PHC is a corporation that meets certain criteria established by the Internal Revenue Service (IRS), primarily concerning the nature of its income and the ownership structure. This form is essential for reporting the income, deductions, and tax liability of a PHC. It ensures that the corporation complies with specific tax obligations, including the payment of the PHC tax, which is applied to undistributed income. Understanding the purpose of this form is crucial for businesses that fall under this classification to avoid penalties and ensure proper tax reporting.

How to use the Form 1120 Schedule PH U S Personal Holding Company PHC Tax

Using the Form 1120 Schedule PH involves several steps to ensure accurate completion and compliance with IRS regulations. First, determine if your corporation qualifies as a PHC by assessing its income sources and shareholder structure. If eligible, gather all necessary financial records, including income statements and balance sheets. Next, fill out the form by providing required information such as total income, deductions, and any applicable credits. It is important to review the instructions carefully to ensure all sections are completed accurately. After filling out the form, it must be filed alongside the corporation's Form 1120, which is the main tax return for corporations. Proper submission helps avoid issues with the IRS.

Steps to complete the Form 1120 Schedule PH U S Personal Holding Company PHC Tax

Completing the Form 1120 Schedule PH requires a systematic approach. Start by confirming the corporation's status as a PHC. Then, follow these steps:

- Gather financial documents, including income statements and tax records.

- Fill in the corporation's identifying information at the top of the form.

- Report total income, including dividends, interest, and rents.

- Detail any deductions the corporation is entitled to, such as expenses related to income generation.

- Calculate the PHC tax based on undistributed income, if applicable.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form with the corporation's Form 1120 by the due date.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1120 Schedule PH. These guidelines outline eligibility criteria for PHCs, including income tests and ownership requirements. The IRS also details how to calculate the PHC tax, which is imposed on undistributed income at a rate of twenty percent. It is essential to follow these guidelines closely to ensure compliance and avoid penalties. The IRS website offers resources and publications that provide additional information on PHC regulations and filing requirements, which can be beneficial for corporate tax professionals and business owners alike.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 Schedule PH align with the due date for the corporation's Form 1120. Generally, this is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, the deadline is April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these deadlines to avoid late filing penalties and interest on unpaid taxes. Corporations may also consider filing for an extension if more time is needed to prepare the necessary documentation.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 1120 Schedule PH can result in significant penalties. The IRS imposes a penalty for failing to file the form on time, which can be a percentage of the unpaid tax amount. Additionally, if a corporation is found to have incorrectly classified itself or failed to meet the PHC criteria, it may be subject to further penalties and interest on any unpaid taxes. Understanding these potential consequences emphasizes the importance of accurate reporting and timely submission of the form to maintain compliance with tax regulations.

Quick guide on how to complete form 1120 schedule ph u s personal holding company phc tax

Prepare [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, enabling you to locate the suitable form and store it securely online. airSlate SignNow equips you with all the tools necessary to produce, modify, and eSign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to store your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 Schedule PH U S Personal Holding Company PHC Tax

Create this form in 5 minutes!

How to create an eSignature for the form 1120 schedule ph u s personal holding company phc tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 Schedule PH U S Personal Holding Company PHC Tax?

Form 1120 Schedule PH U S Personal Holding Company PHC Tax is a tax form used by corporations to report their income and calculate the tax owed on personal holding company income. This form is essential for corporations that meet specific criteria regarding passive income and ownership structure. Understanding this form is crucial for compliance and tax planning.

-

How can airSlate SignNow help with Form 1120 Schedule PH U S Personal Holding Company PHC Tax?

airSlate SignNow provides a streamlined solution for businesses to prepare and eSign Form 1120 Schedule PH U S Personal Holding Company PHC Tax. With our user-friendly platform, you can easily manage document workflows, ensuring that all necessary signatures are obtained efficiently. This helps in reducing the time spent on tax preparation and compliance.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like Form 1120 Schedule PH U S Personal Holding Company PHC Tax. These features enhance the efficiency of document handling and ensure that all parties are informed throughout the process. Additionally, our platform is designed to be intuitive, making it easy for users of all skill levels.

-

Is airSlate SignNow cost-effective for small businesses handling Form 1120 Schedule PH U S Personal Holding Company PHC Tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to handle Form 1120 Schedule PH U S Personal Holding Company PHC Tax. Our pricing plans are designed to accommodate various business sizes and budgets, ensuring that you can access essential features without overspending. This affordability allows small businesses to focus on growth while managing their tax obligations efficiently.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage Form 1120 Schedule PH U S Personal Holding Company PHC Tax alongside your financial records. This integration streamlines the workflow, allowing for seamless data transfer and reducing the risk of errors. By connecting your tools, you can enhance your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including Form 1120 Schedule PH U S Personal Holding Company PHC Tax, provides numerous benefits. You gain access to a secure platform that ensures your documents are protected while allowing for easy collaboration among team members. Additionally, the ability to track document status in real-time enhances accountability and efficiency.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including Form 1120 Schedule PH U S Personal Holding Company PHC Tax, by implementing advanced encryption and secure access protocols. Our platform complies with industry standards to protect sensitive information from unauthorized access. You can confidently manage your tax documents knowing that they are safeguarded.

Get more for Form 1120 Schedule PH U S Personal Holding Company PHC Tax

- Nct002 3 form

- Margate youth football club pitchero form

- Receptionist job application form

- Axiom submission form

- Cscs smartcard application form for craft and operative level occupations

- Please request a mandate form if you are registering a new correspondent

- Coif change of correspondent form

- Peace of mind dna test request form ireland

Find out other Form 1120 Schedule PH U S Personal Holding Company PHC Tax

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation