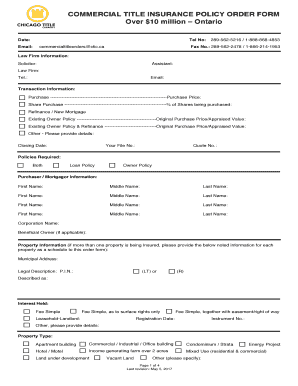

Chicago Title Insurance Company Form

Understanding the Chicago Title Insurance Company

The Chicago Title Insurance Company is a prominent provider of title insurance services in the United States. Established to protect property buyers and lenders from potential title defects, it plays a crucial role in real estate transactions. Title insurance ensures that the property title is clear of any liens, encumbrances, or disputes, providing peace of mind to all parties involved. With a strong reputation, the company is known for its reliability and comprehensive coverage, making it a preferred choice for many in the real estate sector.

How to Utilize the Services of Chicago Title Insurance Company

Using the services of the Chicago Title Insurance Company involves several straightforward steps. First, you should contact a local representative to discuss your specific needs. They will guide you through the process of obtaining title insurance, including gathering necessary documentation such as property deeds and identification. Once the information is collected, the company will conduct a thorough title search to identify any potential issues. After the search, you will receive a title commitment outlining the terms of coverage. Finally, upon closing the real estate transaction, the insurance policy will be issued, ensuring protection against any future claims.

Steps to Obtain Title Insurance from Chicago Title Insurance Company

To obtain title insurance from the Chicago Title Insurance Company, follow these essential steps:

- Contact a local office or representative to initiate the process.

- Provide necessary documentation, including property information and personal identification.

- Allow the company to conduct a title search to uncover any existing issues.

- Review the title commitment provided by the company, which details coverage and any exceptions.

- Finalize the transaction and receive your title insurance policy at closing.

Legal Considerations for Title Insurance in the U.S.

When dealing with title insurance, it is essential to understand the legal framework governing these policies. Title insurance protects against claims that may arise from issues such as undisclosed heirs, fraud, or errors in public records. In the U.S., laws regarding title insurance can vary by state, so it is crucial to consult with a knowledgeable representative from the Chicago Title Insurance Company to ensure compliance with local regulations. This legal protection not only safeguards your investment but also provides assurance that your ownership rights are secure.

Eligibility Criteria for Title Insurance

Eligibility for title insurance through the Chicago Title Insurance Company typically requires that you are either a buyer or lender involved in a real estate transaction. The property in question must be a residential or commercial real estate asset. Additionally, the company may require a title search and examination to assess any potential risks associated with the title. Understanding these criteria can help streamline the process of obtaining coverage and ensure that you are adequately protected.

Quick guide on how to complete chicago title insurance company

Effortlessly Prepare Chicago Title Insurance Company on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as a superb environmentally friendly option compared to traditional printed and signed paperwork, allowing you to obtain the correct form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Chicago Title Insurance Company from any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Chicago Title Insurance Company with Ease

- Find Chicago Title Insurance Company and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools offered specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere moments and carries the same legal validity as a standard ink signature.

- Verify all the details and click the Done button to save your updates.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Chicago Title Insurance Company to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chicago title insurance company

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is title insurance in Ontario?

Title insurance in Ontario is a policy that protects property buyers and lenders from potential losses due to defects in the title of a property. It covers issues such as fraud, liens, and other claims that may arise after the purchase. This insurance is essential for ensuring peace of mind when investing in real estate.

-

How much does title insurance cost in Ontario?

The cost of title insurance in Ontario varies based on the property's value and the insurer. Typically, premiums range from a few hundred to over a thousand dollars. It's a one-time fee that provides long-term protection, making it a cost-effective solution for property buyers.

-

What are the benefits of title insurance in Ontario?

The primary benefits of title insurance in Ontario include protection against financial loss from title defects and legal fees associated with resolving disputes. It also provides coverage for issues that may not be discovered during a title search. This peace of mind is invaluable for homeowners and investors alike.

-

Does title insurance cover all potential issues in Ontario?

While title insurance in Ontario covers many potential issues, it does not cover everything. Common exclusions include zoning issues, environmental hazards, and certain types of fraud. It's important to review the policy details to understand what is and isn't covered.

-

How do I choose a title insurance provider in Ontario?

When selecting a title insurance provider in Ontario, consider factors such as reputation, customer reviews, and the range of coverage options offered. It's also beneficial to compare pricing and ask about any additional services they provide. A reliable provider will help ensure a smooth transaction.

-

Can I purchase title insurance in Ontario before closing?

Yes, you can purchase title insurance in Ontario before closing on a property. In fact, it's often recommended to secure your coverage early in the process. This ensures that you are protected from any title issues that may arise before the transaction is finalized.

-

Is title insurance mandatory in Ontario?

Title insurance is not mandatory in Ontario, but it is highly recommended for anyone purchasing property. While lenders may require it for mortgage approval, having title insurance protects buyers from unforeseen issues that could affect their ownership rights.

Get more for Chicago Title Insurance Company

Find out other Chicago Title Insurance Company

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking