IRS Tax Return Transcript Request Process Tax Filers Can Request a Augustana Form

Understanding the IRS Tax Return Transcript Request Process

The IRS Tax Return Transcript Request Process allows tax filers to obtain a summary of their tax return information. This document is essential for various purposes, including loan applications and financial aid. The transcript includes most line items from the tax return, which can be beneficial for verifying income. Tax filers can request this document for the current tax year and up to three prior years.

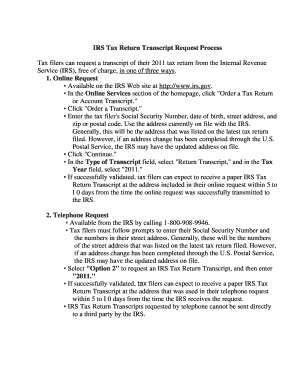

How to Obtain the IRS Tax Return Transcript

Tax filers can obtain their IRS Tax Return Transcript through several methods. The most efficient way is to use the IRS online portal, where users can create an account or log in to access their transcripts. Alternatively, filers can request a transcript by mail using Form 4506-T, which can be downloaded from the IRS website. Lastly, individuals can request transcripts by calling the IRS directly. It is important to have personal information ready, such as Social Security numbers and filing status, to facilitate the process.

Steps to Complete the Request Process

To successfully request an IRS Tax Return Transcript, follow these steps:

- Visit the IRS website and navigate to the transcript request section.

- Select whether to request online, by mail, or by phone.

- If requesting online, create an account or log in to your existing account.

- Provide the necessary personal information, including Social Security number, date of birth, and filing status.

- Choose the tax year for which you need the transcript.

- Submit the request and wait for the transcript to be delivered via your chosen method.

Required Documents for the Request

When requesting an IRS Tax Return Transcript, certain documents and information are necessary to ensure a smooth process. Tax filers should have the following ready:

- Social Security number or Individual Taxpayer Identification Number.

- Date of birth.

- Filing status from the most recent tax return.

- Address used on the last tax return.

Legal Uses of the IRS Tax Return Transcript

The IRS Tax Return Transcript serves multiple legal purposes. It is often required for financial aid applications, mortgage applications, and other financial transactions where proof of income is necessary. Additionally, it can be used to resolve discrepancies with tax filings or to provide documentation during audits. Understanding the legal implications of this document can help tax filers utilize it effectively.

Eligibility Criteria for Requesting a Transcript

All individuals who have filed a tax return with the IRS are eligible to request a Tax Return Transcript. This includes self-employed individuals, retirees, and students. However, it is essential that the requestor has access to the necessary personal information to verify their identity. If a tax return has not been filed for the requested year, a transcript cannot be obtained.

Quick guide on how to complete irs tax return transcript request process tax filers can request a augustana

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, text message (SMS), or an invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana

Create this form in 5 minutes!

How to create an eSignature for the irs tax return transcript request process tax filers can request a augustana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana?

The IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana allows individuals to obtain a summary of their tax return information. This process is essential for tax filers who need to verify their income for loans, financial aid, or other purposes. By following the steps outlined by the IRS, filers can easily access their transcripts online or via mail.

-

How can airSlate SignNow assist with the IRS Tax Return Transcript Request Process?

airSlate SignNow streamlines the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana by providing a secure platform for eSigning necessary documents. Users can quickly prepare and send their requests without the hassle of printing or mailing. This efficiency saves time and ensures that all documents are properly signed and submitted.

-

Are there any costs associated with using airSlate SignNow for the IRS Tax Return Transcript Request?

Using airSlate SignNow for the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana is cost-effective. The platform offers various pricing plans to suit different needs, including a free trial for new users. This allows tax filers to evaluate the service before committing to a subscription.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features that enhance the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana. Key features include customizable templates, automated workflows, and secure cloud storage. These tools help users manage their documents efficiently and ensure compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other applications for my IRS Tax Return Transcript requests?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana. Users can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline their workflow. This integration capability allows for a more cohesive document management experience.

-

What are the benefits of using airSlate SignNow for tax document signing?

The benefits of using airSlate SignNow for the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana include increased efficiency and security. The platform ensures that all documents are signed electronically, reducing the risk of errors and delays. Additionally, users can track the status of their requests in real-time, providing peace of mind.

-

Is airSlate SignNow user-friendly for those unfamiliar with technology?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making the IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana accessible to everyone. The intuitive interface guides users through each step, ensuring that even those with limited tech experience can navigate the platform easily. Comprehensive support resources are also available.

Get more for IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana

- Illinois secretary of state mobile driver services facility form

- Fillable online dmv 185 trlegal heir affidavit fax email form

- How to get and read your ohio crash report bensinger form

- Hawthorne ln form

- 2019 2021 form il dsd tvdl 10 fill online printable

- Central services division office of the secretary of state form

- Wwwpdffillercom446780175 il dsd tvdl 7 2017 form il dsd tvdl 7 fill online printable fillable

- Wwwpdffillercom529642894 form mcd 356 2020 form tx dmv mcd 356 fill online printable fillable

Find out other IRS Tax Return Transcript Request Process Tax Filers Can Request A Augustana

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now