Il 8655 Form 2017-2026

What is the IL 8655 Form

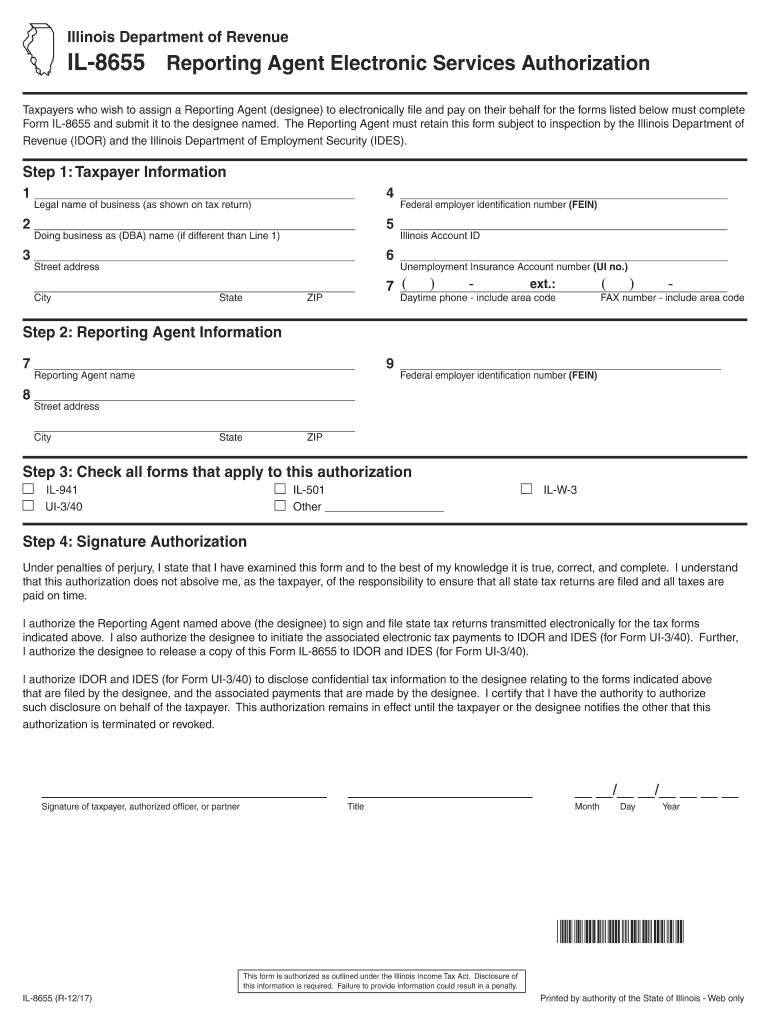

The IL 8655 form, also known as the Illinois Electronic Authorization form, is a document used for reporting electronic services in the state of Illinois. This form is essential for taxpayers who wish to authorize a third party to act on their behalf regarding tax matters. The IL 8655 is particularly relevant for individuals and businesses that engage in electronic filing or need to grant access to tax information to a representative.

How to use the IL 8655 Form

To effectively use the IL 8655 form, you need to follow a few straightforward steps. First, ensure you have all necessary information, including your personal details and the representative's information. Once you have that, you can fill out the form either online or by hand. After completing the form, it must be signed and submitted to the appropriate department. This form allows your designated representative to receive tax information and communicate with the Illinois Department of Revenue on your behalf.

Steps to complete the IL 8655 Form

Completing the IL 8655 form involves several key steps:

- Gather necessary information, including your name, address, and Social Security number.

- Provide the representative’s details, including their name and contact information.

- Fill in the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the completed form to the Illinois Department of Revenue, either electronically or via mail.

Legal use of the IL 8655 Form

The IL 8655 form is legally recognized as a valid method for taxpayers to authorize third-party representation regarding their tax matters. It complies with state regulations and ensures that the designated representative can act on behalf of the taxpayer. Proper use of this form helps maintain compliance with Illinois tax laws and protects the taxpayer's rights when dealing with tax-related issues.

Filing Deadlines / Important Dates

Filing deadlines for the IL 8655 form can vary depending on the specific tax year and the nature of the tax return being filed. It is crucial to check the Illinois Department of Revenue's official announcements for any updates on deadlines. Generally, the form should be submitted before the tax return filing deadline to ensure that your representative can act on your behalf in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The IL 8655 form can be submitted through various methods. Taxpayers have the option to file the form online via the Illinois Department of Revenue's website, which is often the quickest method. Alternatively, the form can be printed and mailed to the department or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete withholding income tax fset illinoisgov

Your assistance manual on preparing your Il 8655 Form

If you're curious about how to generate and submit your Il 8655 Form, here's a brief overview of instructions to facilitate tax processing.

Initially, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow offers a highly intuitive and powerful document solution that enables you to edit, draft, and finalize your tax forms effortlessly. With its editing features, you can transition between text, check boxes, and electronic signatures while revising details as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Il 8655 Form in a matter of minutes:

- Create your account and begin processing PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Il 8655 Form in our editor.

- Enter the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and amend any errors.

- Save changes, print your copy, deliver it to your recipient, and download it to your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Be aware that paper filing can lead to return discrepancies and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct withholding income tax fset illinoisgov

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I've been earning income on Airbnb as a non resident alien on an O1 visa. The site is withholding funds until I fill out a tax information form. Will I be in trouble if I pay tax on this income?

You could be in more trouble if you don't, assuming that you rented the space for at least 15 days in 2012. You are required to report that income on your tax return. Furthermore, AirBnB is required to report it to you and to the IRS (which will then be looking for it on your return) when the amount that they pay you is $600 or more. I strongly recommend that you consult with a tax professional before you file your return. If you personally used the space you rent on AirBnB for more than 14 days or 10% of the number of days you rented it (whichever is greater), you are considered to be renting your personal residence and your ability to take deductions against the income is limited. Furthermore, the method that you use to report the income and expenses depends on whether or not you are renting to make a profit - see Publication 527 (2011), Residential Rental Property for more information.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the withholding income tax fset illinoisgov

How to create an eSignature for the Withholding Income Tax Fset Illinoisgov online

How to generate an electronic signature for the Withholding Income Tax Fset Illinoisgov in Chrome

How to create an eSignature for putting it on the Withholding Income Tax Fset Illinoisgov in Gmail

How to generate an eSignature for the Withholding Income Tax Fset Illinoisgov right from your mobile device

How to make an eSignature for the Withholding Income Tax Fset Illinoisgov on iOS devices

How to generate an electronic signature for the Withholding Income Tax Fset Illinoisgov on Android

People also ask

-

What is the il8655 form used for?

The il8655 form is used for document verification in certain business processes. It ensures that necessary documentation is accurately completed and submitted for compliance purposes, streamlining the workflow for organizations.

-

How can airSlate SignNow help with the il8655 form?

airSlate SignNow simplifies the process of completing and signing the il8655 form. Our platform offers easy-to-use templates and automation features, allowing users to quickly fill out, eSign, and manage their documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the il8655 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing the il8655 form and other documents, making it a cost-effective solution for businesses.

-

Can I integrate airSlate SignNow with other applications while using the il8655 form?

Absolutely! airSlate SignNow supports integrations with a wide range of applications, enhancing the workflow involving the il8655 form. This allows you to connect with your existing tools seamlessly, improving productivity and efficiency.

-

What features does airSlate SignNow offer for managing the il8655 form?

Key features of airSlate SignNow include document sharing, real-time collaboration, and automated workflows for the il8655 form. Users can easily track the status of documents and receive notifications when actions are required, ensuring a smooth process.

-

What are the benefits of using airSlate SignNow for the il8655 form?

Using airSlate SignNow for the il8655 form brings numerous benefits, such as time savings and reduced errors. Our platform enables fast eSigning and minimizes the hassle of paperwork, transitioning to a fully digital process for document management.

-

Is there support available for issues related to the il8655 form?

Yes, airSlate SignNow provides dedicated customer support for any issues encountered while using the il8655 form. Our support team is available to assist with questions or troubleshooting, ensuring you can use our platform effectively.

Get more for Il 8655 Form

- Form 9 1909 employee financial interests certification ja usgs

- Cid complaint form

- Rpd 41348military spouse form

- Raven biology 11th edition chapter outlines form

- Senior brigade attendee feedback form michigan

- Sign permit application form bellavenue org

- Logo ownership contract template form

- Lottery contract template form

Find out other Il 8655 Form

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF