PDF Fillable Hud Form 51001 2018

Understanding the Illinois Revenue Board

The Illinois Revenue Board is responsible for overseeing tax administration in the state. This includes the collection of state taxes, enforcement of tax laws, and ensuring compliance among taxpayers. The board plays a crucial role in maintaining the integrity of the state's tax system, providing guidance and support to both individuals and businesses. Understanding its functions can help taxpayers navigate their obligations more effectively.

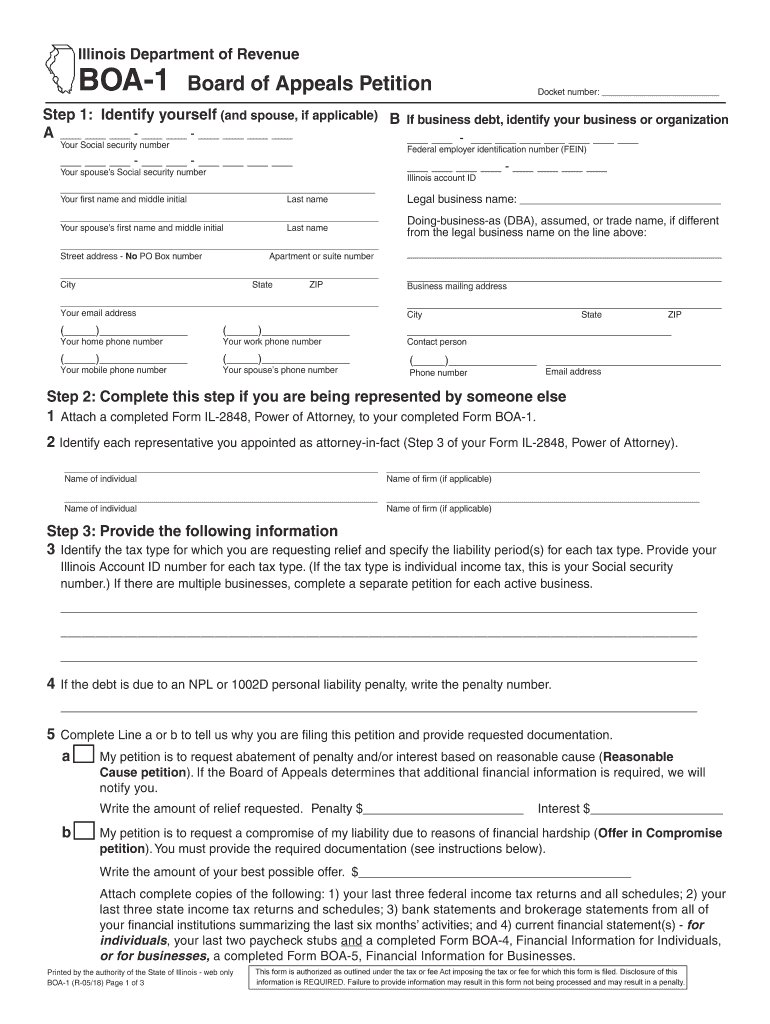

Steps to Complete the Illinois Board Appeals Process

Filing an appeal with the Illinois Revenue Board involves several key steps:

- Gather necessary documentation, including any relevant tax returns and notices from the Illinois Department of Revenue.

- Complete the appropriate forms, such as the BOA-1, which is essential for initiating an appeal.

- Submit your appeal within the designated timeframe, ensuring all forms are filled out accurately.

- Monitor the status of your appeal through the board's online portal or by contacting their office directly.

Required Documents for Appeals

When filing an appeal with the Illinois Revenue Board, it is important to have the following documents ready:

- Completed BOA-1 form.

- Copies of any correspondence from the Illinois Department of Revenue.

- Supporting documentation that substantiates your case, such as financial records or additional tax filings.

Legal Use of the Illinois Revenue Board Appeals

The appeals process through the Illinois Revenue Board is governed by specific legal guidelines. Taxpayers have the right to contest decisions made by the Illinois Department of Revenue. Understanding these rights is essential for ensuring that your appeal is valid and recognized. The board adheres to legal standards that protect taxpayers while also ensuring compliance with state tax laws.

Filing Deadlines for Appeals

Timeliness is crucial when it comes to filing appeals with the Illinois Revenue Board. Generally, taxpayers must file their appeals within a specific period following the receipt of a tax notice or determination. It is advisable to check the exact deadlines for your situation, as missing a deadline can result in the dismissal of your appeal.

Form Submission Methods

Taxpayers can submit their appeals to the Illinois Revenue Board through various methods. These include:

- Online submission via the Illinois Revenue Board's official website.

- Mailing physical copies of the appeal forms and supporting documents.

- In-person submissions at designated state offices.

Examples of Using the Illinois Revenue Board Appeals

Taxpayers may find themselves needing to appeal for various reasons, such as disputes over tax assessments or penalties. For instance, if a taxpayer believes that their property tax assessment is incorrect, they can file an appeal with the Illinois Revenue Board, providing evidence to support their claim. Each case is unique, and understanding the appeals process can help taxpayers effectively present their arguments.

Quick guide on how to complete form boa 1pdffillercom 2018 2019

Your assistance manual on how to prepare your Pdf Fillable Hud Form 51001

If you’re seeking to learn how to finalize and submit your Pdf Fillable Hud Form 51001, here are some straightforward tips on how to facilitate tax submissions.

To start, you merely need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document tool that enables you to edit, create, and finalize your income tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to finalize your Pdf Fillable Hud Form 51001 in a matter of minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax document; explore various versions and schedules.

- Click Obtain form to access your Pdf Fillable Hud Form 51001 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can heighten error rates and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form boa 1pdffillercom 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Are there any chances to fill out the improvement form for 2019 of the RBSE board for 12 class?

Hari om, you are asking a question as to : “ Are there any chancesto fill out the improvement form for 2019 of the RBSE Board for 12 class?”. Hari om. Hari om.ANSWER :Browse through the following links for further details regarding the answers to your questions on the improvement exam for class 12 of RBSE 2019 :how to give improvement exams in rbse class 12is there a chance to fill rbse improvement form 2019 for a 12th class studentHari om.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form boa 1pdffillercom 2018 2019

How to make an eSignature for the Form Boa 1pdffillercom 2018 2019 in the online mode

How to generate an eSignature for the Form Boa 1pdffillercom 2018 2019 in Chrome

How to create an electronic signature for putting it on the Form Boa 1pdffillercom 2018 2019 in Gmail

How to generate an eSignature for the Form Boa 1pdffillercom 2018 2019 straight from your smart phone

How to generate an eSignature for the Form Boa 1pdffillercom 2018 2019 on iOS

How to generate an eSignature for the Form Boa 1pdffillercom 2018 2019 on Android devices

People also ask

-

What is the role of the Illinois Revenue Board in eSigning documents?

The Illinois Revenue Board plays a crucial role in regulating tax documentation and compliance. Utilizing airSlate SignNow allows businesses to create, send, and eSign important documents while ensuring compliance with the Illinois Revenue Board's requirements. This can streamline tax processes and enhance document handling.

-

How does airSlate SignNow benefit businesses dealing with the Illinois Revenue Board?

airSlate SignNow benefits businesses by offering a secure eSigning platform that simplifies the process of preparing documents for the Illinois Revenue Board. It ensures that all eSigned documents meet legal standards, making it easier to manage tax compliance and regulations with confidence.

-

What features does airSlate SignNow offer for compliance with the Illinois Revenue Board?

airSlate SignNow provides features like customizable templates, audit trails, and secure storage to ensure compliance with the Illinois Revenue Board's guidelines. These features help businesses maintain accurate records and provide necessary documentation in case of audits or inquiries.

-

Is airSlate SignNow cost-effective for businesses interacting with the Illinois Revenue Board?

Yes, airSlate SignNow is a cost-effective solution for businesses that frequently interact with the Illinois Revenue Board. Its pricing structure is designed to accommodate a variety of business sizes, ensuring that you can manage your document signing needs without overspending, while still maintaining compliance.

-

Can airSlate SignNow integrate with other tools for ease of use in relation to the Illinois Revenue Board?

AirSlate SignNow offers integrations with various productivity tools and platforms that businesses often use when dealing with the Illinois Revenue Board. These integrations allow for streamlined workflows, making it easier to manage documents and eSignatures without leaving your preferred applications.

-

What types of documents can I eSign for the Illinois Revenue Board using airSlate SignNow?

With airSlate SignNow, you can eSign a variety of documents required by the Illinois Revenue Board, such as tax forms, compliance agreements, and business contracts. The versatile platform allows for quick and secure eSigning, ensuring all necessary documents are completed and submitted promptly.

-

How secure is airSlate SignNow when dealing with documents for the Illinois Revenue Board?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents for the Illinois Revenue Board. The platform employs encryption and stringent security measures, ensuring that all eSigned documents are protected from unauthorized access and data bsignNowes.

Get more for Pdf Fillable Hud Form 51001

- Oncology physiotherapy referral forms examples

- Utah professional engineer license lookup form

- Recurring cash contribution verification form

- Biloxi seafood festival vendor application form

- Placing events on a timeline worksheet form

- Transfer credit re evaluation appeal form pdf george mason gmu

- Additional details form 6

- Logo design graphic design contract template form

Find out other Pdf Fillable Hud Form 51001

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile