Ky Offer 2018-2026

What is the Ky Offer?

The Kentucky offer settlement, often referred to as the Ky offer, is a legal agreement that allows taxpayers to settle their tax liabilities for less than the full amount owed. This settlement option is typically available for individuals or businesses facing financial hardship. The Kentucky Department of Revenue provides this opportunity to help taxpayers resolve their debts while avoiding the lengthy process of tax collection actions. Understanding the specifics of the Ky offer is essential for anyone considering this option.

How to Use the Ky Offer

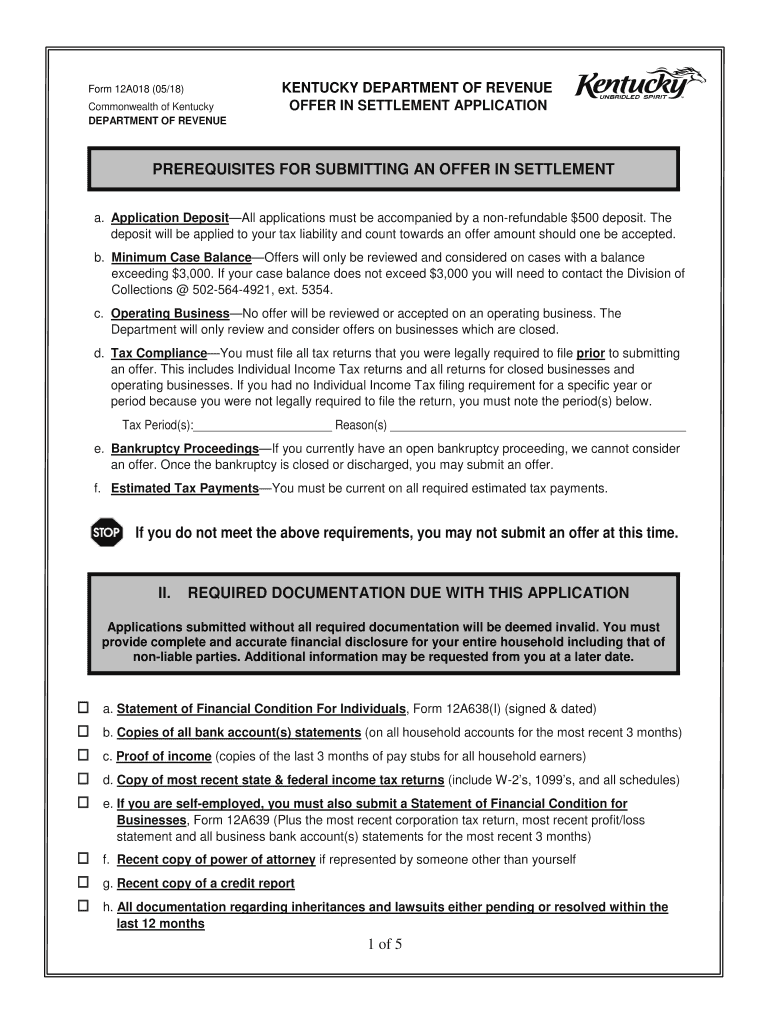

Utilizing the Ky offer involves a straightforward process. First, taxpayers must assess their eligibility based on their financial situation and the amount owed. Once eligibility is confirmed, they can fill out the required forms, including the 12a018 revenue application. This form collects necessary information regarding the taxpayer's financial status, including income, expenses, and assets. After completing the form, it should be submitted to the Kentucky Department of Revenue for review. It is crucial to ensure all information is accurate to avoid delays or rejections.

Steps to Complete the Ky Offer

Completing the Ky offer requires several key steps:

- Evaluate your financial situation to determine eligibility.

- Gather necessary documentation, including income statements and expense records.

- Complete the 12a018 revenue application accurately.

- Submit the application along with any required supporting documents to the Kentucky Department of Revenue.

- Await a response from the department regarding the acceptance or denial of the offer.

Following these steps carefully can enhance the chances of a successful settlement.

Required Documents

When applying for the Ky offer, specific documents are essential to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and receipts.

- Asset information, detailing any properties or investments.

- Any previous correspondence with the Kentucky Department of Revenue.

Having these documents ready can streamline the application process and provide clarity to your financial situation.

Eligibility Criteria

To qualify for the Ky offer, taxpayers must meet specific eligibility criteria set by the Kentucky Department of Revenue. Generally, these criteria include:

- Demonstrating financial hardship that prevents full payment of tax liabilities.

- Providing accurate and complete financial information in the application.

- Having a valid tax liability that is eligible for settlement.

Meeting these criteria is crucial for a successful application and settlement process.

Legal Use of the Ky Offer

The Ky offer is legally binding once accepted by the Kentucky Department of Revenue. This means that both the taxpayer and the department are obligated to adhere to the terms outlined in the settlement agreement. It is important to understand that accepting a settlement may have implications for future tax filings and obligations. Taxpayers should consult with a tax professional to ensure compliance with all legal requirements and to understand the full impact of entering into a settlement agreement.

Quick guide on how to complete 12a018 2018 2019 form

Your assistance manual on how to prepare your Ky Offer

If you’re wondering how to produce and dispatch your Ky Offer, here are a few straightforward instructions on how to simplify tax processing.

Initially, you merely need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to edit, draft, and finalize your tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Ky Offer in just a few minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Ky Offer in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase return mistakes and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 12a018 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 12a018 2018 2019 form

How to create an eSignature for the 12a018 2018 2019 Form online

How to generate an electronic signature for the 12a018 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the 12a018 2018 2019 Form in Gmail

How to make an electronic signature for the 12a018 2018 2019 Form from your smart phone

How to make an electronic signature for the 12a018 2018 2019 Form on iOS devices

How to generate an electronic signature for the 12a018 2018 2019 Form on Android

People also ask

-

What is the Ky Offer from airSlate SignNow?

The Ky Offer from airSlate SignNow is a special promotion designed to provide businesses with a cost-effective solution for e-signatures and document management. This offer enables users to leverage robust features that streamline their signing processes while ensuring compliance and security.

-

How can I take advantage of the Ky Offer?

To take advantage of the Ky Offer, simply visit our website and sign up for an account. During the registration process, you will be prompted to enter the promotional code associated with the Ky Offer, which will unlock exclusive pricing and features tailored for your business needs.

-

What features are included in the Ky Offer?

The Ky Offer includes a comprehensive suite of features such as customizable templates, automated workflows, and real-time tracking of document status. Additionally, users benefit from advanced security measures and integrations with popular business applications, ensuring a seamless experience.

-

Is the Ky Offer suitable for small businesses?

Absolutely! The Ky Offer is specifically designed to cater to small businesses looking for an affordable yet powerful e-signature solution. With its user-friendly interface and scalable features, small businesses can efficiently manage their document signing processes without breaking the bank.

-

What are the pricing options available with the Ky Offer?

The Ky Offer provides competitive pricing that fits within various budget ranges. Depending on your business size and needs, you can choose from different subscription plans that offer flexibility and cost savings, making it an attractive choice for organizations of all sizes.

-

Can I integrate airSlate SignNow with other software using the Ky Offer?

Yes, the Ky Offer allows you to integrate airSlate SignNow with various software applications, enhancing your workflow efficiency. Popular integrations include CRM systems, project management tools, and cloud storage services, allowing for a seamless document management experience.

-

What benefits does the Ky Offer provide for remote teams?

The Ky Offer is particularly beneficial for remote teams as it enables them to sign and manage documents from anywhere, at any time. This flexibility ensures that your team can collaborate effectively and maintain productivity, regardless of their physical location.

Get more for Ky Offer

Find out other Ky Offer

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later