Form ITPS COA Change of Address Form Forms

What is the Form ITPS COA Change Of Address Form

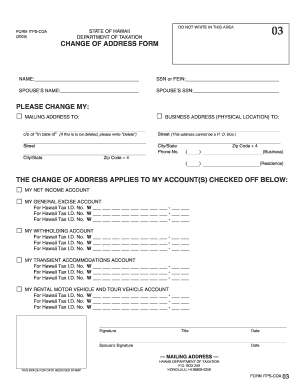

The Form ITPS COA Change Of Address Form is a crucial document used by individuals and businesses to officially notify the relevant authorities of a change in address. This form is particularly important for ensuring that all correspondence, tax documents, and other official communications are sent to the correct location. By submitting this form, users can help prevent delays in receiving important information and maintain compliance with state regulations.

How to use the Form ITPS COA Change Of Address Form

Using the Form ITPS COA Change Of Address Form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from the appropriate state agency or online resources. Next, fill out the form with accurate and up-to-date information, including your old address, new address, and any relevant identification numbers. After completing the form, review it for accuracy before submitting it to the designated authority. This ensures that your change of address is processed smoothly.

Steps to complete the Form ITPS COA Change Of Address Form

Completing the Form ITPS COA Change Of Address Form requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate source.

- Fill in your personal information, including your name and identification details.

- Provide your previous address and your new address.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the form via the specified method, whether online, by mail, or in person.

Legal use of the Form ITPS COA Change Of Address Form

The legal use of the Form ITPS COA Change Of Address Form is essential for maintaining compliance with state and federal regulations. This form serves as an official record of your address change, which can be critical for tax purposes and other legal matters. Failure to submit this form may result in missed communications, potential penalties, or complications with legal documents. It is advisable to keep a copy of the submitted form for your records.

Who Issues the Form

The Form ITPS COA Change Of Address Form is typically issued by the state tax authority or relevant government agency responsible for managing address changes. Each state may have its own specific agency that oversees this process, so it is important to ensure you are using the correct form for your state. Checking with your state’s official website can provide guidance on where to obtain the form and any additional requirements that may apply.

Required Documents

When submitting the Form ITPS COA Change Of Address Form, certain documents may be required to verify your identity and the address change. Commonly required documents include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of residency at the new address, such as a utility bill or lease agreement.

- Any previous correspondence from the tax authority that includes your old address.

Quick guide on how to complete form itps coa change of address form forms

Complete [SKS] effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the appropriate template and securely store it online. airSlate SignNow provides you with all the features necessary to design, modify, and eSign your documents quickly without any holdups. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize key sections of the documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors needing new printed copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ITPS COA Change Of Address Form Forms

Create this form in 5 minutes!

How to create an eSignature for the form itps coa change of address form forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ITPS COA Change Of Address Form Forms?

The Form ITPS COA Change Of Address Form Forms is a specialized document designed to facilitate the process of updating your address with the relevant authorities. This form ensures that all your important communications are sent to the correct location, preventing any disruptions in service or correspondence.

-

How can I access the Form ITPS COA Change Of Address Form Forms?

You can easily access the Form ITPS COA Change Of Address Form Forms through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the specific form you need. It's designed to be user-friendly and accessible.

-

Are there any costs associated with using the Form ITPS COA Change Of Address Form Forms?

Using the Form ITPS COA Change Of Address Form Forms is part of our cost-effective solution at airSlate SignNow. We offer various pricing plans that cater to different business needs, ensuring you get the best value for your document management and eSigning requirements.

-

What features does the Form ITPS COA Change Of Address Form Forms offer?

The Form ITPS COA Change Of Address Form Forms includes features such as customizable fields, electronic signatures, and secure storage. These features streamline the process of completing and submitting your form, making it efficient and hassle-free.

-

How does the Form ITPS COA Change Of Address Form Forms benefit my business?

Utilizing the Form ITPS COA Change Of Address Form Forms can signNowly enhance your business operations by ensuring timely updates to your address. This minimizes the risk of lost communications and helps maintain a professional image with clients and partners.

-

Can I integrate the Form ITPS COA Change Of Address Form Forms with other tools?

Yes, the Form ITPS COA Change Of Address Form Forms can be integrated with various third-party applications and tools. This allows for seamless workflows and enhances your overall document management process, making it easier to keep track of important forms.

-

Is the Form ITPS COA Change Of Address Form Forms secure?

Absolutely! The Form ITPS COA Change Of Address Form Forms is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to ensure that your sensitive information remains protected throughout the signing and submission process.

Get more for Form ITPS COA Change Of Address Form Forms

Find out other Form ITPS COA Change Of Address Form Forms

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template