Form W 2A, NOT Fill in Capable Information Copy Only American Samoa Wage and Tax Statement

What is the Form W-2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

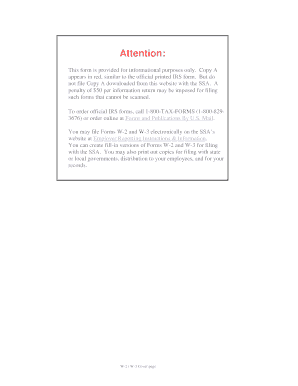

The Form W-2A is a specific wage and tax statement used exclusively in American Samoa. It serves as an informational copy for employees, detailing their earnings and the taxes withheld during the year. Unlike other wage statements, this form is not fillable, meaning it is intended solely for informational purposes and cannot be completed electronically. Employers are required to provide this document to their employees for record-keeping and tax filing purposes.

How to use the Form W-2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

Using the Form W-2A involves understanding its purpose and how it fits into the broader tax filing process. Employees should receive this form from their employers by January 31 of each year. It is essential to review the information for accuracy, as it includes crucial details such as total wages earned and the amount of taxes withheld. Employees should retain this form for their records and use it when preparing their tax returns, ensuring that the reported figures align with their W-2A.

Steps to complete the Form W-2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

While the Form W-2A is not fillable, employees should follow these steps to ensure they correctly utilize the information provided:

- Receive the W-2A from your employer by the end of January.

- Check the form for accuracy, including your name, Social Security number, and earnings.

- Compare the figures on the W-2A with your personal records, such as pay stubs.

- Use the information for your tax return, ensuring that the income and tax withheld match what is reported.

- Keep the W-2A for your records, as it may be needed for future reference or audits.

Key elements of the Form W-2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

The Form W-2A contains several key elements that are important for both employers and employees. These include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Wages: Total wages earned during the tax year.

- Tax Withheld: The amount of federal and local taxes withheld from the employee's earnings.

- State Information: Any applicable state taxes and contributions specific to American Samoa.

Legal use of the Form W-2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

The legal use of the Form W-2A is primarily for tax reporting purposes. Employers must provide this form to their employees to comply with federal and local tax laws. It serves as a record of income and tax withholdings, which employees will use when filing their annual tax returns. Failing to provide this form or providing incorrect information can lead to penalties for employers and complications for employees during tax filing.

IRS Guidelines

The IRS provides specific guidelines regarding the issuance and use of the Form W-2A. Employers must ensure that they distribute this form to employees by January 31 each year. The IRS mandates that the information reported on the W-2A must be accurate and reflect the employee's earnings and tax withholdings for the previous year. Employers should also retain copies of the W-2A for their records and ensure compliance with any state-specific requirements applicable to American Samoa.

Quick guide on how to complete form w 2a not fill in capable information copy only american samoa wage and tax statement

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed papers, as you can find the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for the form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form searching, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

Create this form in 5 minutes!

How to create an eSignature for the form w 2a not fill in capable information copy only american samoa wage and tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement?

The Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement is a tax document used to report wages and taxes for employees in American Samoa. This form is specifically designed for informational purposes and cannot be filled in electronically. Understanding this form is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement?

airSlate SignNow provides a streamlined solution for sending and eSigning documents, including the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement. Our platform allows you to easily manage and track the signing process, ensuring that all necessary parties receive the document promptly.

-

What are the pricing options for using airSlate SignNow for the Form W 2A?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that simplify the management of documents like the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement. Check our website for the latest pricing details.

-

Are there any features specifically designed for handling the Form W 2A?

Yes, airSlate SignNow includes features that enhance the handling of the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement. These features include customizable templates, secure eSigning, and document tracking, which help ensure compliance and efficiency in your tax reporting processes.

-

Can I integrate airSlate SignNow with other software for managing the Form W 2A?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to seamlessly manage the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement alongside your existing tools. This integration capability enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for tax documents like the Form W 2A?

Using airSlate SignNow for tax documents such as the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement provides numerous benefits. These include increased efficiency, reduced paper usage, and enhanced security for sensitive information. Our platform simplifies the entire document management process.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including the Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement, are protected. We utilize advanced encryption and compliance measures to safeguard your data, giving you peace of mind when managing sensitive tax information.

Get more for Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

- Hormone replacement therapy the aesthetic amp wellness center form

- Fillable online pediatric critical care and trauma form

- Pediatric critical care and trauma scientist development program form

- Tobacco word search form

- Aces aware update implementation of medi cal aces form

- For the federal reserve board regulated entities form

- Warren county human services form

- Minority owned business certification texas certification directory form

Find out other Form W 2A, NOT Fill In Capable Information Copy Only American Samoa Wage And Tax Statement

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation