Low Income Taxpayer Clinics LITCs Represent Low Income Individuals in Disputes with the Internal Revenue Service IRS, Including Form

Understanding Low Income Taxpayer Clinics (LITCs)

Low Income Taxpayer Clinics (LITCs) provide essential support to low-income individuals facing disputes with the Internal Revenue Service (IRS). These clinics specialize in assisting taxpayers who may be dealing with audits, appeals, and other tax-related issues. LITCs aim to ensure that low-income taxpayers understand their rights and receive the representation they need to navigate complex tax matters. They offer services such as legal assistance, education on tax rights, and guidance through the appeals process. By focusing on these specific needs, LITCs play a crucial role in safeguarding the interests of vulnerable populations in the U.S.

How to Access LITC Services

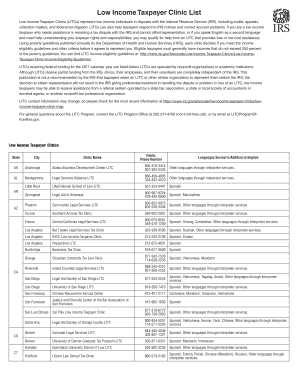

To access the services provided by Low Income Taxpayer Clinics, individuals can begin by locating a clinic in their area. The IRS provides a list of LITCs, which can be found on their official website. Once a clinic is identified, potential clients should contact the clinic directly to inquire about eligibility and the specific services offered. Many LITCs offer free or low-cost assistance, making them an invaluable resource for individuals who may not otherwise afford legal representation in tax disputes.

Eligibility Criteria for LITC Assistance

Eligibility for assistance from Low Income Taxpayer Clinics typically depends on the individual's income level and the nature of the tax issue. Generally, LITCs serve taxpayers whose income is at or below a certain percentage of the federal poverty level. Additionally, the tax matter must involve a dispute with the IRS, such as an audit or an appeal. Each LITC may have specific criteria, so it is advisable for individuals to check with their local clinic for detailed eligibility requirements.

Steps to Resolve Tax Disputes with LITCs

Engaging with a Low Income Taxpayer Clinic involves several steps to effectively resolve tax disputes. First, individuals should gather all relevant documentation related to their tax issue, including notices from the IRS and any previous correspondence. Next, they should contact the LITC to schedule an appointment. During the appointment, the clinic will review the case and provide guidance on the best course of action. This may include representing the taxpayer in discussions with the IRS or helping them prepare necessary appeals. Following the clinic's advice and maintaining communication with them throughout the process is essential for a successful resolution.

Key Services Offered by LITCs

Low Income Taxpayer Clinics offer a range of services tailored to assist low-income individuals in their tax-related challenges. These services include:

- Representation in audits and appeals before the IRS.

- Education on taxpayer rights and responsibilities.

- Assistance with filing tax returns and resolving outstanding tax liabilities.

- Support in negotiating payment plans or settlements with the IRS.

By providing these services, LITCs empower individuals to effectively manage their tax situations and ensure compliance with tax laws.

Common Tax Issues Addressed by LITCs

Low Income Taxpayer Clinics handle various tax issues that low-income individuals frequently encounter. Some common issues include:

- Disputes arising from IRS audits.

- Challenges related to tax refunds and credits.

- Appeals for denied claims or adjustments made by the IRS.

- Concerns regarding tax liens and levies.

By focusing on these areas, LITCs help taxpayers navigate the complexities of the tax system and advocate for their rights.

Quick guide on how to complete low income taxpayer clinics litcs represent low income individuals in disputes with the internal revenue service irs including

Complete [SKS] seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] without any hassle

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Leave behind concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Low Income Taxpayer Clinics LITCs Represent Low Income Individuals In Disputes With The Internal Revenue Service IRS, Including

Create this form in 5 minutes!

How to create an eSignature for the low income taxpayer clinics litcs represent low income individuals in disputes with the internal revenue service irs including

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Low Income Taxpayer Clinics (LITCs)?

Low Income Taxpayer Clinics (LITCs) are organizations that provide free or low-cost legal assistance to low-income individuals in disputes with the Internal Revenue Service (IRS). They help with issues such as audits, appeals, and other tax-related matters, ensuring that those who cannot afford representation receive the support they need.

-

How do LITCs assist individuals with IRS audits?

Low Income Taxpayer Clinics (LITCs) represent low-income individuals in disputes with the Internal Revenue Service (IRS), including audits. They provide guidance on the audit process, help gather necessary documentation, and advocate on behalf of the taxpayer to ensure fair treatment and resolution of the audit.

-

What types of disputes can LITCs help with?

LITCs can assist with various disputes involving the IRS, including audits, appeals, and collection issues. They are dedicated to representing low-income individuals and ensuring their rights are protected throughout the tax dispute process.

-

Are there any costs associated with using LITC services?

Most Low Income Taxpayer Clinics (LITCs) offer their services for free or at a very low cost to eligible individuals. They are funded by grants and donations, allowing them to provide essential support to low-income taxpayers facing disputes with the Internal Revenue Service (IRS).

-

How can I find a Low Income Taxpayer Clinic near me?

You can find a Low Income Taxpayer Clinic (LITC) near you by visiting the IRS website or contacting local legal aid organizations. These clinics are spread across the country and are dedicated to helping low-income individuals in disputes with the Internal Revenue Service (IRS).

-

What benefits do LITCs provide to low-income taxpayers?

Low Income Taxpayer Clinics (LITCs) provide numerous benefits, including expert legal representation, assistance with understanding tax laws, and support during audits and appeals. They empower low-income individuals to navigate disputes with the Internal Revenue Service (IRS) effectively and confidently.

-

Can LITCs help with tax appeals?

Yes, Low Income Taxpayer Clinics (LITCs) represent low-income individuals in disputes with the Internal Revenue Service (IRS), including appeals. They guide taxpayers through the appeals process, ensuring that their cases are presented effectively and that their rights are upheld.

Get more for Low Income Taxpayer Clinics LITCs Represent Low Income Individuals In Disputes With The Internal Revenue Service IRS, Including

Find out other Low Income Taxpayer Clinics LITCs Represent Low Income Individuals In Disputes With The Internal Revenue Service IRS, Including

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself