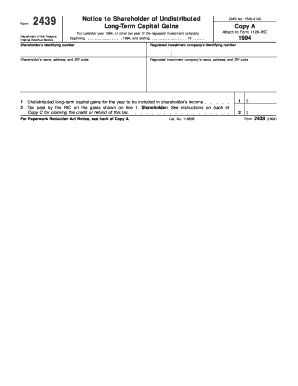

Form 2439 1994

What is the Form 2439

The Form 2439, also known as the IRS 2439 tax form, is a document used by investors to report undistributed long-term capital gains from regulated investment companies (RICs) or real estate investment trusts (REITs). This form is essential for taxpayers who receive distributions from these entities, as it helps them accurately report income on their tax returns. The form provides details about the capital gains that have not been distributed, allowing investors to understand their tax liabilities related to these gains.

How to use the Form 2439

Using the Form 2439 involves several steps to ensure accurate reporting of undistributed capital gains. Taxpayers should first receive the form from the investment company or trust that issued the distribution. The form includes critical information such as the amount of undistributed capital gains and the taxpayer's share of those gains. Taxpayers must then report this information on their tax returns, typically on Schedule D, which deals with capital gains and losses. It's important to follow the instructions carefully to avoid errors that could lead to penalties.

Steps to complete the Form 2439

Completing the Form 2439 requires attention to detail. Here are the steps involved:

- Obtain the form from the investment company or trust.

- Fill in your personal information, including your name and Social Security number.

- Review the amounts reported for undistributed capital gains.

- Calculate your share of the gains based on your investment.

- Transfer the information to your tax return, ensuring it aligns with Schedule D.

- Keep a copy of the form for your records.

How to obtain the Form 2439

The Form 2439 can typically be obtained directly from the investment company or real estate investment trust that issued the distribution. Many companies provide this form electronically through their websites or customer service portals. If you do not receive the form by mail or electronically, you should contact the issuer to request it. Additionally, the IRS may offer resources or guidance on obtaining this form if needed.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of Form 2439. Taxpayers must ensure that they report undistributed capital gains accurately and on time. The IRS also outlines the importance of including this form when filing tax returns, as failing to do so could result in discrepancies and potential audits. It is advisable to consult the latest IRS publications or a tax professional for detailed instructions and updates regarding the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2439 align with the general tax filing deadlines in the United States. Typically, taxpayers must file their returns by April 15 of the following year. If the due date falls on a weekend or holiday, the deadline may shift to the next business day. It is crucial to keep track of these dates to avoid late filing penalties. Additionally, if you are filing for an extension, ensure that you follow the extended deadlines to remain compliant.

Quick guide on how to complete form 2439

Complete Form 2439 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 2439 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Form 2439 with ease

- Locate Form 2439 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact confidential information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 2439 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2439

Create this form in 5 minutes!

How to create an eSignature for the form 2439

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2439 and how can airSlate SignNow help with it?

Form 2439 is a tax form used to report undistributed long-term capital gains from regulated investment companies. airSlate SignNow simplifies the process of filling out and eSigning form 2439, ensuring that you can complete your tax documentation efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for form 2439?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the eSigning process for documents like form 2439, making it a cost-effective solution for your business.

-

What features does airSlate SignNow offer for managing form 2439?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage, all of which enhance the management of form 2439. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for form 2439?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 2439 alongside your existing tools. This integration enhances productivity and ensures that your document workflows remain uninterrupted.

-

What are the benefits of using airSlate SignNow for form 2439?

Using airSlate SignNow for form 2439 offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface makes it easy to navigate, ensuring that you can focus on completing your tax obligations without hassle.

-

How secure is airSlate SignNow when handling form 2439?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including form 2439. You can trust that your sensitive information is safe while using our platform.

-

Can I track the status of my form 2439 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 2439 in real-time. This feature ensures that you are always informed about the progress of your document, making it easier to manage your eSigning process.

Get more for Form 2439

- Fire life safety pre test sheet department of building and ladbs form

- Regions identity theft kit form

- Antecedent variables assessment form

- How to get our marriage licenses in new brunswick form

- 1099 employee contract template form

- 3 month contract template form

- 3 month probation period contract template form

- Fitness membership contract template form

Find out other Form 2439

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed