Ir433 2019-2026

What is the IR433?

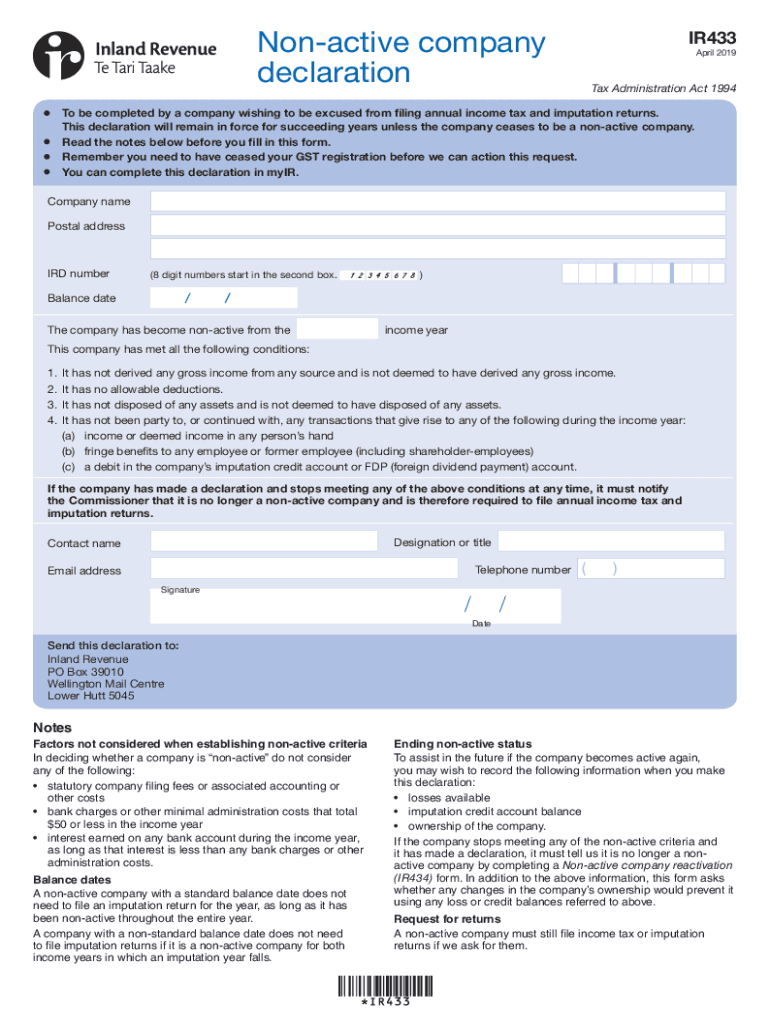

The IR433 is a specific form used for tax purposes in the United States. It is designed to assist taxpayers in reporting various financial activities to the Internal Revenue Service (IRS). Understanding the purpose of the IR433 is crucial for ensuring compliance with tax regulations and for accurate financial reporting. This form plays a significant role in the overall tax process, helping to maintain transparency and accountability in financial dealings.

How to Use the IR433

Using the IR433 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information that pertain to the reporting period. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to double-check the information for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to Complete the IR433

Completing the IR433 requires attention to detail. Here are the essential steps:

- Gather financial documents, including income statements and expense records.

- Obtain the latest version of the IR433 form from the IRS website.

- Fill out the form, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate IRS address.

Legal Use of the IR433

The legal use of the IR433 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Compliance with these regulations ensures that the form is legally binding and can be used as a credible document in case of audits or inquiries from the IRS. Understanding the legal implications of using the IR433 helps taxpayers avoid penalties and maintain good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the IR433 are crucial to avoid penalties. Typically, the form must be submitted by a specific date each year, which aligns with the overall tax filing season. It is essential to stay informed about these deadlines to ensure timely submission. Missing the deadline can result in late fees and complications with tax processing, so setting reminders for these important dates is advisable.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the IR433. These guidelines outline the necessary information required on the form, the acceptable methods of submission, and any additional documentation that may be needed. Familiarizing oneself with these guidelines is important for ensuring compliance and for understanding the implications of the information reported on the form.

Required Documents

When completing the IR433, certain documents are required to support the information reported. These may include:

- Income statements, such as W-2s or 1099s.

- Expense records related to the reporting period.

- Any relevant tax documents that may affect the reporting.

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Quick guide on how to complete ir433

Effortlessly Prepare Ir433 on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without any delays. Manage Ir433 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The Easiest Way to Modify and eSign Ir433 Effortlessly

- Locate Ir433 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether through email, SMS, or sharing a link, or download it to your computer.

Eliminate the frustrations of lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Ir433 to maintain excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir433

Create this form in 5 minutes!

How to create an eSignature for the ir433

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the ir433 feature in airSlate SignNow?

The ir433 feature in airSlate SignNow refers to our innovative electronic signature technology designed to streamline document signing. This feature allows users to sign documents securely from anywhere, enhancing efficiency and productivity.

-

How much does airSlate SignNow cost for using the ir433 feature?

AirSlate SignNow offers competitive pricing plans that include access to the ir433 feature. Depending on the selected plan, users can enjoy various functionalities at a cost-effective rate, including unlimited documents and templates.

-

What are the benefits of using airSlate SignNow for ir433 document signing?

Using airSlate SignNow for ir433 document signing simplifies the signing process signNowly. Users can enjoy quick turnaround times, improved document management, and enhanced security measures, making it ideal for businesses of all sizes.

-

Is airSlate SignNow compatible with other software for ir433 functionalities?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing ir433 functionalities for users. This includes popular tools like Google Workspace, Salesforce, and more, facilitating a smooth workflow.

-

Can I customize templates using the ir433 feature in airSlate SignNow?

Absolutely! The ir433 feature in airSlate SignNow allows users to create custom templates tailored to their specific needs. This flexibility ensures that businesses can maintain their brand identity while simplifying the signing process.

-

What security measures are in place for the ir433 feature in airSlate SignNow?

AirSlate SignNow prioritizes security, especially for the ir433 feature. With advanced encryption, secure storage, and compliance with eSignature laws, users can trust that their documents remain safe and protected throughout the signing process.

-

How does the ir433 feature enhance collaboration in document signing?

The ir433 feature enhances collaboration by allowing multiple users to review and sign documents concurrently within airSlate SignNow. This real-time interaction improves communication and speeds up the overall document workflow.

Get more for Ir433

- Cambridge technology partners massachusetts inc form

- United states cellular corp form def 14a received 04

- Management long term incentive compensation plan form

- Proxy statements strategy amp f form

- Jacor communications inc form

- Hayes wheels announces public offering of common stock form

- Schedule 14a secgovhome form

- 363 cash awards in lieu of stock for subsidiary corporations in countries where a stock form

Find out other Ir433

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement