Illinois Revenue Board 2022-2026

What is the Illinois Revenue Board

The Illinois Revenue Board, also known as the Illinois Department of Revenue, is the state agency responsible for administering tax laws and collecting taxes in Illinois. This board plays a crucial role in ensuring compliance with state tax regulations, managing tax assessments, and addressing taxpayer inquiries. It oversees various tax programs, including income tax, sales tax, and property tax, providing essential services to both individuals and businesses within the state.

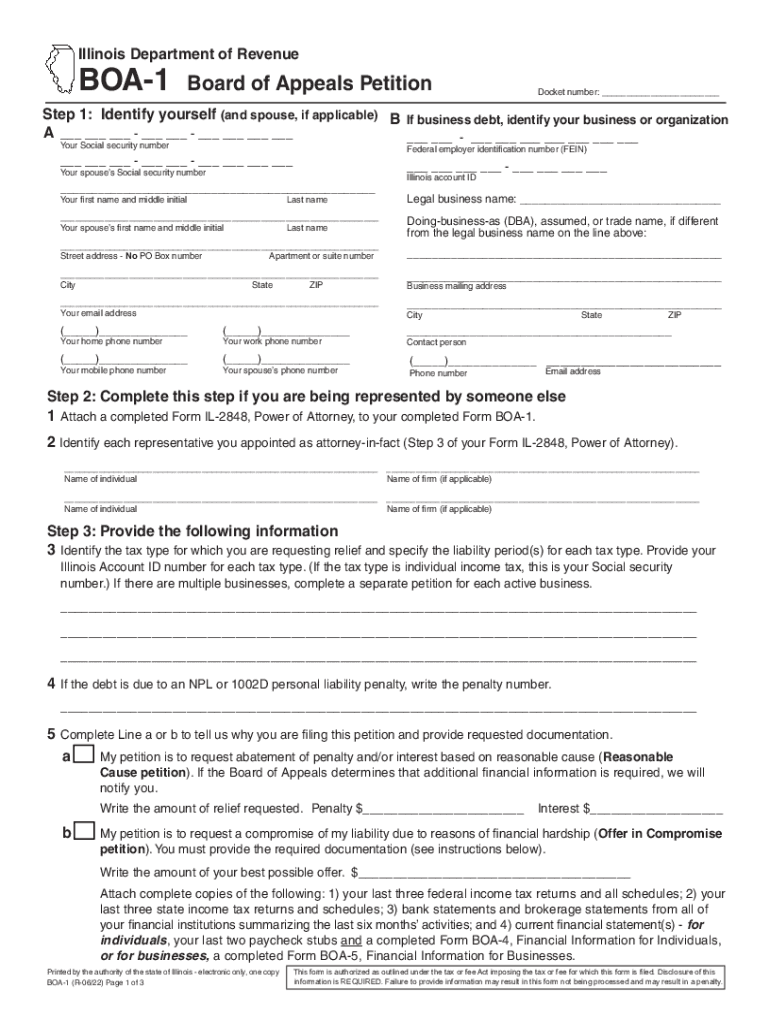

Steps to complete the Illinois Revenue Board forms

Completing forms associated with the Illinois Revenue Board involves several key steps. First, identify the specific form you need based on your tax situation, such as the IL Form BOA-1 for appeals. Next, gather all necessary documentation, including income statements and previous tax returns, to support your submission. Carefully fill out the form, ensuring all information is accurate and complete. Once completed, review the form for any errors before submitting it. Finally, choose your submission method, whether online, by mail, or in person, to ensure timely processing.

Required Documents

When submitting forms to the Illinois Revenue Board, certain documents are typically required to support your application or appeal. Commonly required documents may include:

- Proof of income, such as W-2s or 1099s

- Previous tax returns for reference

- Any relevant correspondence from the Illinois Department of Revenue

- Documentation supporting your claim or appeal, such as receipts or invoices

Having these documents ready can streamline the process and help ensure your submission is complete.

Form Submission Methods

The Illinois Revenue Board offers multiple methods for submitting forms, catering to different preferences and needs. You can submit forms online through the Illinois Department of Revenue's official website, which provides a convenient and efficient option. Alternatively, forms can be mailed to the appropriate address listed on the form or submitted in person at designated offices. Each method has its advantages, so consider your circumstances when choosing how to submit.

Legal use of the Illinois Revenue Board forms

Forms associated with the Illinois Revenue Board must be used in accordance with state laws and regulations. Understanding the legal framework surrounding these forms is essential to ensure compliance and avoid penalties. Each form, including the IL Form BOA-1, has specific legal requirements that must be met for it to be considered valid. Utilizing a reliable electronic signature solution, like signNow, can help meet these legal standards while ensuring your documents remain secure and compliant with eSignature laws.

Eligibility Criteria

Eligibility criteria for various forms under the Illinois Revenue Board can vary based on the specific form and the taxpayer's circumstances. For example, to file an appeal using the IL Form BOA-1, you must typically meet certain conditions, such as having a valid reason for the appeal and submitting the form within a specified timeframe. It is important to review the eligibility requirements for each form to ensure that you qualify before proceeding with your submission.

Quick guide on how to complete illinois revenue board

Complete Illinois Revenue Board effortlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Illinois Revenue Board on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Illinois Revenue Board with ease

- Find Illinois Revenue Board and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Illinois Revenue Board and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois revenue board

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the Illinois Department of Revenue?

airSlate SignNow is an eSignature solution that allows businesses to send and sign documents electronically. It simplifies processes such as filing forms with the Illinois Department of Revenue, making it easier to comply with state requirements efficiently.

-

How can airSlate SignNow help businesses comply with the Illinois Department of Revenue regulations?

By using airSlate SignNow, businesses can ensure that all necessary documents are signed correctly and submitted on time to the Illinois Department of Revenue. This reduces the risk of non-compliance, saving time and potential fines.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it accessible for organizations of all sizes. These affordable options allow you to leverage features that facilitate interactions with the Illinois Department of Revenue seamlessly.

-

What features does airSlate SignNow provide for users interacting with the Illinois Department of Revenue?

airSlate SignNow includes essential features like customizable templates, real-time tracking, and the ability to gather multiple signatures. These tools streamline your documentation processes with the Illinois Department of Revenue, enhancing efficiency.

-

Are there integrations available with airSlate SignNow for easier management of Illinois Department of Revenue documents?

Yes, airSlate SignNow integrates with various third-party applications, making it easy to manage your Illinois Department of Revenue documents alongside other tools. This compatibility enhances your workflow, ensuring you stay organized and efficient.

-

How does airSlate SignNow enhance the document security needed for the Illinois Department of Revenue submissions?

AirSlate SignNow prioritizes document security with advanced encryption and authentication measures. These features provide peace of mind when submitting sensitive documents to the Illinois Department of Revenue.

-

What types of businesses benefit from using airSlate SignNow for Illinois Department of Revenue forms?

AirSlate SignNow is beneficial for a wide range of businesses, including freelancers, small businesses, and large corporations that need to submit forms to the Illinois Department of Revenue. Its user-friendly interface makes it suitable for everyone, regardless of their technical expertise.

Get more for Illinois Revenue Board

- Tenant consent to background and reference check hawaii form

- Residential lease or rental agreement for month to month hawaii form

- Residential rental lease agreement hawaii form

- Hawaii tenant 497304520 form

- Warning of default on commercial lease hawaii form

- Warning of default on residential lease hawaii form

- Landlord tenant closing statement to reconcile security deposit hawaii form

- Hi name change form

Find out other Illinois Revenue Board

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form