Miami Dade Local Business Tax 2017-2026

What is the Miami Dade Local Business Tax

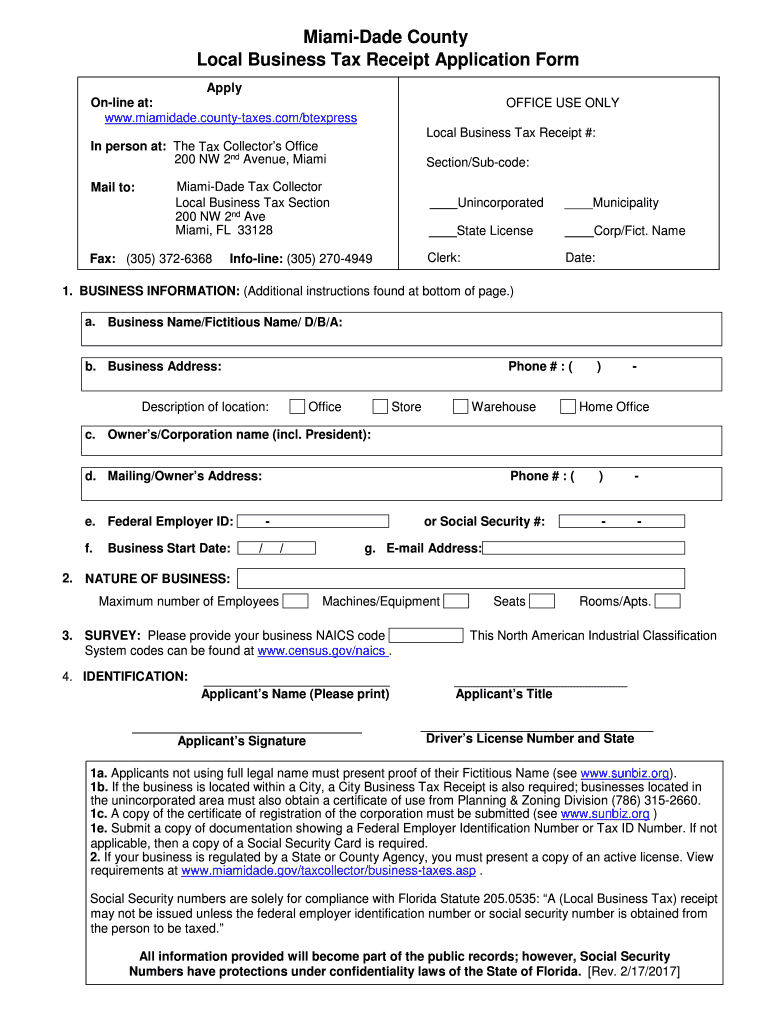

The Miami Dade Local Business Tax is a mandatory fee that businesses operating within Miami Dade County must pay to legally conduct their operations. This tax is designed to regulate local business activities and ensure compliance with county regulations. The tax applies to various types of businesses, including sole proprietorships, partnerships, and corporations. Each business must obtain a local business tax receipt, which serves as proof of payment and compliance.

How to Obtain the Miami Dade Local Business Tax

To obtain the Miami Dade Local Business Tax, businesses must complete an application process. This typically involves submitting the necessary documentation, such as proof of business ownership and identification. The application can often be completed online through the Miami Dade County website or in person at designated offices. It is important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to Complete the Miami Dade Local Business Tax

Completing the Miami Dade Local Business Tax involves several key steps:

- Gather required documents, including identification and proof of business ownership.

- Access the online application portal or visit a local office.

- Fill out the application form with accurate information.

- Submit the application along with the required fee.

- Receive confirmation of your application and the local business tax receipt once processed.

Legal Use of the Miami Dade Local Business Tax

The legal use of the Miami Dade Local Business Tax is crucial for compliance with local regulations. Businesses must display their local business tax receipt prominently at their place of operation. This receipt not only demonstrates compliance but also allows businesses to access certain services and permits required for operation within the county. Failing to obtain or display this receipt can lead to penalties and fines.

Required Documents

When applying for the Miami Dade Local Business Tax, several documents are typically required. These may include:

- Proof of identity (e.g., driver's license or state ID).

- Business registration documents (e.g., Articles of Incorporation for corporations).

- Proof of address for the business location.

- Any applicable licenses or permits specific to your business type.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Miami Dade Local Business Tax is essential for compliance. Typically, businesses must renew their local business tax receipt annually. The renewal period usually begins at the start of the calendar year, and businesses are encouraged to submit their applications early to avoid any last-minute issues. Specific deadlines may vary, so it is advisable to check with local authorities for the most accurate information.

Quick guide on how to complete business tax receipt 2017 2019 form

Your assistance manual on how to prepare your Miami Dade Local Business Tax

If you're interested in understanding how to complete and submit your Miami Dade Local Business Tax, here are a few brief instructions on how to simplify tax filing.

To begin, you just need to set up your airSlate SignNow account to revolutionize your handling of documents online. airSlate SignNow is a very user-friendly and powerful document solution that allows you to edit, create, and complete your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to make changes as necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Miami Dade Local Business Tax in a few minutes:

- Establish your account and start handling PDFs in no time.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Miami Dade Local Business Tax in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Apply the Signature Tool to insert your legally-recognized eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Keep in mind that submitting on paper may lead to increased errors and delayed refunds. Certainly, before electronically filing your taxes, consult the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct business tax receipt 2017 2019 form

FAQs

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the business tax receipt 2017 2019 form

How to create an electronic signature for the Business Tax Receipt 2017 2019 Form online

How to make an eSignature for your Business Tax Receipt 2017 2019 Form in Chrome

How to create an eSignature for putting it on the Business Tax Receipt 2017 2019 Form in Gmail

How to create an eSignature for the Business Tax Receipt 2017 2019 Form straight from your mobile device

How to generate an eSignature for the Business Tax Receipt 2017 2019 Form on iOS devices

How to make an electronic signature for the Business Tax Receipt 2017 2019 Form on Android

People also ask

-

What is Miami Dade Axia 2024?

Miami Dade Axia 2024 refers to a progressive initiative that aims to enhance digital document management in Miami-Dade County. By leveraging solutions like airSlate SignNow, businesses can streamline their document workflows and boost productivity.

-

How does airSlate SignNow support Miami Dade Axia 2024?

airSlate SignNow aligns with Miami Dade Axia 2024 by providing a user-friendly platform for electronic signatures and document sharing. This helps organizations to comply with modern digital practices and improve their operational efficiency.

-

What are the pricing plans for airSlate SignNow under Miami Dade Axia 2024?

Pricing for airSlate SignNow is designed to be cost-effective, particularly for initiatives like Miami Dade Axia 2024. Our plans cater to businesses of all sizes, ensuring you find the perfect option that meets your budget while accessing essential features.

-

What features does airSlate SignNow offer related to Miami Dade Axia 2024?

airSlate SignNow offers a range of features that align with the goals of Miami Dade Axia 2024, including easy eSignature solutions, document templates, and integrations. These tools simplify the document workflow and promote paperless practices in the county.

-

What are the benefits of using airSlate SignNow for Miami Dade Axia 2024?

Using airSlate SignNow contributes signNowly to Miami Dade Axia 2024 by enhancing efficiency, ensuring compliance, and reducing turnaround times on documents. This empowers businesses to focus on growth while maintaining seamless communication.

-

Can I integrate airSlate SignNow with other tools for Miami Dade Axia 2024?

Yes, airSlate SignNow supports numerous integrations that facilitate smoother operations in line with Miami Dade Axia 2024. Whether you're using CRM systems, storage solutions, or project management tools, you can easily connect them with our platform.

-

How secure is airSlate SignNow in relation to Miami Dade Axia 2024?

Security is a top priority for airSlate SignNow, especially in the context of Miami Dade Axia 2024. We employ advanced encryption and compliance measures to ensure your documents and data are always safe and secure.

Get more for Miami Dade Local Business Tax

Find out other Miami Dade Local Business Tax

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template