F2439 PDF VOID Name Address and ZIP Code of RIC or REIT 2021-2026

What is the IRS 2439 form?

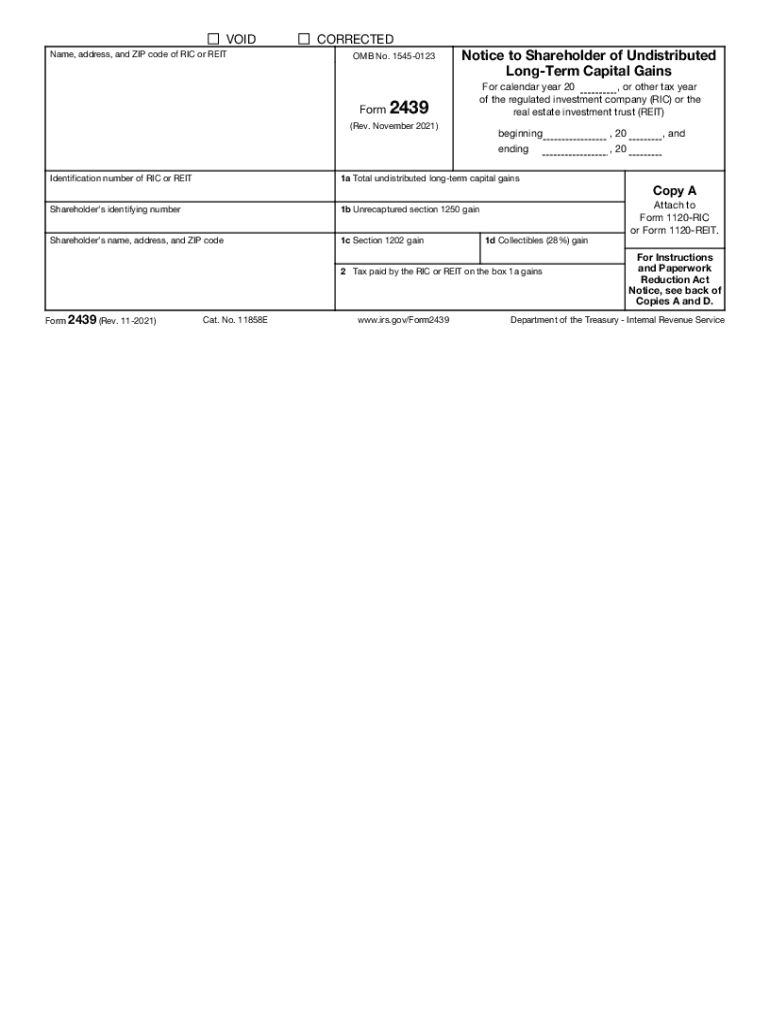

The IRS 2439 form, also known as the 2439 undistributed form, is a tax document used to report undistributed capital gains from a regulated investment company (RIC) or real estate investment trust (REIT). This form is essential for investors who receive distributions from these entities but do not directly receive cash or property. The form helps taxpayers calculate their tax obligations on these undistributed gains, ensuring compliance with IRS regulations.

Key elements of the IRS 2439 form

The IRS 2439 form includes several important sections that taxpayers need to understand. Key elements include:

- Name and Address: This section requires the name and address of the RIC or REIT, which is crucial for identifying the source of the undistributed gains.

- Taxpayer Information: Taxpayers must provide their name, address, and taxpayer identification number (TIN) to ensure proper filing and processing.

- Undistributed Capital Gains: This section details the amount of undistributed capital gains that must be reported on the taxpayer's return.

- Tax Calculation: The form includes calculations to determine the tax owed on the undistributed gains, which is essential for accurate tax reporting.

Steps to complete the IRS 2439 form

Completing the IRS 2439 form involves a few straightforward steps:

- Gather Information: Collect all necessary information, including the name and address of the RIC or REIT, as well as your personal tax information.

- Fill Out the Form: Enter the required details in each section of the form, ensuring accuracy to avoid delays in processing.

- Calculate Tax: Use the provided calculations to determine the tax owed on the undistributed capital gains.

- Review and Sign: Double-check the completed form for errors before signing and dating it.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IRS 2439 form. Generally, the form must be filed with your tax return by the due date of that return, which is typically April fifteenth for most taxpayers. If you require an extension, be sure to file the form by the extended deadline to avoid penalties.

Legal use of the IRS 2439 form

The IRS 2439 form serves a legal purpose in tax reporting. It ensures that taxpayers accurately report undistributed capital gains, which is essential for compliance with federal tax laws. Failing to file this form or inaccurately reporting information can lead to penalties and interest on unpaid taxes. Understanding its legal implications helps taxpayers maintain good standing with the IRS.

How to obtain the IRS 2439 form

Obtaining the IRS 2439 form is straightforward. Taxpayers can access the form directly from the IRS website, where it is available as a downloadable PDF. Additionally, tax preparation software often includes the form, making it easier to fill out and file electronically. Ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Quick guide on how to complete f2439 pdf void name address and zip code of ric or reit

Effortlessly prepare F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT on any device

Managing documents online has gained traction among both organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents quickly without any hold-ups. Handle F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT without hassle

- Locate F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Alter and eSign F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f2439 pdf void name address and zip code of ric or reit

Create this form in 5 minutes!

How to create an eSignature for the f2439 pdf void name address and zip code of ric or reit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2439 form and how can airSlate SignNow help with it?

The 2439 form is a tax document used for reporting certain transactions. airSlate SignNow simplifies the process of completing and signing the 2439 form by providing an intuitive platform that allows users to fill out, eSign, and send the document securely.

-

Is there a cost associated with using airSlate SignNow for the 2439 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and signing of the 2439 form, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the 2439 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to enhance the management of the 2439 form. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for the 2439 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the 2439 form. This means you can connect with tools you already use, making the process even more efficient.

-

How does airSlate SignNow ensure the security of the 2439 form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and secure access controls to protect your 2439 form and other sensitive documents, ensuring that your information remains confidential.

-

Can I access the 2439 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the 2439 form on the go. This flexibility ensures that you can complete and sign documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for the 2439 form?

Using airSlate SignNow for the 2439 form offers numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. The platform's user-friendly interface makes it easy for anyone to complete and eSign documents quickly.

Get more for F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT

- Topic estimating sums and differences horizontallyworksheet 1 form

- Form xxii filled sample for minor

- Landlord declaration form malta

- The gift of the magi answer key pdf form

- Form ct 3 a general business corporation combined franchise tax return tax year 772083707

- Dfa template no 2 affidavit of reversion to use maiden name form

- Auto repair contract template form

- Film deferred payment contract template form

Find out other F2439 pdf VOID Name Address And ZIP Code Of RIC Or REIT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF