Clear Form Schedule 4 Tax on Moist Snuff Definition B on Units at or below Floor Attach This Schedule to Name Form 530 Form 531

Understanding the Clear Form Schedule 4 Tax on Moist Snuff

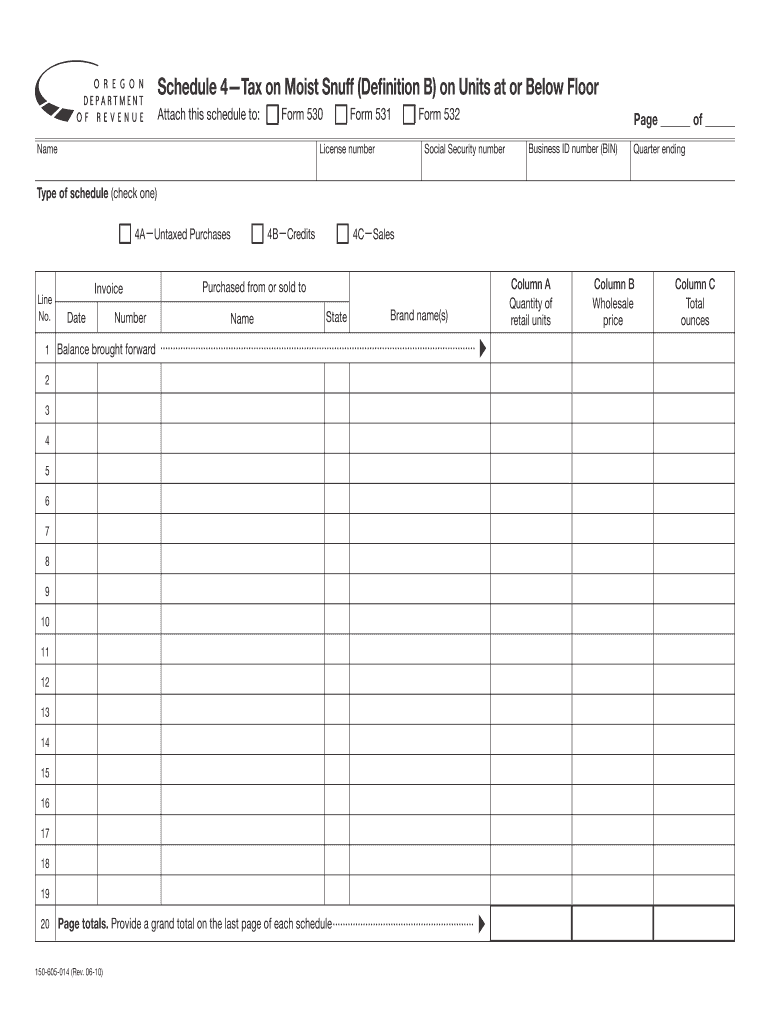

The Clear Form Schedule 4 Tax on Moist Snuff is a specific tax form used in the United States for reporting taxes related to moist snuff tobacco products. This form is essential for businesses that manufacture or distribute moist snuff, as it outlines the tax obligations associated with these products. It is important to understand the definition of "Definition B" as it pertains to units sold at or below a specified floor price. This definition helps clarify the tax calculations and ensures compliance with federal regulations.

Steps to Complete the Clear Form Schedule 4 Tax on Moist Snuff

Completing the Clear Form Schedule 4 Tax on Moist Snuff involves several key steps. First, gather all necessary information, including your business ID number, Social Security number, and license number. Next, accurately report the quantity of moist snuff units sold during the quarter. Ensure that you attach this schedule to the appropriate forms, such as Form 530, Form 531, or Form 532, as required. Finally, review the completed form for accuracy before submission to avoid any penalties.

Legal Use of the Clear Form Schedule 4 Tax on Moist Snuff

The Clear Form Schedule 4 Tax on Moist Snuff is legally required for businesses involved in the tobacco industry. It serves to report the tax due on moist snuff products and ensures compliance with federal tax laws. Failure to file this form correctly can result in significant penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is crucial for maintaining compliance and avoiding legal issues.

Required Documents for Filing the Clear Form Schedule 4 Tax on Moist Snuff

When filing the Clear Form Schedule 4 Tax on Moist Snuff, several documents are required to ensure a complete and accurate submission. These include:

- Your business ID number and Social Security number.

- Records of moist snuff units sold during the reporting period.

- Any previous tax forms that may be relevant, such as Form 530, Form 531, or Form 532.

Having these documents ready will streamline the filing process and help prevent errors.

Filing Deadlines for the Clear Form Schedule 4 Tax on Moist Snuff

It is important to be aware of the filing deadlines for the Clear Form Schedule 4 Tax on Moist Snuff to avoid penalties. Typically, this form must be submitted quarterly, with specific due dates depending on the end of your reporting period. Keeping track of these deadlines ensures timely compliance and helps maintain good standing with tax authorities.

Examples of Using the Clear Form Schedule 4 Tax on Moist Snuff

Understanding practical examples of how to use the Clear Form Schedule 4 Tax on Moist Snuff can clarify its application. For instance, if a business sells five hundred units of moist snuff at a price below the floor price, they must accurately report this on the form. Each unit sold must be counted, and the applicable tax calculated based on the total sales. This example illustrates the importance of precise record-keeping and reporting for tax compliance.

Quick guide on how to complete clear form schedule 4 tax on moist snuff definition b on units at or below floor attach this schedule to name form 530 form 531

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form, either by email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clear form schedule 4 tax on moist snuff definition b on units at or below floor attach this schedule to name form 530 form 531

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clear Form Schedule 4 Tax On Moist Snuff Definition B?

The Clear Form Schedule 4 Tax On Moist Snuff Definition B is a specific tax form used for reporting taxes on moist snuff products. It is essential for businesses dealing with these products to understand how to fill it out correctly. This form must be attached to Name Form 530, Form 531, or Form 532, depending on your business's requirements.

-

How can I access the Clear Form Schedule 4 Tax On Moist Snuff Definition B?

You can easily access the Clear Form Schedule 4 Tax On Moist Snuff Definition B through our platform. Simply log in to your airSlate SignNow account, and navigate to the forms section. From there, you can find and download the necessary forms to ensure compliance with tax regulations.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Clear Form Schedule 4 Tax On Moist Snuff Definition B streamlines the process of document management. Our platform allows for easy eSigning and sharing, ensuring that your forms are completed accurately and submitted on time. This efficiency can save your business both time and money.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to various needs, ensuring you get the best value for managing forms like the Clear Form Schedule 4 Tax On Moist Snuff Definition B. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software. This allows you to seamlessly manage your tax forms, including the Clear Form Schedule 4 Tax On Moist Snuff Definition B, alongside your other business operations, enhancing overall efficiency.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow provides a range of features for managing tax forms, including eSigning, document templates, and secure storage. These features ensure that you can easily complete and submit forms like the Clear Form Schedule 4 Tax On Moist Snuff Definition B while maintaining compliance and security.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your tax documents, including the Clear Form Schedule 4 Tax On Moist Snuff Definition B. You can trust that your sensitive information, such as Social Security Number and Business ID Number, is safe with us.

Get more for Clear Form Schedule 4 Tax On Moist Snuff Definition B On Units At Or Below Floor Attach This Schedule To Name Form 530 Form 531

- Fema independent study transcript form

- Ccc 633 ez loan deficiency payment ldp agreement and request form

- Ccc 633 ez loan deficiency payment ldp agreement and request forms sc egov usda

- Form 231

- Oh 58ac and th 67 performance planning card da form 5701 228mar 2016 apd army

- Roof repair cost form

- V 3 september 2020 statenndss id required form

- National hypothesis generating questionnaire form

Find out other Clear Form Schedule 4 Tax On Moist Snuff Definition B On Units At Or Below Floor Attach This Schedule To Name Form 530 Form 531

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document