Advisory Cicular 65 26d 2016-2026

Understanding Advisory Circular 65 26d

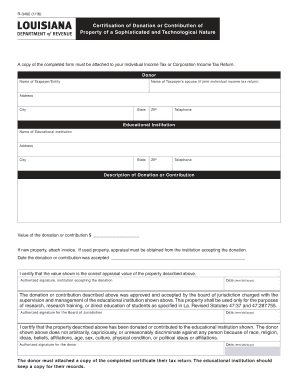

The Advisory Circular 65 26d serves as a crucial document for individuals and businesses navigating the certification contribution technological landscape. It outlines guidelines and best practices for ensuring compliance with state regulations regarding certification donations. This circular is particularly relevant for those involved in the preparation and submission of forms related to tax deductions and contributions.

Key Elements of Advisory Circular 65 26d

Key elements of Advisory Circular 65 26d include:

- Eligibility Criteria: Defines who can make certification contributions and under what conditions.

- Documentation Requirements: Specifies the necessary documents needed to validate contributions.

- Compliance Guidelines: Offers detailed instructions on adhering to state laws and IRS regulations.

- Submission Methods: Outlines the acceptable ways to submit certification contributions, including online options.

Steps to Complete the Advisory Circular 65 26d

Completing the requirements outlined in Advisory Circular 65 26d involves several steps:

- Review the eligibility criteria to ensure compliance.

- Gather all necessary documentation, including proof of contributions.

- Fill out the required forms accurately, ensuring all information is complete.

- Submit the forms through the designated channels, either online or via mail.

Legal Use of Advisory Circular 65 26d

The legal use of Advisory Circular 65 26d is vital for individuals and organizations to avoid penalties. It is essential to adhere to the guidelines provided to ensure that all contributions are recognized legally. This circular helps clarify the legal framework surrounding certification contributions, making it easier for users to comply with state and federal regulations.

Examples of Using Advisory Circular 65 26d

Practical examples of using Advisory Circular 65 26d include:

- A non-profit organization utilizing the circular to guide their donation processes.

- An individual taxpayer following the guidelines to claim deductions on their state income tax returns.

- A business ensuring compliance when making contributions to local charities.

IRS Guidelines Related to Certification Contributions

IRS guidelines play a significant role in shaping the requirements for certification contributions. It is important for individuals and organizations to stay informed about these guidelines to ensure their contributions are eligible for tax benefits. Regular updates from the IRS can affect how contributions are documented and reported, making it essential to consult these guidelines frequently.

Quick guide on how to complete la dept of revenue form r 3400 2016 2019

Your assistance manual on how to prepare your Advisory Cicular 65 26d

If you’re seeking information on how to finalize and submit your Advisory Cicular 65 26d, here are some concise guidelines to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to adjust, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify responses as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to complete your Advisory Cicular 65 26d in a matter of minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax document; explore different versions and schedules.

- Click Obtain form to access your Advisory Cicular 65 26d within our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-recognized eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, submit it to your intended recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for submission guidelines pertinent to your state.

Create this form in 5 minutes or less

Find and fill out the correct la dept of revenue form r 3400 2016 2019

Create this form in 5 minutes!

How to create an eSignature for the la dept of revenue form r 3400 2016 2019

How to create an electronic signature for your La Dept Of Revenue Form R 3400 2016 2019 online

How to generate an eSignature for the La Dept Of Revenue Form R 3400 2016 2019 in Google Chrome

How to generate an electronic signature for putting it on the La Dept Of Revenue Form R 3400 2016 2019 in Gmail

How to make an eSignature for the La Dept Of Revenue Form R 3400 2016 2019 straight from your mobile device

How to create an electronic signature for the La Dept Of Revenue Form R 3400 2016 2019 on iOS devices

How to create an electronic signature for the La Dept Of Revenue Form R 3400 2016 2019 on Android OS

People also ask

-

What is the certification contribution technological behind airSlate SignNow?

The certification contribution technological in airSlate SignNow includes industry-standard security measures and compliance certifications that ensure your documents are protected. Our platform is built on advanced encryption technologies, making it a reliable choice for companies needing secure electronic signatures.

-

How does airSlate SignNow's pricing structure accommodate businesses?

airSlate SignNow offers a flexible pricing structure that reflects its certification contribution technological benefits. From individual plans to enterprise solutions, our pricing models are designed to provide cost-effective options while delivering essential features for every business size.

-

What are the key features of airSlate SignNow that enhance document signing?

Key features of airSlate SignNow include customizable templates, real-time tracking, and robust API integrations. These features are part of our commitment to innovation and reflect the certification contribution technological that simplifies and enhances your document workflows.

-

How does airSlate SignNow ensure compliance with legal standards?

airSlate SignNow adheres to legal standards such as eIDAS and UETA, ensuring your signed documents are legally binding. Our certification contribution technological guarantees compliance, providing peace of mind for businesses when it comes to digital transactions.

-

What technological integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various third-party applications like Google Drive, Salesforce, and Zapier. This extensive connectivity is a reflection of our certification contribution technological, allowing businesses to streamline their workflows and improve operational efficiency.

-

Can I customize documents before sending them for eSignature?

Yes, airSlate SignNow allows you to customize documents with fields, tags, and specific instructions before sending them out for eSignature. This customization capability underscores our certification contribution technological by ensuring accuracy and efficiency during the signing process.

-

What benefits does airSlate SignNow provide for businesses?

The primary benefits of using airSlate SignNow include increased efficiency, reduced turnaround times, and enhanced security for document transactions. These advantages showcase our certification contribution technological, helping businesses digitize their processes effortlessly.

Get more for Advisory Cicular 65 26d

Find out other Advisory Cicular 65 26d

- How To Integrate eSign in Insurance

- How To Use eSign in Legal

- How To Set Up eSign in Legal

- How To Implement eSign in Legal

- How To Integrate eSign in Sports

- How To Use eSign in Sports

- How To Install eSign in Sports

- How To Add eSign in Sports

- How To Implement eSign in Sports

- How To Use eSign in Real Estate

- How To Install eSign in Police

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer