Offer in Settlement Department of Revenue Kentucky Department of 2017

What is the Offer In Settlement Department Of Revenue Kentucky Department Of

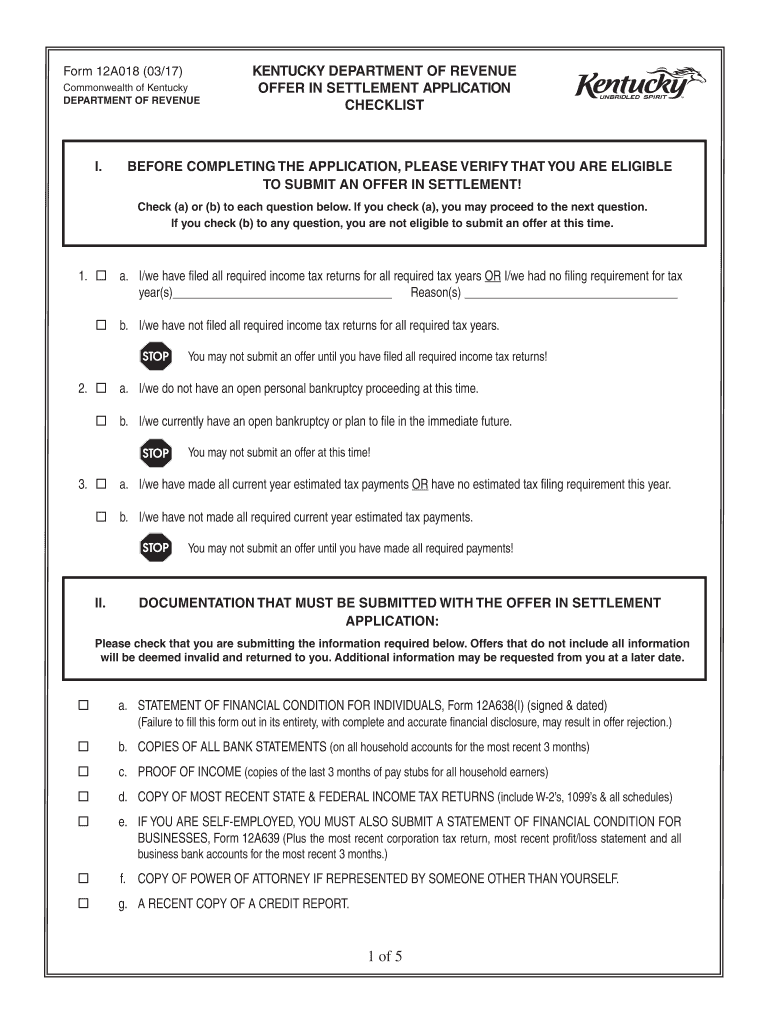

The Offer In Settlement Department Of Revenue Kentucky Department Of is a formal proposal submitted by taxpayers to resolve outstanding tax liabilities for less than the full amount owed. This process allows individuals and businesses to negotiate with the Kentucky Department of Revenue, aiming for a settlement that is financially manageable. The offer is typically based on the taxpayer's financial situation, including income, expenses, and assets, and must be supported by appropriate documentation to demonstrate the inability to pay the full tax amount.

Steps to complete the Offer In Settlement Department Of Revenue Kentucky Department Of

Completing the Offer In Settlement requires careful preparation and attention to detail. Here are the key steps:

- Gather financial information, including income statements, expense reports, and asset documentation.

- Complete the Offer In Settlement form accurately, ensuring all required fields are filled out.

- Provide a comprehensive explanation of your financial situation, including any hardships that impact your ability to pay.

- Submit the completed form along with supporting documents to the Kentucky Department of Revenue.

- Monitor the status of your offer and respond promptly to any requests for additional information from the department.

Key elements of the Offer In Settlement Department Of Revenue Kentucky Department Of

Understanding the key elements of the Offer In Settlement is crucial for a successful submission. Important components include:

- Financial Disclosure: A complete and honest representation of your financial situation is essential.

- Settlement Amount: The proposed amount should reflect what you can realistically pay based on your financial circumstances.

- Supporting Documentation: Include necessary documents such as tax returns, bank statements, and proof of income.

- Compliance with Terms: Adhere to any terms set forth by the Kentucky Department of Revenue regarding the offer.

Legal use of the Offer In Settlement Department Of Revenue Kentucky Department Of

The Offer In Settlement is a legally recognized process that allows taxpayers to negotiate their tax debts. It is important to ensure that all submissions comply with relevant tax laws and regulations. Taxpayers should be aware that submitting an offer does not guarantee acceptance, and the Kentucky Department of Revenue reserves the right to reject offers that do not meet legal requirements or are not supported by adequate documentation.

Eligibility Criteria

To qualify for the Offer In Settlement, taxpayers must meet specific eligibility criteria, which may include:

- Demonstrating an inability to pay the full tax liability.

- Providing complete financial disclosures and supporting documents.

- Being in compliance with all filing and payment requirements for previous tax years.

Form Submission Methods

Taxpayers can submit the Offer In Settlement form through various methods, including:

- Online Submission: Utilizing the Kentucky Department of Revenue's online portal for electronic filing.

- Mail: Sending the completed form and documents via postal service to the appropriate department address.

- In-Person: Delivering the form directly to a local Kentucky Department of Revenue office.

Quick guide on how to complete offer in settlement department of revenue kentucky department of

Your assistance manual on how to prepare your Offer In Settlement Department Of Revenue Kentucky Department Of

If you’re interested in learning how to create and submit your Offer In Settlement Department Of Revenue Kentucky Department Of, here are some straightforward guidelines to make tax submission considerably easier.

To begin, simply register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, generate, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and revisit to update details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the steps below to complete your Offer In Settlement Department Of Revenue Kentucky Department Of in just a few minutes:

- Create your account and start processing PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Offer In Settlement Department Of Revenue Kentucky Department Of in our editor.

- Complete the essential fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and amend any discrepancies.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting physically can lead to increased return errors and postponed refunds. It goes without saying, prior to e-filing your taxes, verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct offer in settlement department of revenue kentucky department of

FAQs

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

Is there any cutoff for the Indian Air Force meteorological department other than the required of filling out a form?

U should keep checking the official website of Indian air force n keep looking for it, as of now there is no cut off released for the meteorological Dept

-

Can I fill more than one form of navy in different departments like AA, SSR or MR?

yes you could….

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How can a government employee apply to renew his passport? Which form to fill in for department permission?

Write an application to your Head of Department seeking permission to renew his or her passport no …….!This current passport expires on dd-mm-yyyy.Kindly grant permission to renew!This letter must be received by office with seal & sign of receivers!thanking you

Create this form in 5 minutes!

How to create an eSignature for the offer in settlement department of revenue kentucky department of

How to generate an eSignature for your Offer In Settlement Department Of Revenue Kentucky Department Of in the online mode

How to make an eSignature for the Offer In Settlement Department Of Revenue Kentucky Department Of in Google Chrome

How to make an electronic signature for signing the Offer In Settlement Department Of Revenue Kentucky Department Of in Gmail

How to make an electronic signature for the Offer In Settlement Department Of Revenue Kentucky Department Of from your mobile device

How to generate an electronic signature for the Offer In Settlement Department Of Revenue Kentucky Department Of on iOS devices

How to generate an eSignature for the Offer In Settlement Department Of Revenue Kentucky Department Of on Android

People also ask

-

What is an Offer In Settlement with the Department Of Revenue Kentucky Department Of?

An Offer In Settlement with the Department Of Revenue Kentucky Department Of is a proposal made by taxpayers to settle tax debts for less than the total amount owed. This process can help individuals and businesses reduce their tax liabilities and find financial relief.

-

How can airSlate SignNow assist with submitting an Offer In Settlement to the Department Of Revenue Kentucky Department Of?

airSlate SignNow streamlines the document submission process for an Offer In Settlement to the Department Of Revenue Kentucky Department Of. Our eSigning features allow users to easily sign necessary documents online, ensuring they are submitted promptly and securely.

-

What are the costs associated with filing an Offer In Settlement to the Department Of Revenue Kentucky Department Of?

While airSlate SignNow offers an affordable pricing plan for eSigning services, the costs associated with filing an Offer In Settlement to the Department Of Revenue Kentucky Department Of may include fees you'll need to consider. Ensure to consult with a tax professional for total estimated expenses related to your Offer In Settlement.

-

What features does airSlate SignNow offer for managing Offers In Settlement?

airSlate SignNow offers features like document templates, eSigning, secure storage, and real-time tracking, all of which enhance your efficiency when managing Offers In Settlement to the Department Of Revenue Kentucky Department Of. These tools help you stay organized and compliant throughout the settlement process.

-

Are there any benefits of using airSlate SignNow for Offers In Settlement with the Department Of Revenue Kentucky Department Of?

Using airSlate SignNow for Offers In Settlement provides numerous benefits, including a user-friendly interface, faster turnaround times, and enhanced security for your tax documents. These features make submitting your Offer In Settlement to the Department Of Revenue Kentucky Department Of easy and efficient.

-

Can I integrate airSlate SignNow with other tools when preparing my Offer In Settlement?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, allowing you to manage your Offer In Settlement to the Department Of Revenue Kentucky Department Of more effectively. Consider integrations with tools like CRM software or document management systems to streamline your workflow.

-

What support does airSlate SignNow offer for users dealing with Offers In Settlement?

airSlate SignNow provides dedicated customer support to assist users with any questions related to Offers In Settlement to the Department Of Revenue Kentucky Department Of. Our support team is available through multiple channels to ensure your experience is smooth and efficient.

Get more for Offer In Settlement Department Of Revenue Kentucky Department Of

- Grant invoice template form

- Cif concussion return to play rtp protocol e 6145 2 form

- Bokepmi form

- The rules and conditions miss international queen form

- Naic fillable application form

- Authorization for release of confidential information form lsdvi

- Makeup service contract template form

- Makeup for service contract template form

Find out other Offer In Settlement Department Of Revenue Kentucky Department Of

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement