1545 0074 IRS E File Signature Authorization Do Not Send to the IRS Form

Understanding the IRS E file Signature Authorization Do Not Send To The IRS

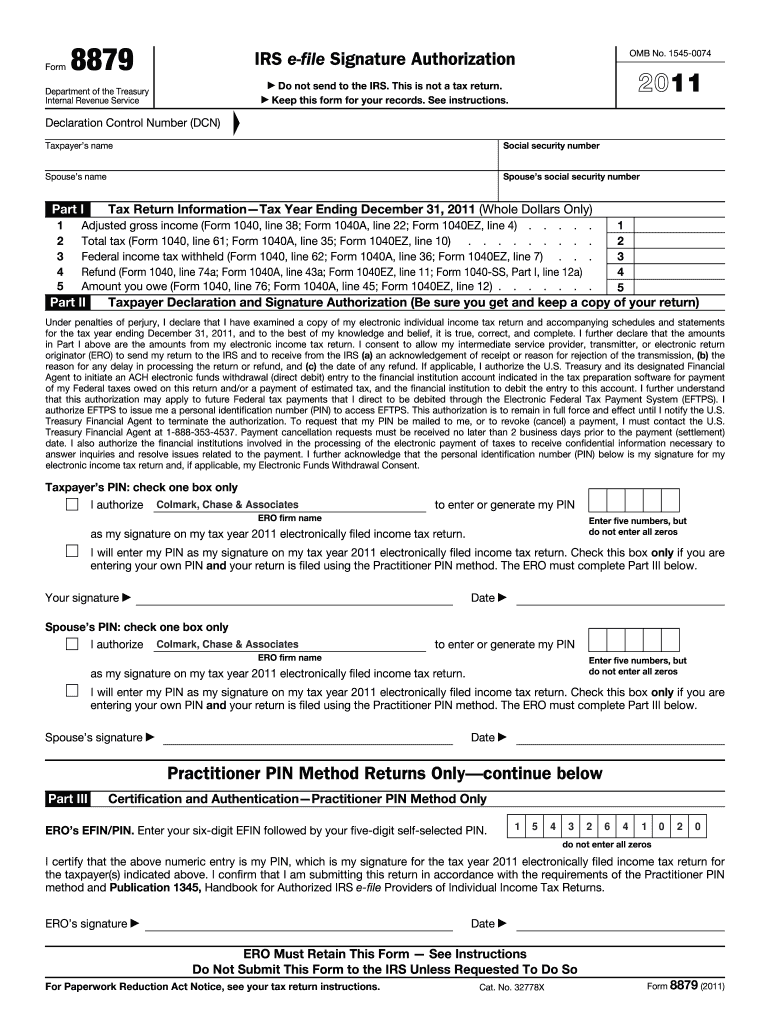

The IRS E file Signature Authorization Do Not Send To The IRS is a crucial form for taxpayers who wish to authorize an electronic return originator (ERO) to file their tax returns electronically. This form allows the ERO to sign the return on behalf of the taxpayer, streamlining the e-filing process. It is important to note that this form should not be sent to the IRS; it is solely for the records of the ERO and the taxpayer. Understanding its purpose and proper usage is essential for ensuring compliance with IRS regulations.

Steps to Complete the IRS E file Signature Authorization Do Not Send To The IRS

Completing the form involves several straightforward steps:

- Obtain the form from a reliable source, such as the IRS website or your ERO.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide the ERO's information, including their name and EFIN (Electronic Filing Identification Number).

- Sign and date the form to authorize the ERO to file your tax return electronically.

- Keep a copy of the completed form for your records, as it will not be submitted to the IRS.

Key Elements of the IRS E file Signature Authorization Do Not Send To The IRS

The key elements of this form include:

- Taxpayer Information: This includes the taxpayer's name, Social Security number, and address.

- ERO Information: Details about the ERO, including their name and EFIN, must be accurately filled out.

- Signature: The taxpayer must sign and date the form to validate the authorization.

- Instructions: Clear guidance on how to complete the form and the importance of retaining it for personal records.

Legal Use of the IRS E file Signature Authorization Do Not Send To The IRS

The legal use of the form is defined by IRS regulations governing electronic filing. By signing this form, the taxpayer legally authorizes the ERO to file their tax return electronically. This authorization is essential for compliance, as it ensures that the ERO can act on behalf of the taxpayer without any legal repercussions. It is important for taxpayers to understand that this form does not replace the actual tax return but serves as a necessary authorization document.

IRS Guidelines for the IRS E file Signature Authorization Do Not Send To The IRS

The IRS provides specific guidelines regarding the use of the form. Taxpayers should ensure that:

- The form is completed accurately and legibly.

- It is retained by the ERO and the taxpayer for their records.

- It is not submitted to the IRS with the tax return.

- All information provided is current and correct to avoid any issues during the e-filing process.

Eligibility Criteria for Using the IRS E file Signature Authorization Do Not Send To The IRS

To use the form, taxpayers must meet certain eligibility criteria:

- Must be filing an individual tax return electronically.

- Must have a designated ERO who will be filing the return on their behalf.

- Must provide accurate personal and ERO information on the form.

Quick guide on how to complete 1545 0074 irs e file signature authorization do not send to the irs

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hindrances. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign [SKS] with ease

- Retrieve [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating new printed copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS

Create this form in 5 minutes!

How to create an eSignature for the 1545 0074 irs e file signature authorization do not send to the irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS form?

The 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS form is a document that allows taxpayers to authorize an e-file provider to submit their tax returns electronically. This form ensures that the IRS receives the necessary authorization without requiring the physical submission of the document.

-

How can airSlate SignNow help with the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS?

airSlate SignNow provides a seamless platform for electronically signing the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS form. Our solution simplifies the signing process, ensuring that you can complete your tax filings efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your document signing, including the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS, without breaking the bank.

-

What features does airSlate SignNow offer for managing the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents like the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS. These features enhance your workflow and ensure compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software for the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easy to manage the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS alongside your other business tools. This integration streamlines your processes and improves efficiency.

-

What are the benefits of using airSlate SignNow for the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS?

Using airSlate SignNow for the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind.

-

Is airSlate SignNow compliant with IRS regulations for the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS?

Yes, airSlate SignNow is designed to comply with IRS regulations, including those related to the 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS. Our platform adheres to industry standards for security and compliance, ensuring your documents are handled appropriately.

Get more for 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS

- Fillable online ohr law on the high representative for form

- Does lottery retailers know winning tickets sanjeevani hms form

- Phone 877 542 2474 fax 888 232 2567 form

- Ca form llc 2 2014 2021 fill and sign printable template

- Private patrol operator application for license private patrol operator application for license form

- Family law judgment form california

- Application to add a father on a michigan form

- Fillable online nfpa call for presentations form pdf

Find out other 1545 0074 IRS E file Signature Authorization Do Not Send To The IRS

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement