Employer Group Information to Be Completed by Employer

Understanding the Employer Group Information Form

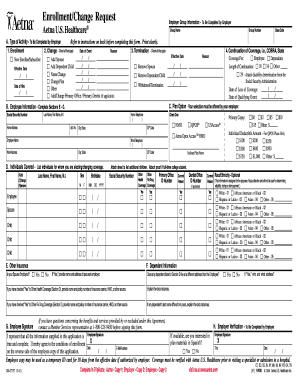

The Employer Group Information To Be Completed By Employer is a crucial document used by employers to provide essential details about their organization. This form typically collects information such as the employer's name, address, and tax identification number. It is often required for various administrative processes, including health insurance enrollment and tax reporting. Completing this form accurately ensures compliance with regulations and facilitates smooth operations within the employer's benefits programs.

Steps to Complete the Employer Group Information Form

Filling out the Employer Group Information form involves several key steps:

- Gather necessary information: Collect all required details about your organization, including the legal name, business address, and Employer Identification Number (EIN).

- Fill in the form: Carefully input the gathered information into the designated fields of the form. Ensure that all entries are accurate and up-to-date.

- Review for accuracy: Double-check the completed form for any errors or omissions. This step is essential to prevent delays or issues in processing.

- Submit the form: Follow the specified submission guidelines, whether online, by mail, or in person, to ensure the form is received by the appropriate entity.

Legal Use of the Employer Group Information Form

The Employer Group Information form serves several legal purposes. It is often required for compliance with federal and state regulations, particularly in relation to employee benefits and taxation. Accurate completion of this form is vital to avoid potential legal issues, such as penalties for non-compliance. Employers should be aware of the specific legal requirements applicable to their industry and ensure that the information provided is consistent with regulatory standards.

Key Elements of the Employer Group Information Form

Several key elements must be included when completing the Employer Group Information form:

- Employer Identification Number (EIN): This unique number is essential for tax purposes and helps identify the business entity.

- Business Name and Address: The legal name and physical address of the business must be clearly stated.

- Contact Information: Provide the name and contact details of a representative who can address any inquiries regarding the form.

- Type of Business Entity: Indicate the nature of the business, such as corporation, partnership, or sole proprietorship.

Filing Deadlines and Important Dates

Employers should be aware of specific deadlines associated with the Employer Group Information form. These dates can vary based on the purpose of the form and the applicable regulations. It is advisable to check for any state-specific deadlines as well as federal guidelines to ensure timely submission. Missing these deadlines can result in penalties or complications with employee benefits and tax filings.

Examples of Using the Employer Group Information Form

The Employer Group Information form is utilized in various scenarios, including:

- Health Insurance Enrollment: Employers may need to provide this information to enroll employees in health insurance plans.

- Tax Reporting: The form is often required for accurate reporting to the IRS and state tax agencies.

- Compliance Audits: During audits, employers may be asked to present this form to demonstrate compliance with regulations.

Quick guide on how to complete employer group information to be completed by employer

Finish [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files swiftly without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from your preferred device. Alter and eSign [SKS] and guarantee excellent communication at any step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Employer Group Information To Be Completed By Employer

Create this form in 5 minutes!

How to create an eSignature for the employer group information to be completed by employer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Employer Group Information To Be Completed By Employer?

The Employer Group Information To Be Completed By Employer is designed to collect essential details from employers to streamline the onboarding process. This information helps ensure that all necessary data is accurately captured for effective document management and compliance. By completing this section, employers can facilitate smoother transactions and enhance overall efficiency.

-

How does airSlate SignNow handle Employer Group Information To Be Completed By Employer?

airSlate SignNow provides a user-friendly platform that allows employers to easily fill out the Employer Group Information To Be Completed By Employer. Our solution simplifies the process by offering templates and guided prompts, ensuring that all required fields are completed accurately. This feature minimizes errors and saves time for both employers and employees.

-

Is there a cost associated with using the Employer Group Information To Be Completed By Employer feature?

Yes, there is a cost associated with using airSlate SignNow, which includes access to the Employer Group Information To Be Completed By Employer feature. Our pricing plans are designed to be cost-effective, catering to businesses of all sizes. You can choose a plan that best fits your needs and budget, ensuring you get the most value from our services.

-

What benefits does airSlate SignNow offer for managing Employer Group Information?

Using airSlate SignNow for managing Employer Group Information To Be Completed By Employer offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick eSigning and document sharing, which accelerates the onboarding process. Additionally, it enhances security and compliance, giving employers peace of mind.

-

Can I integrate airSlate SignNow with other software for managing Employer Group Information?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage Employer Group Information To Be Completed By Employer alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your data is synchronized across platforms. Check our integration options to find the best fit for your business.

-

How secure is the Employer Group Information To Be Completed By Employer data?

Security is a top priority at airSlate SignNow. We implement robust encryption and security protocols to protect the Employer Group Information To Be Completed By Employer data. Our platform complies with industry standards, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

What types of documents can I send using airSlate SignNow related to Employer Group Information?

With airSlate SignNow, you can send a variety of documents related to Employer Group Information To Be Completed By Employer, including employment contracts, tax forms, and benefits enrollment documents. Our platform supports multiple file formats, making it easy to manage all your documentation in one place. This versatility helps streamline your HR processes.

Get more for Employer Group Information To Be Completed By Employer

- Living certificate form

- Ultrasonic cavitation consent form pdf

- Hw019 form

- Wwwservicesaustraliagovauformshw019application for a medicare provider number and or prescriber

- To download the english termination form stavrosfiorg stavrosfi

- Pdf odometermileage disclosure statement chase bank form

- Chase odometer statement form

- Employment application trash away form

Find out other Employer Group Information To Be Completed By Employer

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document