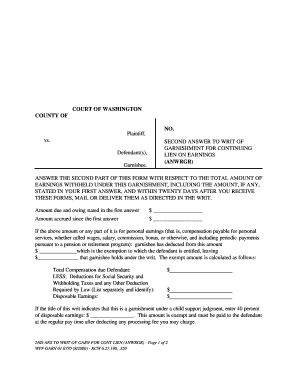

Writ of Garnishment 2000

What is the writ of garnishment

The writ of garnishment is a legal order that allows a creditor to collect a debt by seizing funds directly from a debtor's bank account or wages. This process is typically initiated after a court judgment has been obtained against the debtor, confirming the validity of the debt. The garnishment serves as a means for creditors to secure payment when other collection methods have failed. Understanding the implications of this legal tool is essential for both creditors and debtors, as it can significantly impact a debtor's financial situation.

How to obtain the writ of garnishment

To obtain a writ of garnishment, a creditor must first secure a judgment in court. This involves filing a lawsuit and proving that the debtor owes the debt. Once the judgment is granted, the creditor can file a request for the writ of garnishment with the court. This request typically requires specific information, including the debtor's details and the amount owed. After the court issues the writ, it must be served to the garnishee, such as the debtor's employer or bank, to initiate the garnishment process.

Steps to complete the writ of garnishment

Completing a writ of garnishment involves several key steps:

- Obtain a court judgment confirming the debt.

- File a request for the writ of garnishment with the appropriate court.

- Provide necessary information about the debtor and the amount owed.

- Receive the writ from the court once approved.

- Serve the writ to the garnishee, such as the debtor's employer or financial institution.

- Monitor the garnishment process to ensure compliance and receipt of funds.

Legal use of the writ of garnishment

The legal use of a writ of garnishment is governed by state laws, which outline the procedures and limitations for garnishment. Creditors must adhere to these regulations to ensure that the garnishment is lawful. For instance, there are often restrictions on the amount that can be garnished from wages, typically a percentage of disposable income. Additionally, certain types of income, such as Social Security benefits, may be exempt from garnishment. Understanding these legal parameters helps protect both creditors and debtors during the garnishment process.

Key elements of the writ of garnishment

Several key elements are essential to the writ of garnishment process:

- Judgment: A court judgment confirming the debt is required.

- Garnishee: The entity responsible for withholding funds, such as an employer or bank.

- Amount Owed: The specific amount that the creditor is seeking to collect.

- Service of Process: Properly serving the writ to the garnishee is crucial for enforcement.

- Compliance: The garnishee must comply with the writ and withhold the specified funds.

State-specific rules for the writ of garnishment

Each state in the U.S. has its own laws governing the writ of garnishment, including the procedures for obtaining and enforcing the writ. These laws can vary significantly, affecting the amount that can be garnished, the types of income that are exempt, and the timeframes for compliance. It is important for creditors and debtors to familiarize themselves with the specific rules in their state to navigate the garnishment process effectively. Consulting with a legal professional can provide clarity on these state-specific regulations.

Quick guide on how to complete writ of garnishment 6940850

Prepare Writ Of Garnishment effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without interruptions. Manage Writ Of Garnishment on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Writ Of Garnishment with no hassle

- Locate Writ Of Garnishment and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your updates.

- Choose the method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Writ Of Garnishment and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct writ of garnishment 6940850

Create this form in 5 minutes!

How to create an eSignature for the writ of garnishment 6940850

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a writ of garnishment?

A writ of garnishment is a legal order that allows a creditor to collect a debt by seizing a debtor's assets or funds held by a third party. This process typically involves the court directing a bank or employer to withhold funds until the debt is satisfied. Understanding how a writ of garnishment works is crucial for both creditors and debtors.

-

How can airSlate SignNow help with the writ of garnishment process?

airSlate SignNow streamlines the process of preparing and sending documents related to a writ of garnishment. With our easy-to-use platform, you can quickly create, eSign, and manage all necessary paperwork, ensuring compliance and efficiency. This helps you focus on your case rather than getting bogged down in administrative tasks.

-

What are the pricing options for using airSlate SignNow for writ of garnishment documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to manage your writ of garnishment documents without breaking the bank. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need.

-

Are there any features specifically designed for handling writ of garnishment documents?

Yes, airSlate SignNow includes features tailored for managing writ of garnishment documents, such as customizable templates, automated workflows, and secure eSigning. These tools help ensure that your documents are completed accurately and efficiently, reducing the risk of errors in the garnishment process.

-

Can I integrate airSlate SignNow with other software for managing writ of garnishment cases?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including CRM systems and document management tools. This allows you to streamline your workflow and manage your writ of garnishment cases more effectively by connecting all your essential tools in one place.

-

What benefits does airSlate SignNow provide for businesses dealing with writ of garnishment?

Using airSlate SignNow for writ of garnishment documents provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, making it easier to manage your garnishment cases.

-

Is airSlate SignNow compliant with legal standards for writ of garnishment?

Yes, airSlate SignNow is designed to comply with legal standards and regulations surrounding writ of garnishment and electronic signatures. Our platform ensures that all documents are legally binding and secure, giving you peace of mind when managing sensitive legal processes.

Get more for Writ Of Garnishment

- State court process server application packet henry county co henry ga form

- Bupa claim form pdf

- Hcc letterhead form

- Youth ministry permission slip htrccorg form

- Marriage contract template form

- Marriage pact contract template form

- Employee behavior contract template form

- Florist wedding contract template form

Find out other Writ Of Garnishment

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe