Form 3 Wisconsin Partnership Return Fillable Revenue Wi

What is the Form 3 Wisconsin Partnership Return fillable Revenue Wi

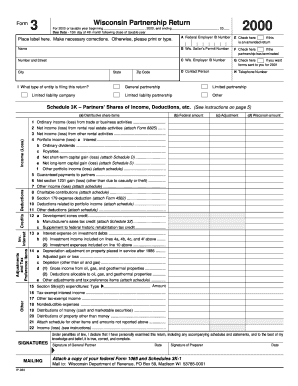

The Form 3 Wisconsin Partnership Return is a tax document specifically designed for partnerships operating in Wisconsin. This form allows partnerships to report income, deductions, and credits to the Wisconsin Department of Revenue. It is essential for ensuring compliance with state tax laws and for calculating the tax obligations of the partnership. The fillable version of this form facilitates easier completion, allowing users to enter their information directly into the digital document before printing or submitting it.

How to use the Form 3 Wisconsin Partnership Return fillable Revenue Wi

Using the Form 3 fillable version is straightforward. First, download the form from the Wisconsin Department of Revenue website or a trusted source. Once you have the form open, you can fill in the required fields directly on your device. Ensure that all necessary information, such as partnership details, income, and deductions, is accurately entered. After completing the form, review it for any errors before printing or saving it for submission. The fillable format helps minimize mistakes and streamlines the filing process.

Steps to complete the Form 3 Wisconsin Partnership Return fillable Revenue Wi

Completing the Form 3 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Open the fillable Form 3 on your device.

- Enter the partnership's name, address, and federal employer identification number (EIN).

- Input the total income earned by the partnership during the tax year.

- List all deductions applicable to the partnership, including business expenses and credits.

- Review the calculations for accuracy, ensuring that all figures are correctly entered.

- Sign and date the form before submission.

Key elements of the Form 3 Wisconsin Partnership Return fillable Revenue Wi

The Form 3 includes several critical components that must be completed accurately. Key elements include:

- Partnership Information: Basic details about the partnership, including name, address, and EIN.

- Income Reporting: Sections for detailing total income earned by the partnership.

- Deductions: Areas to list allowable deductions that reduce taxable income.

- Signature Line: A space for the authorized individual to sign and date the form, confirming its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3 Wisconsin Partnership Return are crucial to avoid penalties. Typically, the form is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is generally due by March 15. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Form Submission Methods (Online / Mail / In-Person)

The Form 3 can be submitted through various methods, providing flexibility for partnerships. Options include:

- Online Submission: If available, partnerships may submit the form electronically through the Wisconsin Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address as indicated on the form.

- In-Person: Partnerships may also choose to deliver the form in person at designated Department of Revenue offices.

Quick guide on how to complete form 3 wisconsin partnership return fillable revenue wi

Modify [SKS] effortlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your files swiftly without delays. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to alter and eSign [SKS] seamlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that function.

- Create your signature with the Sign feature, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3 Wisconsin Partnership Return fillable Revenue Wi

Create this form in 5 minutes!

How to create an eSignature for the form 3 wisconsin partnership return fillable revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

The Form 3 Wisconsin Partnership Return fillable Revenue Wi is a tax form specifically designed for partnerships operating in Wisconsin. It allows businesses to report their income, deductions, and credits efficiently. Using this fillable form simplifies the filing process and ensures compliance with state tax regulations.

-

How can airSlate SignNow help with the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Form 3 Wisconsin Partnership Return fillable Revenue Wi. Our solution streamlines the document management process, allowing you to fill out the form digitally and securely send it for signatures. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion and eSigning of documents, including the Form 3 Wisconsin Partnership Return fillable Revenue Wi. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for the Form 3 Wisconsin Partnership Return fillable Revenue Wi. These features enhance the user experience by making it easier to manage documents and ensuring that all parties can sign efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow when handling the Form 3 Wisconsin Partnership Return fillable Revenue Wi. This means you can connect with your existing tools for accounting, CRM, and more, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

Using airSlate SignNow for the Form 3 Wisconsin Partnership Return fillable Revenue Wi offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick completion and signing of documents, which can signNowly speed up your tax filing process.

-

Is airSlate SignNow secure for handling the Form 3 Wisconsin Partnership Return fillable Revenue Wi?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 3 Wisconsin Partnership Return fillable Revenue Wi is handled safely. The platform employs advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for Form 3 Wisconsin Partnership Return fillable Revenue Wi

Find out other Form 3 Wisconsin Partnership Return fillable Revenue Wi

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast