Form 8874 B Rev December Notice of Recapture Event for New Markets Credit Irs

Understanding Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS

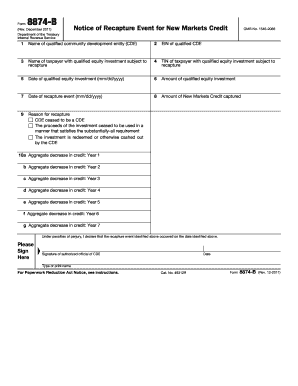

Form 8874 B Rev December is a crucial document for taxpayers involved in the New Markets Tax Credit (NMTC) program. This form is specifically designed to notify the IRS of a recapture event, which occurs when a taxpayer must repay previously claimed tax credits due to certain changes in their investment status. The form serves as an official communication to ensure compliance with IRS regulations regarding the NMTC program.

Steps to Complete Form 8874 B Rev December

Completing Form 8874 B Rev December requires careful attention to detail. Taxpayers should follow these steps:

- Gather necessary information, including details of the original investment and any changes that triggered the recapture event.

- Fill out the form accurately, ensuring all sections are completed, including taxpayer identification and relevant financial data.

- Review the form for accuracy and completeness to avoid delays in processing.

- Sign and date the form before submission.

How to Obtain Form 8874 B Rev December

Taxpayers can obtain Form 8874 B Rev December directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to ensure that you are using the most current version of the form to comply with IRS guidelines. Additionally, taxpayers can request a physical copy by contacting the IRS directly.

Legal Use of Form 8874 B Rev December

The legal use of Form 8874 B Rev December is strictly governed by IRS regulations. Taxpayers must use this form when a recapture event occurs to report the necessary information accurately. Failure to file this form when required can result in penalties and interest on unpaid taxes. It is important to understand the legal implications of the recapture event and to seek professional advice if needed.

Filing Deadlines for Form 8874 B Rev December

Timely filing of Form 8874 B Rev December is essential to avoid penalties. The form must be submitted in accordance with the IRS deadlines for the tax year in which the recapture event occurs. Typically, this aligns with the annual tax filing deadline, but specific dates may vary, so it is advisable to check the IRS guidelines for any updates regarding filing deadlines.

Key Elements of Form 8874 B Rev December

Form 8874 B Rev December includes several key elements that taxpayers must complete:

- Taxpayer identification information, including name, address, and taxpayer identification number.

- Details of the original investment and the nature of the recapture event.

- Calculation of the recaptured credit amount and any applicable penalties.

- Signature and date to certify the information provided is accurate.

Quick guide on how to complete form 8874 b rev december notice of recapture event for new markets credit irs

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to initiate.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to secure your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Put an end to missing or lost files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit Irs

Create this form in 5 minutes!

How to create an eSignature for the form 8874 b rev december notice of recapture event for new markets credit irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS is a tax form used to report recapture events related to New Markets Tax Credits. This form is essential for businesses that have previously claimed these credits and need to report any changes in their eligibility. Understanding this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help with Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

airSlate SignNow provides a streamlined solution for businesses to prepare and eSign Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS. Our platform simplifies document management, ensuring that all necessary forms are completed accurately and efficiently. This helps businesses stay compliant while saving time and resources.

-

What features does airSlate SignNow offer for managing tax documents like Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are ideal for managing tax documents like Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS. These features enhance efficiency and ensure that all parties involved can easily access and sign documents. Additionally, our platform supports collaboration among team members.

-

Is airSlate SignNow cost-effective for businesses needing to file Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS. Our pricing plans are designed to accommodate businesses of all sizes, providing essential features without breaking the bank. This allows companies to manage their tax documentation efficiently while keeping costs low.

-

Can airSlate SignNow integrate with other software for filing Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to file Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS. This integration ensures that your data flows smoothly between platforms, reducing the risk of errors and saving time during the filing process.

-

What are the benefits of using airSlate SignNow for Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

Using airSlate SignNow for Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS offers numerous benefits, including enhanced security, ease of use, and improved workflow efficiency. Our platform ensures that your documents are securely stored and easily accessible, while the user-friendly interface allows for quick completion and signing of forms. This ultimately leads to a more organized and compliant tax filing process.

-

How does airSlate SignNow ensure the security of documents like Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS?

airSlate SignNow prioritizes the security of your documents, including Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit IRS, by implementing advanced encryption and secure access controls. Our platform complies with industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. This commitment to security gives businesses peace of mind when managing their tax documentation.

Get more for Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit Irs

- Survey questionnaire about rotc form

- Tri s application 2006 07 andersonedu form

- Wwwpdffillercom401003827 tris applicationfillable online anderson tri s application 2006 07 anderson form

- Congress may let you skip mandatory withdrawals from ira form

- Rio hondo transcript request form

- Campus visit approval form

- Is ithttpwwwmichiganurologycomwp form

- Apply to the program lccclaramie county community form

Find out other Form 8874 B Rev December Notice Of Recapture Event For New Markets Credit Irs

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract