Form 990T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e Nccsdataweb Urban

Understanding the Form 990T Exempt Organization Business Income Tax Return

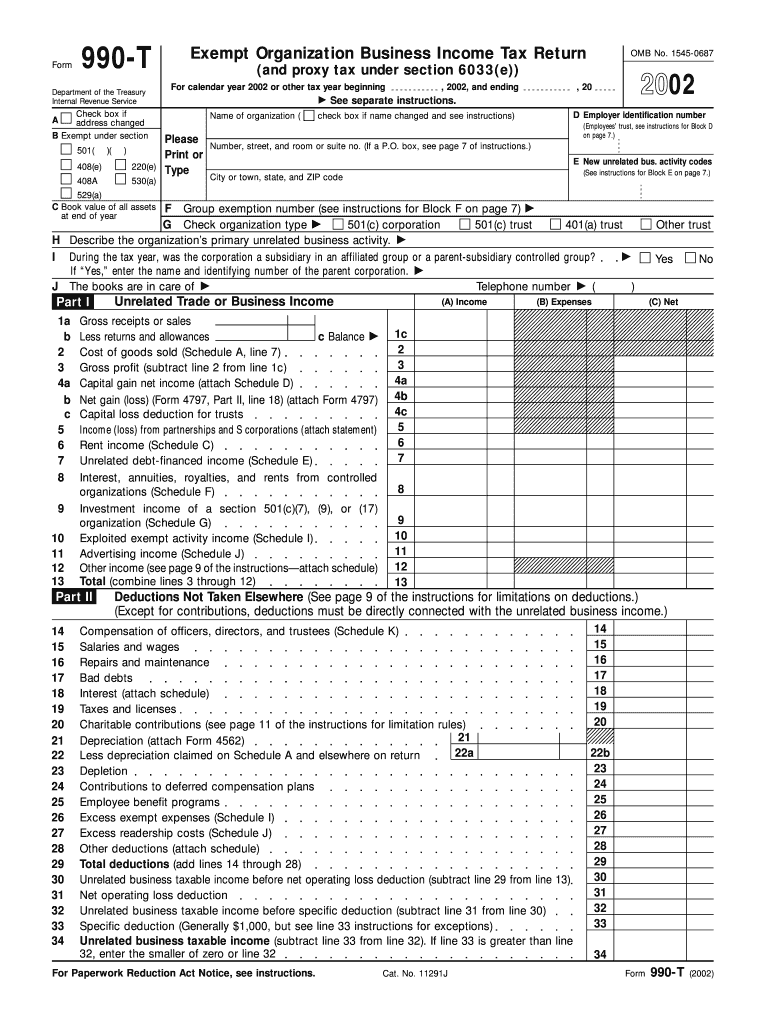

The Form 990T Exempt Organization Business Income Tax Return is a crucial document for tax-exempt organizations in the United States. This form is specifically designed for organizations that generate unrelated business income (UBI). UBI refers to income from a trade or business that is not substantially related to the organization's exempt purpose. The form also addresses the proxy tax under Section 6033(e), which applies to certain organizations that fail to meet disclosure requirements. Understanding this form is essential for compliance and maintaining tax-exempt status.

Steps to Complete the Form 990T

Completing the Form 990T involves several key steps. First, gather all necessary financial information related to the organization's unrelated business income. This includes revenue, expenses, and any deductions applicable to the UBI. Next, accurately fill out the form, ensuring that all sections are completed, including the calculation of the tax owed on UBI. It is important to review the form for accuracy before submission. Finally, submit the form by the due date to avoid penalties.

Obtaining the Form 990T

The Form 990T can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include the Form 990T, allowing organizations to complete it digitally. Ensuring that you have the most current version of the form is essential for compliance.

Filing Deadlines for Form 990T

The filing deadline for Form 990T is typically the 15th day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this means the form is due by May 15. If additional time is needed, organizations can file for an extension, which provides an additional six months to submit the form. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance with Form 990T

Failure to file Form 990T or filing it late can result in significant penalties. The IRS imposes a penalty for each month the form is late, up to a maximum amount. Additionally, if an organization fails to pay the tax owed on unrelated business income, interest will accrue on the unpaid amount. It is crucial for organizations to adhere to filing requirements to maintain their tax-exempt status and avoid financial repercussions.

Key Elements of the Form 990T

Key elements of the Form 990T include sections for reporting unrelated business income, expenses related to that income, and the calculation of tax owed. The form also requires organizations to disclose any proxy tax owed under Section 6033(e). Accurate reporting of these elements is vital for compliance and ensuring that the organization maintains its tax-exempt status. Understanding each section of the form helps organizations prepare their tax filings correctly.

Quick guide on how to complete form 990t exempt organization business income tax return and proxy tax under section 6033e nccsdataweb urban

Prepare [SKS] easily on any device

Virtual document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive details with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes merely seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the information and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and eSign [SKS] and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban

Create this form in 5 minutes!

How to create an eSignature for the form 990t exempt organization business income tax return and proxy tax under section 6033e nccsdataweb urban

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban?

The Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban is a tax form that exempt organizations must file to report unrelated business income. This form helps organizations comply with IRS regulations while ensuring transparency in their financial activities.

-

How can airSlate SignNow assist with filing the Form 990T?

airSlate SignNow provides an efficient platform for preparing and eSigning the Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban. Our user-friendly interface simplifies document management, making it easier for organizations to file their tax returns accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various organizations. Whether you are a small nonprofit or a larger entity, our cost-effective solutions ensure that you can manage your Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban without breaking the bank.

-

What features does airSlate SignNow offer for tax document management?

With airSlate SignNow, you gain access to features such as document templates, eSignature capabilities, and secure cloud storage. These tools streamline the process of managing your Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban, enhancing efficiency and compliance.

-

Is airSlate SignNow compliant with IRS regulations for tax forms?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban is handled securely and in accordance with legal requirements. Our platform prioritizes data security and compliance to protect your organization.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software. This allows you to easily manage your Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban alongside your existing financial systems, improving overall workflow.

-

What benefits does airSlate SignNow provide for nonprofit organizations?

Nonprofit organizations benefit from airSlate SignNow through enhanced efficiency, reduced paperwork, and improved compliance. By simplifying the process of filing the Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban, nonprofits can focus more on their mission and less on administrative tasks.

Get more for Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban

Find out other Form 990T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e Nccsdataweb Urban

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement